Adhir Kadve of Eight Capital believes that Voyager Digital (Voyager Digital Stock Quote, Chart, News CSE:VYGR) may be hitting some rough waters. In an update to clients on Wednesday, Kadve maintained a “Buy” rating and lowered his target price from C$31/share to C$23/share for a potential return of 122 per cent..

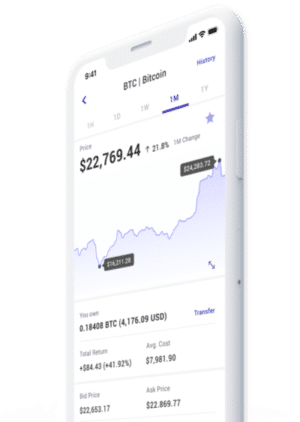

Founded in 2018 and headquartered in New York City, Voyager Digital is a digital asset focused agency broker and financial services firm with 3.2 million Verified Users and over one million funded accounts.

Kadve’s latest analysis comes after Voyager released its financial results for the second quarter of its 2022 fiscal year.

“Our key takeaway from the quarter is that Voyager is actively investing to diversify its revenue streams via increasing Yield and Staking revenues and new product rollouts, a sound strategy in our view as it reduces the company’s reliance on the more volatile and lower visibility transaction based revenues,” said Kadve.

Voyager’s quarterly reports were headlined by $164.8 million in revenue, a significant increase on the $3.5 million in revenue from the second fiscal quarter of 2021. Transaction revenue was Voyager’s biggest driver at $86.5 million to account for 52.5 per cent of the company’s revenue mix, followed closely by the combined Lending and Staking metrics at $57 million, presenting an additional 34.6 per cent of company revenue. (All report figures and estimates are in US dollars except where noted otherwise.)

Meanwhile, Voyager’s Coinify merchant platform brought in $15.8 million in revenue, accounting for an additional 9.6 per cent of the mix.

Voyager’s margin items produced mixed results, with the reported $3.2 million in operating income and two per cent margin in the quarter missing both the Eight Capital projection of $6.9 million in operating income and a five per cent margin, as well as the Street estimate of $8.1 million and a six per cent margin.

However, the adjusted EBITDA report proved a positive, as it came in at $17.4 million and an 11 per cent margin compared to the Eight Capital estimate of $14.1 million and a 10 per cent margin, as well as the consensus estimate of $16.4 million and a 12 per cent margin.

“I am excited to report our best quarter ever, doubling our revenue from the previous quarter, and highlighting Voyager’s positioning and revenue opportunity in active markets,” said Steve Ehrlich, CEO and Co-founder of Voyager in the company’s February 15 press release. “More importantly, we delivered significant revenue growth and supported a marked increase in customer activity without any material system issues during the quarter, highlighting the steps we’ve taken to build out the scale and security of the Voyager platform in 2021, as we position Voyager for a series of product roll outs in calendar 2022.”

Kadve has softened his financial projections for the remainder of the 2022 fiscal year, lowering his third quarter estimate from $146.1 million to $114.1 million while dropping his fourth quarter projections from $163.7 million to 127.8 million. Those revisions lead to a lower annual 2022 projection of $488.2 million (previously $533.8 million), which still suggests a year-over-year increase of 179 per cent. In addition, Kadve introduced a 2023 revenue projection of $615.9 million for an implied year-over-year increase of 26 per cent.

Going forward, company management expects a minimum of $100 million in quarterly revenue as it works to diversify its offerings.

Overall, Kadve forecasts positive movement in Voyager’s EV/Sales multiple, as he estimates a drop from 7.5x in 2021 to 2.7 in 2022, then down to 2.1x in 2023.

Meanwhile, on account of the company’s focus on growth investments, Kadve has also lowered his expectations for both operating income and adjusted EBITDA. From the operating income perspective, Kadve now projects a loss of $16.4 million in 2022 (previously a $3.9 million loss), with the new 2023 projection turning positive at $24.3 million.

In terms of adjusted EBITDA, softened quarterly estimates put Kadve’s annual projection for 2022 at a $5 million loss (previously $3.2 million positive), then turning positive in 2023 at a projected $55.2 million to imply a margin of nine per cent.

After setting the EV/EBITDA multiple at 21x in 2021, Kadve listed the 2022 projection as NMF, while at its current market price, the 2023 projection would come out at around 23.1x.

“The company continues to focus on user acquisition via increasing marketing spending, and geographic expansion. While we remain confident in Voyager’s ability to execute on these initiatives, we are lowering our target price on account of overall multiple compression in crypto related stocks and the broader technology industry,” Kadve wrote.

Since it began trading on the Toronto Stock Exchange on September 7, Voyager’s stock price has had an adventure, resulting in a 47.4 per cent loss in that time, paired with a 31.2 per cent loss since the start of 2022. Voyager enjoyed a high of $25.17/share on November 9, but has since fallen below $10/share, going as low as $9.10/share on January 27.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment