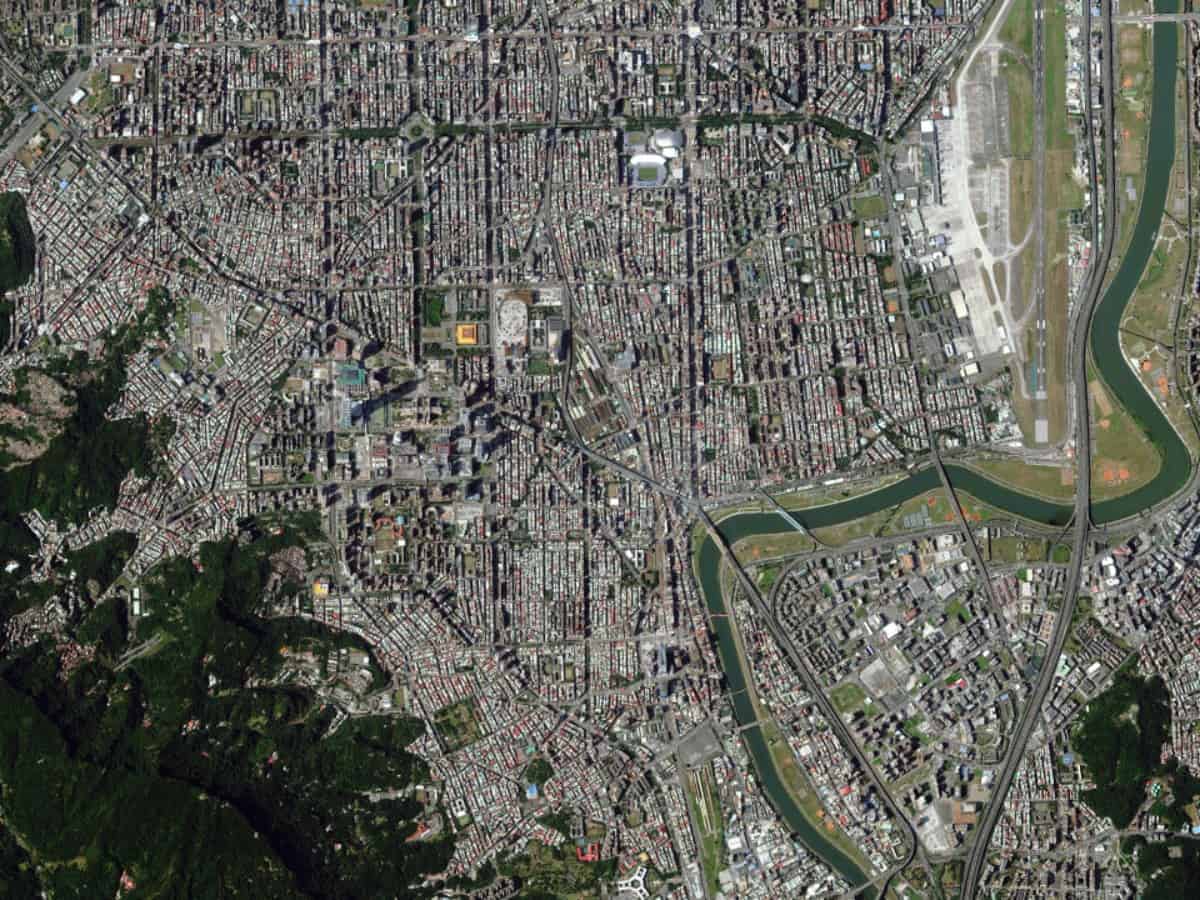

Space and geospace tech company Maxar Technologies (Maxar Technologies Stock Quote, Chart TSX, NYSE:MAXR) suffered a 45 per cent price drop this week as a result of its third quarter earnings report, but the market reaction was overblown, says analyst Richard Tse, who thinks there’s plenty to be positive about for Maxar going forward.

Space and geospace tech company Maxar Technologies (Maxar Technologies Stock Quote, Chart TSX, NYSE:MAXR) suffered a 45 per cent price drop this week as a result of its third quarter earnings report, but the market reaction was overblown, says analyst Richard Tse, who thinks there’s plenty to be positive about for Maxar going forward.

Maxar’s Q3 revealed a net loss of $432.5-million on a top line of $508.2 million, in part due to drag from the company’s GEO Communications segment which was down 31 per cent compared to last year’s Q3.

The stock has also been the victim of a short-selling campaign by Spruce Point Capital Management who intimated that the company’s cash flow problems were bringing solvency issues to the fore.

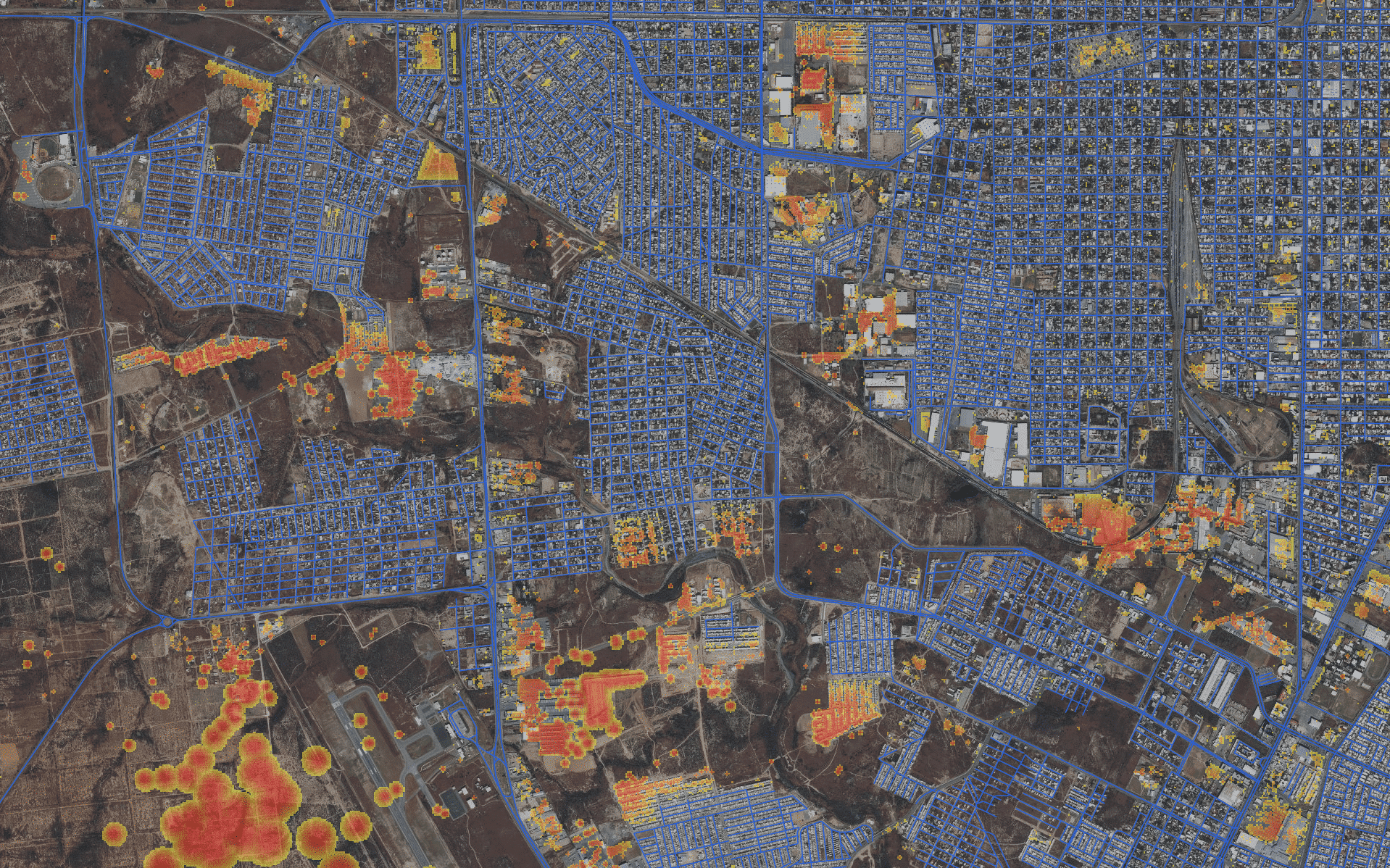

But both the GEO Comm and leveraging issues aren’t so significant, says Tse, who sees positive catalysts around the corner for Maxar. On the one hand, the company is performing well in segments other than GEO, says Tse, notably, Space Systems which was up 13 per cent year-over-year in the third quarter. On the leverage issue, Tse says Maxar has opportunities coming up to de-risk its balance sheet, with some of its options being the potential sale of its GEO Comm business, real estate divestitures, the securitization of Orbital receivables, cutting into the company’s dividend and dealing with operating efficiencies.

“The reality remains this: MAXR continues to be a 2019 story with most of the meaningful catalysts to re-rate the valuation not surfacing until next year,” says Tse. “And while the Q3 miss adds some doubt to that line of thinking, it’s not enough to have us changing our investment thesis based on a 3.5x P/E (after our estimate revisions) and a ~7.5 per cent dividend yield.”

With his revised estimates, Tse now reiterates his “Outperform” rating with a lowered price target of $45.00 (was $60.00), implying a 12-month projected return of 209 per cent at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment