Maxar Technologies will hit $100, this portfolio manager says

The past couple of years have been rough on the nerves for shareholders of Maxar Technologies (Maxar Stock Quote, Chart, News, Analysts, Financials TSX:MAXR), but the stock still came out of 2020 with more than a double, leaving investors wondering what lies ahead. More upside, according to portfolio manager John Zechner, who likes Maxar’s positioning in the rising satellite data business.

The past couple of years have been rough on the nerves for shareholders of Maxar Technologies (Maxar Stock Quote, Chart, News, Analysts, Financials TSX:MAXR), but the stock still came out of 2020 with more than a double, leaving investors wondering what lies ahead. More upside, according to portfolio manager John Zechner, who likes Maxar’s positioning in the rising satellite data business.

Maxar Technologies, which makes satellites for geospatial imagery and intelligence but also offers software and analytics, saw the bottom fall out in late 2018 and early 2019 when an accumulation of bad news took the stock from $70.00 to a sad $6.00 per share.

A writedown on its satellite business, accounting issues which led to a short-seller report, an imagining satellite which crapped out early in its lifespan plus an executive shakeup and mounting debt — all of these factors contributed to a dismal outlook form an investment point of view.

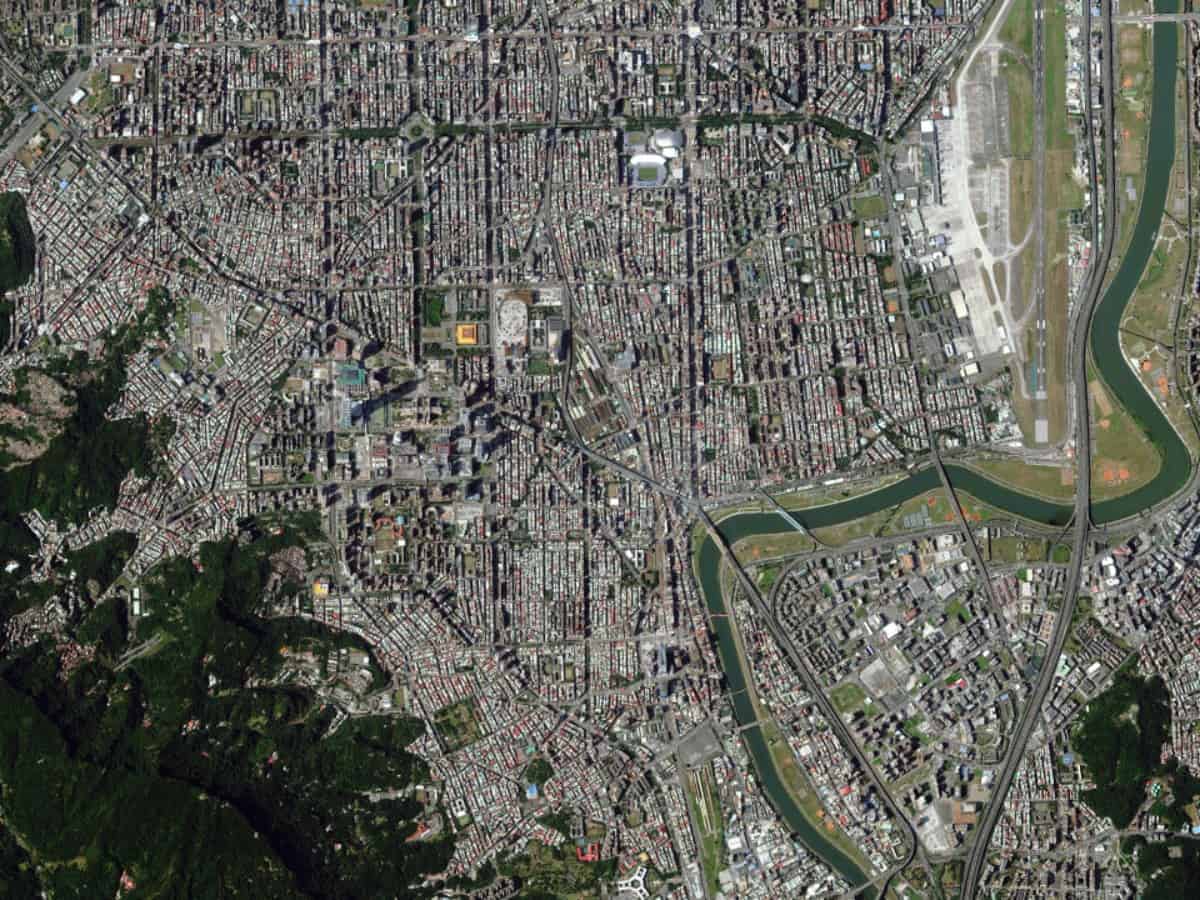

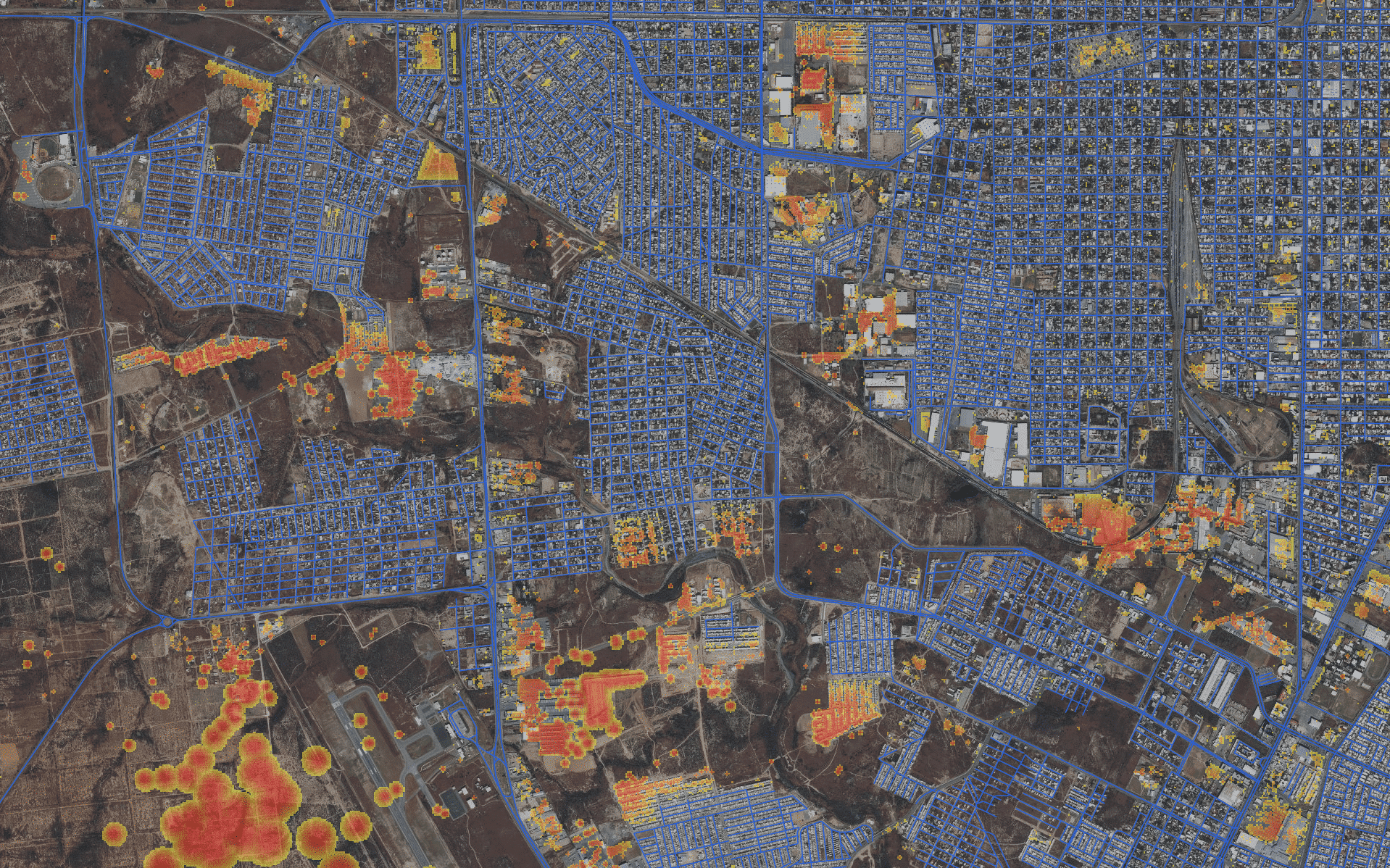

But by 2020, Maxar had turned a corner. The company sold off MDA, the Canadian space robotics and radar systems branch of the company, to relieve some debt. That move left Maxar with its DigitalGlobe business as its main engine, a US satellite imagery provider. Maxar began to post stronger quarterly earnings, aided by its SecureWatch geospatial subscription service, which started pulling in more customers as the demand for monitoring and mapping capabilities rose.

And it’s those sector-wide tailwinds that should keep Maxar investors happy, according to Zechner, chairman of J. Zechner Associates.

“We continue to hold it. I took a little money off the table on this one because it’s had such a substantial move in the past year,” Zechner said, speaking on BNN Bloomberg on Monday.

“But I think they’re really well positioned, from their space simulation software plays, they’re launching of their orbital satellites next year and their capital spending is going to slow down a little bit so they’ll start to generate some positive free cash flow to pay down the big debt they put on the books in order to do the Digital Globe acquisition a couple of years ago,” he said.

“I think it’s positioned right,” Zechner said.

Maxar released its 2020 full-year financials in February, where the company posted revenue of $1.723 billion compared to $1.666 billion for 2019. Results were steady from its business segments, with Earth Intelligence bringing in $1.081 billion compared to $1.085 billion in the year prior, while Space Infrastructure went from $706 million to $721 million. Adjusted EBITDA improved from $416 million to $422 million.

“We made solid progress during 2020 toward achieving our longer-term targets, including efforts to drive sustainable growth in both our Earth Intelligence and Space Infrastructure segments and to reduce our debt and leverage, as evidenced by solid 17-per-cent year-over-year backlog growth and the closure of the MDA divestiture and subsequent repayment of debt,” said president and CEO Dan Jablonsky in a press release.

Jablonsky said the company had key contract wins in Earth Intelligence with a number of US Government agencies including the US Army, the US Airforce and Department of Homeland Security, along with its commercial customers. On the Space Infrastructure side, Maxar was awarded six new GEO Comsat contracts and a number of civil awards including work for NASA’s Human Landing System.

Maxar said its backlog by the end of the year stood at $1.9 billion compared to $1.6 billion at the end of 2019, with the US Government contracts accounting for the uptick.

Zechner said Maxar’s share price appreciation in 2020 doesn’t preclude more good times ahead for shareholders.

“The valuation is not extended — it’s about 9x-10x operating cash flow, which when you look at the rest of the players in the industry is reasonable,” Zechner said. “It’s not one of the hyper-growth companies in there but what’s real and and what will continue to happen is that we need space data, whether it’s for agriculture, defence, urban planning, whatever else.”

“There’s so much information and we’re constantly needing the data you can download. You need the ability to assimilate it, to bring it in securely and that’s what the DigitalGlobe acquisition gave Maxar — they have the ability not only in hardware but they have the software, and there’s a growing use for governments as well,” Zechner said.

With the 2020 gains, Zechner said investors would be forgiven for trimming their positions a bit.

“I think there’s a lot of headroom still left to go on this but it’s had a pretty tremendous move in the past year and maybe peeling a little bit off the position is not unreasonable,” Zechner said. “[But] I’m still there. I think this thing will crack $100 in a couple of years. It was north of $80 when they did the Digital Globe acquisition then it crashed all the way down to $6 because of this perfect storm of bad events.”

“I think the story is fully intact, and the sales they’ve done have improved the balance sheet dramatically,” he said.