Following a quarter that had a few more moving parts than he expected, Echelon Wealth Partners analyst Doug Loe is still bullish on Merus Labs (Merus Labs Stock Quote, Chart, News: TSX:MSL).

This morning, Merus Labs reported its fourth quarter and fiscal 2016 results. In the fourth quarter, the company generated EBITDA of $11.6-million on revenue of $34.3-million.

“Two thousand sixteen was a transformative year for Merus Labs. We evolved into a true regional specialty pharmaceutical company — selling 12 branded products in 36 countries, with a strong pan-European platform,” said CEO Barry Fishman. “Our near-term priority is to optimize the profitability of our diverse product line.”

Loe says that both on revenue and profitability drivers, this quarter had a few more moving parts than he expected. He says the company’s new fiscal 2017 EBITDA guidance instills some caution in him, but overall he thinks the stock is still undervalued.

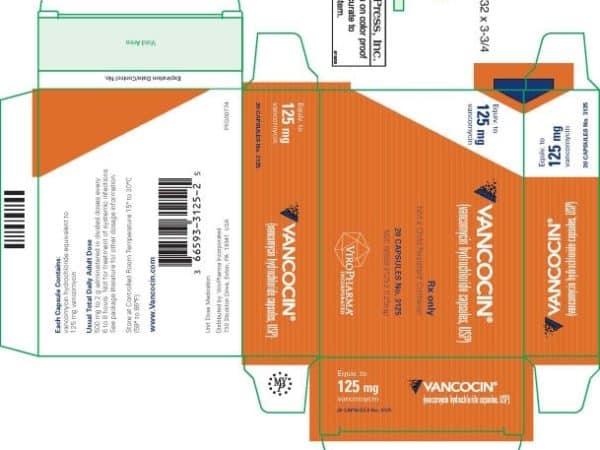

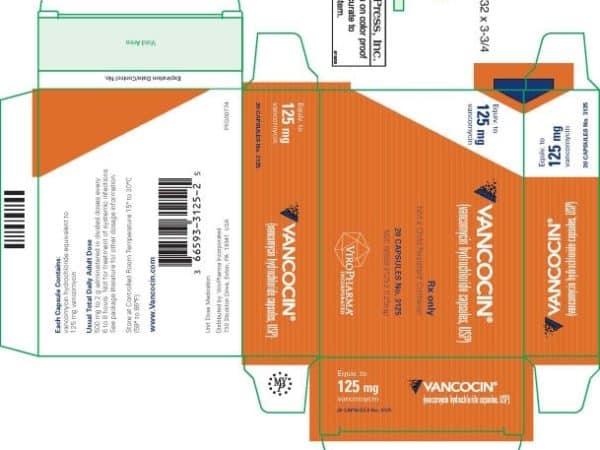

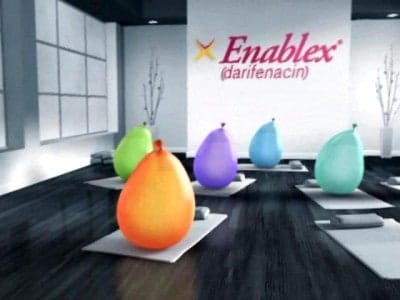

“No denying that F2017 EBITDA guidance is below prior expectations, but with abundant cost-containment initiatives and manufacturing/marketing transitions that should conclude by end-of-F2017 and positively impact EBITDA thereafter: Taking a longer-term view, we are not overly concerned about sales potential for any of Merus’ current portfolio assets – most of the elements generating recent Emselex sales pullback (reimbursement levels in Germany, EU patent expiration mid-quarter) are largely incorporated into our revenue forecasts, and the balance of the portfolio are mature pharma assets to which pricing pressure or shifts in competitive landscape should impact quarterly sales at an end-pharmacy level,” says Loe. “But, there is no denying that newly-shared F2017 EBITDA guidance of $44M-$48M, while it does imply modest profitability growth of up to 11% if the top-end of guided EBITDA is achieved, it is clearly far below our prior forecast of $53.5M (consensus was higher) and our eyes subsequently shifted to Merus’ self-proclamation that F2017 will be a ‘transition year’ for the firm – in our experience, capital markets tend to shift attention to equities for which transitions have concluded, not equities for which transitions are commencing, and we separately suspect that Merus’ market response to FQ416 data is as relevant to that statement as to the quarter itself (well, and to the EBITDA guidance to which the transition is relevant).”

In a research update to clients today, Loe maintained his “Buy” rating and one-year price target of $2.00 on Merus Labs, implying a return of 74 per cent at the time of publication.

Loe believes Merus Labs will generate EBITDA of $46-million on revenue of $131.5-million in fiscal 2017. He expects these numbers will improve to EBITDA of $55.7-million on a topline of $127.4-million the following year.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment