Merus Labs’ (Merus Labs Stock Quote, Chart, News: TSX:MSL) first quarter results have done nothing to change Laurentian Bank Securities analyst Joseph Walewicz opinion that the stock is undervalued.

This morning, Merus Labs reported its Q1, 2017 results. The company lost $6.3-million on revenue of $26.1-million, a 64 per cent top line increase over the $15.9-million in revenue the company posted in the same period last year.

“The first quarter of 2017 performance met our expectations and we are on track to executing our plan for the year,” said CEO Barry Fishman. “Our near-term priority continues to be optimizing the profitability of our diverse product line.”

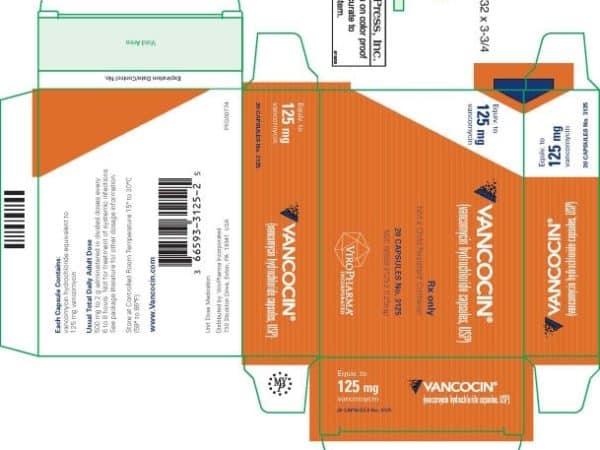

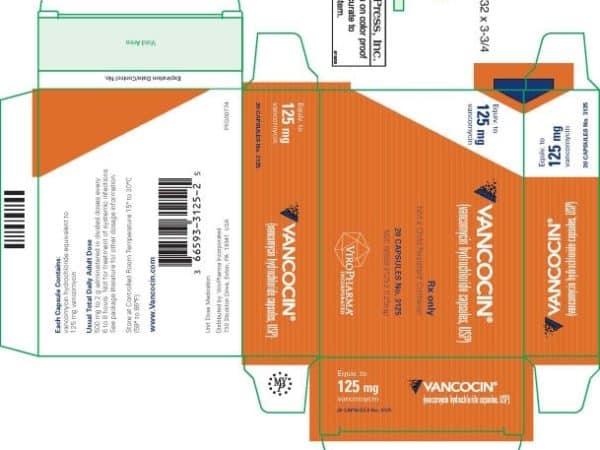

Walewicz says that while both Emselex and Sintrom results were below his expectations due to inventory adjustments, he sees improvement in the form of the company controlling expenses, which is positively impacting its bottom line.

“Our outlook for the company is based on our expectation for improved gross and operating margins, and this quarter demonstrated considerable improvement,” says the analyst. “The GM of ~69% was well above our 58% estimate, and we expect the GM to continue to improve during F2017 (transition of Sintrom manufacturing, lower nitrates COGS). OpEx came in slightly higher than forecast, but results were impacted by $1M in legal settlement fees – excluding this, OpEx were down from Q4/F16. New suppliers should deliver OpEx improvements, and MSL is re-considering its NASDAQ listing ($200-$250k in savings).”

In a research update to clients today, Walewicz maintained his “Buy” rating and one-year price target on Merus Labs, implying a return of 57.1 per cent at the time of publication.

Walewicz thinks Merus Labs will generate Adjusted EBITDA of $46.22-million on revenue of $116.5-million in fiscal 2017. He thinks those numbers will improve to EBITDA of $50.3-million on a topline of $119.4-million the following year.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment