The resignation of CEO Elie Farah is a short-term negative for Merus Labs (Merus Labs Stock Quote, Chart, News: TSX:MSL), but the company’s lucrative platform remains, says Paradigm Capital analyst Alan Ridgeway.

The resignation of CEO Elie Farah is a short-term negative for Merus Labs (Merus Labs Stock Quote, Chart, News: TSX:MSL), but the company’s lucrative platform remains, says Paradigm Capital analyst Alan Ridgeway.

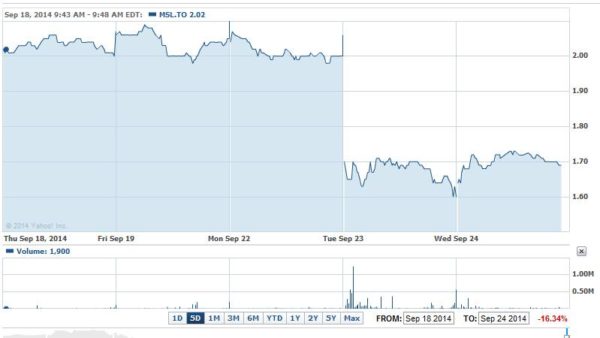

Shares of Merus fell by more than 22% yesterday after Farah’s sudden resignation as CEO and from the company’s board. The company said Barry Fishman, an industry veteran previously with Teva Canada and Eli Lilly, will assume the role of interim CEO. Fishman was previously a senior advisor to the company.

In a research update to clients this morning, Ridgeway maintained his “Buy” rating and $3.00 one-year target on Merus Labs, implying a return of 88% at the time of publication.

Ridgeway says that one of the “main tenets” of his investment thesis on Merus was the strength of its management, particularly with regards to Farah. But the analyst says he is impressed with the experience of Fishman and thinks his deep industry knowledge will serve the company well once he is apprised of the company’s pipeline of potential acquisition targets.

The Paradigm analyst says investors should take a wait-and-see approach to Merus Labs right now. He says he still believes the company offers an attractive risk/reward opportunity because of its approach to product acquisition and its current size, which he sees as a “ground floor” opportunity for investors who can get in ahead of the impact that the company’s small initial deals should have on its valuation.

Ridgeway says his $3.00 target is based on 9x his estimate of Merus Labs’ 2015 EBITDA, which he expects will be $36.7-million. He says this multiple is a discount to comparable Canadian specialty pharma companies which are trading at more than 10x.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment