Early this year, things weren’t looking that great for Quebec City’s AEterna Zentaris (TSX:AEZ).

On January 21st, the company received notification from the NASDAQ that they didn’t comply with the exchange’s minimum bid price requirements. Shares of AEterna, an oncology and endocrine therapy drug development company with a Phase 3 cancer therapy candidate, Perifosine, had been slipping for years.

Despite the fact that AEterna is also listed on the TSX, a delisting of its shares from NASDAQ might have seriously affected the company’s ability to raise capital at a critical time.

To the great relief of it’s shareholders, management, led by President and CEO Jürgen Engel, steered AEZ out of its storm. The Company has raised $25 million in the nine months ended September 30th, mostly through two registered direct offerings in April and June. With $40 million in Cash and Short Term Investments, AEZ management anticipates it now has the working capital to make it to commercialization with Perifosine.

At present, the company’s only revenues are non periodic milestone payments for Cetrotide, an in vitro fertilization drug. That revenue stream represented under $6 million to the company in their most recent quarter, not enough to stem the tide of development money the company burns through; AEZ lost $10.14-million (U.S.) in Q3 2010.

AEterna Zentaris management is quick to point out that the company’s product pipeline is deep, but it’s clear that commercialization of Perifosine could be a single giant step in the right direction for a company that has had some recent notable disappointments, including the failure of cetrorelix, a prostate treatment that failed to meet its primary endpoint and led to the termination of its partnership with Paris based pharmaceutical giant Sanofi-Aventis.

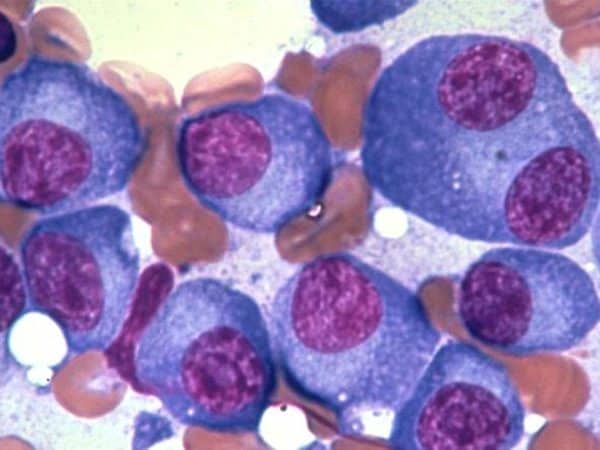

Perifosine is a drug with multiple niche applications in cancer treatment. While the company has received encouraging news in the forms of FDA fast tracking and orphan status (for the treatment of neuroblastoma) some investors may have mistakenly believed the treatment itself only has niche potential, after all The FDA’s orphan drug status is reserved for new treatments that are being developed for diseases or conditions that affect fewer than 200,000 people in the United States. But the sum total of all opportunities for Perifosine is large enough to make AEterna Zenteris investors happy for some time. Some estimate the US market potential for multiple myeloma alone to “exceed $3 billion in the coming years. ”

Expect, as management has hinted at that the company to be busy with exploring partnership opportunities in the first half of 2011. AEZ has partnered with Keryx for North America and Handok for Korea, but has no active partnerships for the treatment elsewhere in the world.

In the meantime AEZ management is busy unveiling more data. They’ll be conducting poster presentations for Perifosine at the Annual Meeting of the American Society of Hematology in Orlando Florida until tomorrow.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment