Byron Capital analyst Douglas Loe says while today’s new represents yet another setback for AEterna Zentaris, the competitive landscape for multiple myeloma was becoming crowded, and the market potential for perifosine was likely diminished if it had been approved. Shares of AEterna Zentaris (TSX:AEZ) were halted today, then slammed when the news that the company was discontinuing its Phase 3 trial multiple myeloma trial with perifosine, following the recommendation of an independent data safety monitoring board.

Shares of the company on the TSX closed the day down 21.7% to $2.09.

CEO Juergen Engel said the company will move on after the setback.

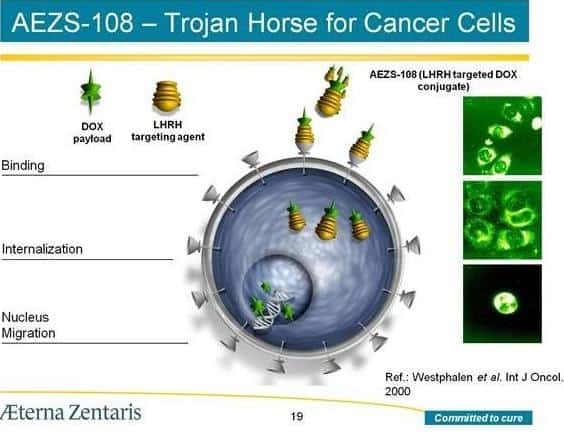

“We are obviously disappointed with the outcome of the interim analysis as reported to us by the DSMB, both from a patient and company perspective, ” he said. “However, we remain focused on other significant opportunities, such as our phase 3 trial in endometrial cancer and phase 2 trials in breast, prostate and bladder cancer with AEZS-108, our NDA filing for AEZS-130 as an oral diagnostic test for growth hormone deficiency in adults, as well as our earlier-stage oncology compound, AEZS-120.”

Byron Capital analyst Douglas Loe says while today’s news represents yet another setback for AEterna Zentaris, the competitive landscape for multiple myeloma was becoming crowded, and the market potential for perifosine was likely diminished if it had been approved.

The Byron analyst says there were, in fact, solid scientific underpinnings that justified perifosine Phase 3 testing, such as the data from a published 73-patient trial that showed a 41% response rate in Velcade-refractory subjects, and the treatment’s known inhibition of AKt signalling pathways relevant to multiple myeloma progression. While Loe says he believes AEZ’s current pipeline still has medical potential, he is no longer assuming any perifosine royalty revenue from multiple myeloma or any other cancer form. In a research update to clients today, Loe maintained his HOLD rating, but dropped his target price to (US) $2, down $.75 from his previous $2.75 target.

Loe says his new target is based on net-present value plus a 35% discount rate, 20x EPS and 12.5x EV/EBITDA on his fiscal 2018 forecasts. He says the company’s net available cash of approximately $37-million will be enough to fund Phase 3 endometrial cancer trials for LHRH-doxorubicin conjugate AEZS-108 and to fund regulatory initiatives for ghrelin agonist AEZS-130. LOe maintains his assumption that IVF agent Cetrotide will generate (US) $31-33 million in revenue annually but that gross margins for the treatment will be small, at about 18%.

___________

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment