Beacon Securities analyst Gabriel Leung is staying bullish on digital advertising and analytics company INEO Tech Corp (INEO Tech Stock Quote, Charts, News, Analysts, Financials TSXV:INEO). Leung delivered a report to clients on INEO on Friday where he reasserted a “Speculative Buy” rating on the stock and C$0.80 target price, which at the time of publication represented a projected one-year return of 310 per cent.

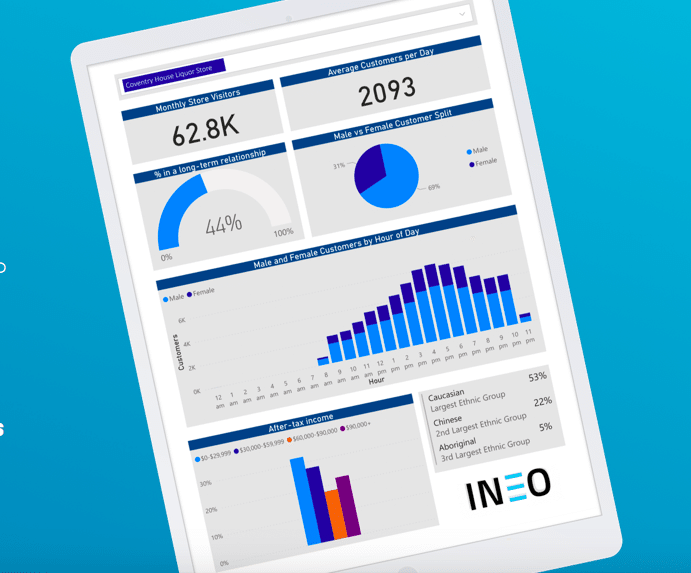

Surrey, BC-based INEO Tech has patented, location-based and targeted digital advertising and analytics solutions, with the company focusing on commercializing its INEO Welcoming System, complete with sensor gates at the entrance to stores, to support retail theft protection systems.

INEO released on Thursday preliminary fourth quarter fiscal 2022 results for the three months ended June 30, 2022, saying the company should show 90 per cent year-over-year revenue growth in the fiscal Q4. Looking ahead, INEO said its sales pipeline has doubled from $20 million in annual recurring revenue to now over $40 million. The company said it has active pilot installations and commitments with large retail chains across a broad spectrum of industries such as grocery, apparel, wholesale club, hardware, department store and pharmacy. INEO says it has had over 30 brands or advertisers using the INEO Media Network and it has recently launched its largest advertising campaign to date.

CEO Kyle Hall said instead of being hit by recession-related impacts, INEO has been experiencing accelerated growth with new retailers coming on board and advertising fill rates increasing.

“INEO is performing better than ever and is on track to exceed our previous quarter’s performance with another record high in revenue for Q4 2022,” said Hall in a press release. “Growth in the fourth quarter is approaching 90 per cent year-over-year despite the increasing interest rates, significant supply chain disruptions, inflationary concerns and other macroeconomic challenges currently affecting other companies around the globe.”

Commenting on the preliminary Q4 numbers, Leung said it looks like INEO is up for quarterly revenue of about $410,000, which would represent the 90 per cent revenue growth rate and would be above the analyst’s own estimate of $369,000. (All figures in US dollars except where noted otherwise.)

As for INEO’s clients, Leung said the retailers likely include Staples, with whom INEO recently signed a Master Services Agreement, along with an unnamed retailer with about 500 franchisee locations across Canada with whom INEO is the preferred vendor for Electronic Article Surveillance (EAS) products. Leung said Staples, at about 1,000 stores, could represent about $12 million in annual recurring revenues once fully deployed.

“Aside from signing new banners to its pipeline, we believe the company is also negotiating larger system deployments with potential retailer customers, which could encompass Dual Screen Welcoming Systems, Gate product, media player, etc., which we believe has the potential of increasing monthly ARPU from $500 to up to $1,000 (for direct sales and half this figure for indirect Prosegur-driven deals),” Leung wrote.

Looking further ahead, Leung is calling for INEO to deliver full fiscal 2022 net revenue and adjusted EBITDA of $1.2 million and negative $2.8 million, respectively, fiscal 2023 revenue and EBITDA of $4.6 million and negative $1.6 million, respectively, and fiscal 2024 revenue and EBITDA of $11.3 million and $0.7 million, respectively.

On valuation, Leung is calling for INEO’s EV/Net Revenue to go from 7.8x in fiscal 2022 to 2.1x in 2023 to 0.8x in 2024 and for its EV/adjusted EBITDA to be at 13.4x in fiscal 2024.

“We are maintaining our estimates pending the release of the full results where we expect to get more details around the current balance sheet. Despite the positive pipeline developments, we continue to be of the view that there could be a risk of dilution over the near-term should the company prefer to give itself a cash cushion (both for operations and working capital as it manages potential enterprise deployments on direct sales opportunities),” Leung wrote.

Disclosure: INEO Tech Corp is an annual sponsor of Cantech Letter.

Share

Share Tweet

Tweet Share

Share

Comment