Beacon Securities analyst Gabriel Leung is staying bullish on Canadian ad tech company INEO Tech Corp (INEO Tech Stock Quote, Charts, News, Analysts, Financials TSXV:INEO), saying in a new report that INEO’s stock has a number of key catalysts upcoming.

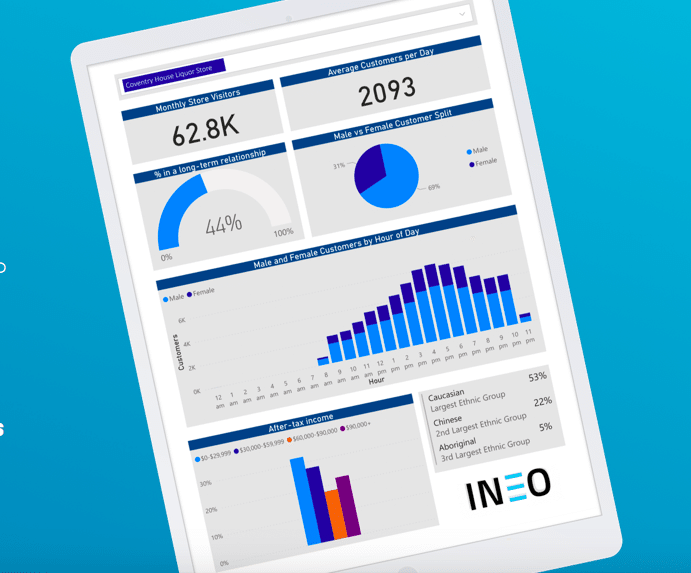

BC-based INEO Tech offers location-based, targeted digital advertising and analytics solutions using its cloud-based IoT and AI-driven platform to customize advertising for retail outlets. The company has a Master Services Agreement signed earlier this year with Staples as well as a distribution partnership with Spain-based security giant Prosegur, first announced last fall.

Also earlier this year, INEO announced it was selected as a preferred vendor for Electronic Article Surveillance (EAS) products by a retailer with 500 franchisee locations across Canada. In his October 5 report, Leung said through channel checks he has discerned that the unnamed retailer is most likely Canadian Tire, with several INEO Welcoming Systems (including the INEO GATE System) recently having been spotted at a Port Coquitlam, BC, Canadian Tire.

Leung said there’s could be an opportunity for INEO to displace Canadian Tire’s current in-store Media Player systems, as well, with that deployment potentially representing the upper end of INEO’s monthly annual revenue per user range of $500-$1,000.

“Based on INEO’s recent quarterly conference call, we believe there could be additional Canadian Tire deployments by the end of this calendar year,” Leung said in his report. “We also understand that Canadian Tire recently held its Dealers Association show in Toronto where the INEO story was well received, which we believe positions INEO well for future expansion in Canadian Tire in CY23 and beyond. With ~500 franchisee locations, we believe Canadian Tire could be a ~$6 million annual revenue opportunity for INEO once deployed.”

On the Prosegur partnership, Leung said INEO has now installed or secured commitments for pilots with several retail chains in the US across various industries and the analyst put a ballpark of over 8,000 potential store location installation sites from those retail chains in the US alone.

“Bottom-line, at a market cap of only $9.3 million, we believe that INEO’s value continues to be dwarfed by its near-term pipeline of opportunities,” Leung wrote. “We maintain our Speculative Buy rating and $0.80 target, which is based on 4x EV/Sales (FY24).”

Leung thinks INEO will generate net revenue in 2022 of $1.2 million, which should move to $4.6 million for 2023 and to $11.3 million for 2024. On adjusted EBITDA, Leung is calling for negative $2.8 million in 2022, negative $1.6 million in 2023 and positive $0.7 million in 2024.

On valuation, Leung has INEO at an EV/Net Revenue multiple of 5.8x for 2022’s numbers, 1.5x for 2023 and 0.6x for 2024. On EV/Adj. EBITDA, he estimates INEO at 9.9x for 2024.

INEO’s share price reached a momentary high of over $0.50 in February, 2021, but the stock has mostly been dropping since. Currently around $0.15 per share, INEO is sporting a year-to-date return of about negative 48 per cent.

At the time of publication of his report, Leung’s $0.80 target represented a projected one-year return of 416 per cent.

Disclosure: INEO Tech Corp is an annual sponsor of Cantech Letter.

Share

Share Tweet

Tweet Share

Share

Comment