It may have come a long way over the past 12 months, but there’s more gas left in the tank for Google and parent company Alphabet (Alphabet Stock Quote, Charts, News, Analysts, Financials NASDAQ:GOOGL). That’s according to Scotia Wealth advisor Stan Wong who says despite the share price appreciation, Google’s businesses are so solid that investors shouldn’t shy away from buying more.

“We continue to own Alphabet in the portfolios and I continue to love that name. It is the undisputed heavyweight champion in the online search market, and no one’s going to take that title anytime soon,” said Wong, Director of Wealth Management at Scotia Wealth, who spoke on BNN Bloomberg on Wednesday.

One year ago, Wong had chosen GOOGL as one of his top picks for the 12 months ahead, and he couldn’t have been more on target. The stock has lit it up over that period, returning 85 per cent since last September. That’s at a time when its FAANG pals haven’t done as well, with names like Amazon pulling in just five per cent over that span while Apple’s 28 per cent and Facebook’s 40 per cent were a little better.

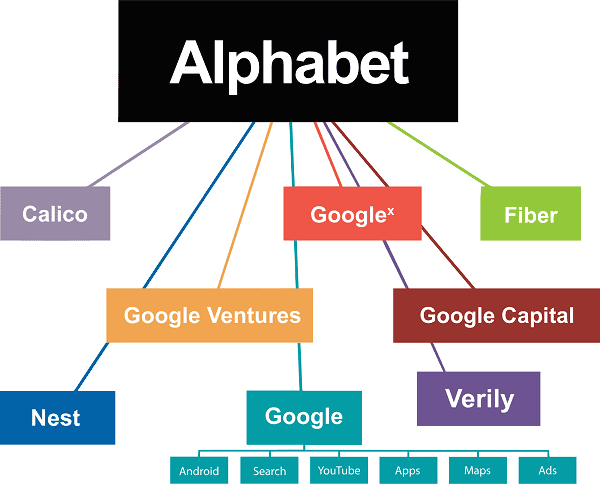

Wong said the variety of Alphabet’s offerings is very attractive, even as its search engine and advertising business remains its key strength.

“Google’s global [search market] share is above 80 per cent. That’s going to be strong revenue and cash flow going forward,” said Wong. “They’re doing a great job with their ecosystem and they continue to strengthen their product lineup, whether it be the home hubs and the watches and so forth through Fitbit. That’s going to continue to be adopted by more and more users and that makes it online advertising services that much more attractive to advertisers and publishers.”

“I like what’s happening with YouTube and clearly what’s happening with Google’s cloud momentum business. That’s going to continue to help the top and bottom lines for Alphabet,” he said.

Alphabet’s latest quarter showed how strong the company’s growth has been. Revenue for the Q2 was a mammoth $61.880 billion, which was 62 per cent higher than a year earlier, while net income was even better at $18.525 billion or $27.26 per share compared to $6.959 billion or $10.13 per share a year ago. (All figures in US dollars.)

“[In the second quarter], we saw a rising tide of online consumer and business activity. We’re proud that our services helped so many businesses and partners. In fact, we set a number of records this quarter,” said Alphabet and Google CEO Sundar Pichai, in the company’s second quarter conference call on July 27.

“This quarter, publisher partners earned more than they ever have from our network. We also paid more to YouTube creators and partners than in any quarter in our history. And on top of that, over the past year, we have sent more traffic to third party websites than any year prior, in addition to generating billions of direct connections – like phone calls, directions, ordering food and making reservations – that drove customers and revenue to businesses around the world that are working to get back on their feet,” Pichai said.

Pichai touted the company’s investments in artificial intelligence which have added capabilities to its Search offerings, advancements in the Android operating system on privacy and safety for the Android 12 this fall and the company’s devices category through Pixel, which includes Nest and Fitbit.

But beyond those businesses, Alphabet’s Cloud revenue grew by 54 per cent over the second quarter, while YouTube continues to spread its dominance internationally and YouTube Shorts is being pegged as a rival to TikTok.

Wong said with the company buying back shares at an impressive rate, the stock remains within the Buy category on a fundamentals basis.

“Earlier this year management authorized a $50 billion share buyback — that’s almost double that of last year’s $28 billion share buyback, so that’s certainly a shareholder-friendly move,” Wong said.

“Long term, we know that there’s a continued growth of online usage, and therefore digital ad spending. Android is doing well. They’re dominating the market share in smartphones. Alphabet shares are trading at a reasonable valuation at 29x forward earnings with a 20 per cent growth rate,” he said.

“I continue to like that name. I like leadership names, whereby there’s not a lot of viable competitors,” Wong said.

On YouTube’s success, Senior Vice President Philipp Schindler said the business had a great quarter with key trends in helping advertisers reach audiences.

“YouTube is uniquely positioned to drive both massive reach and action. We’re seeing more advertisers adopt a full funnel approach to scale their businesses with increased efficiency,” said Schindler in the second quarter conference call.

“Compara, a financial services market leader in Chile, combined a reach and direct response campaign to capitalize on leads. Over 10 weeks, they reached five million users with incremental conversions up 70%. This trend is widely embraced by our largest advertisers where businesses are breaking down silos between online and offline,” he said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment