Higher than anticipated projected crop yields mean that OrganiGram Holdings (OrganiGram Holdings Stock Quote, Chart, News: TSXV:OGI) gets a price bump, says Matt Bottomley, analyst with Canaccord Genuity, who rates the cannabis company’s stock a “Speculative Buy.”

Higher than anticipated projected crop yields mean that OrganiGram Holdings (OrganiGram Holdings Stock Quote, Chart, News: TSXV:OGI) gets a price bump, says Matt Bottomley, analyst with Canaccord Genuity, who rates the cannabis company’s stock a “Speculative Buy.”

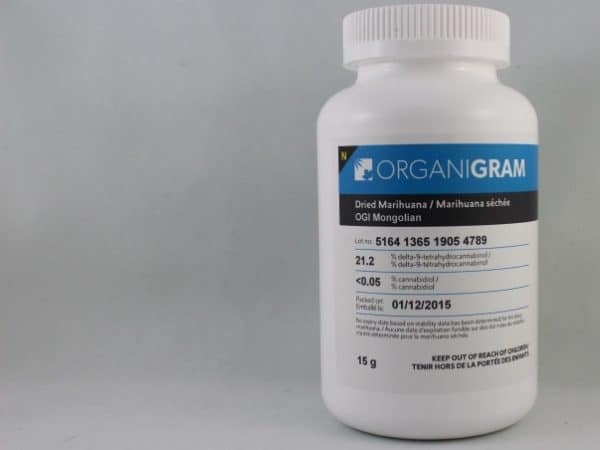

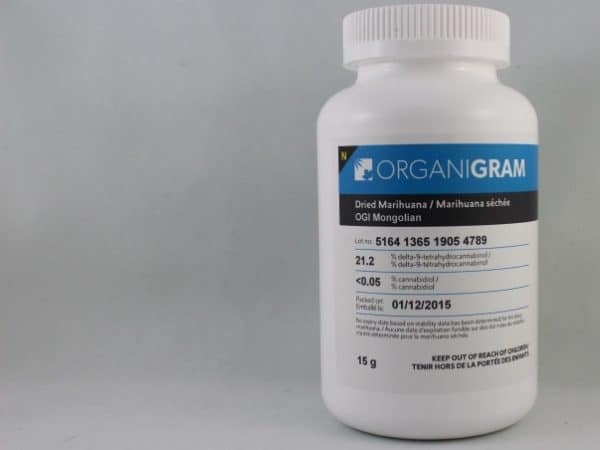

Moncton, New Brunswick-based OrganiGram announced on Tuesday that it has received Health Canada approval for the remaining 13 rooms of its Phase 2 expansion, less than a month after getting approval for the first ten in its 23-room facility. The company also announced that its production yields have been coming in 50 per cent higher than previous estimates.

“We are seeing some harvest yields that are more than 400 grams per square foot a year and have witnessed the quality, density and size of flowers improve tremendously,” said Greg Engel, CEO, in a press release. “With these results we are revising our current production forecast estimates as well as those for our next expansion, set to break ground in April 2018, so that by early 2020 we will be producing over 110,000 kg/annum from fully funded operations.”

In a client update on Tuesday, Bottomley says that OrganiGram’s design improvements and increased yields encouraging, noting that the company has enough cash on hand to complete all four phases of its planned build-out.

“As we expect the company to benefit from a first-mover advantage, we have modestly increased our assumed market share by 50 basis points to 6.0 per cent of the Canadian market as a result of the company’s higher expected output,” says the analyst. “As a result, we are increasing our target price to C$5.50 per share (up from C$5.25).”

Bottomley also likes OrganiGram’s location in New Brunswick, where hydro and labour will help lower production costs.

“OrganiGram currently trades at ~6.4x its two-year forward EV/EBITDA, the lowest relative valuation in our Canadian cannabis coverage, and a discount to its most comparable peers at 8.3x,” says the analyst. “Based on its attractive relative valuation, low-cost production, geographic location, and expanding footprint, we would continue to be buyers of OGI at current levels.”

The analyst maintains his “Speculative Buy” recommendation with a raised target price of $5.50, representing a 12-month return of 31 per cent at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment