Sernova could have an impactful 2024, Research Capital says

Its most recent quarterly results are in the books, but Research Capital analyst Andre Uddin is looking in another place when it comes to Sernova (Sernova Stock Quote, Chart, News, Analysts, Financials TSX:SVA).

On March 18, SVA reported its first quarter results, and the analyst summarized them against his expectations.

“SVA reported Q4 revenues of $0.0M vs. our estimate of $0.0M compared to $0.0M last year. The net (loss) was ($9.7M) or ($0.03/share) vs. our estimate of ($8.9M) or ($0.03/share). As of January 31, 2024, SVA reported $15.6M of cash and marketable securities with zero debt.”

Uddin cautions investors not to look at quarterly results, but upcoming data he says could be a “major catalyst”.

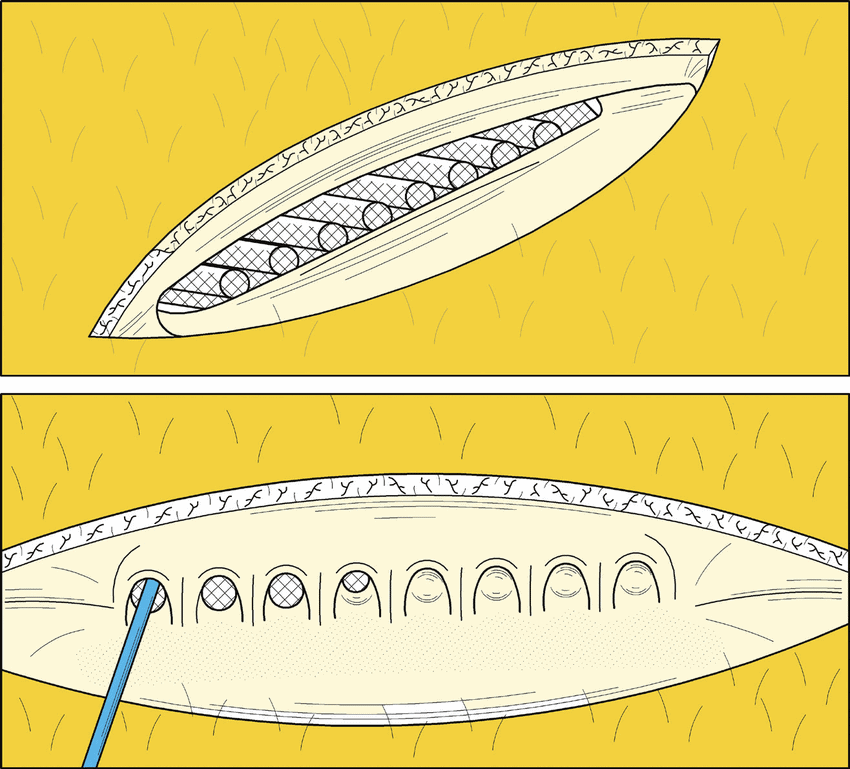

“Sernova is a clinical-stage company and the financials are less important,” he argued. “SVA has previously reported a clean safety profile and stellar efficacy with its 8-chamber Cell Pouch System from an ongoing Phase 1/2 T1D (Type 1 diabetes) trial. Now all eyes are on interim data from the second cohort of the trial, which tests an upgraded 10-chamber version. We emphasize that this data could be a major catalyst for the stock, which we expect in H1 2024. Management continues to forge ahead with its strategic plan: (i) obtain additional capital (ii) generate key proof of concept data with its 1st generation T1D program, (iii) move its iPSCs (induced pluripotent stem cells licensed from Evotec) for T1D towards the clinic (expected Q4 2025), (iv) advance its Cell Pouch System for the treatment of postoperative hypothyroidism (autologous cells) into the clinic (H1 2025), (v) forge strategic partnerships with big pharma & biotech (2024/2025) and (vi) seek a NASDAQ listing (2024/2025).”

In a research update to clients March 19, Uddin maintained his “Speculative Buy” rating and price target of $3.50 on SVA, implying a return of 483.3% at the time of publication.

“We remain bullish on SVA given its scalable Cell Pouch System platform and its ongoing strategic collaboration with Evotec,” the analyst concluded. “In addition, we expect strong interim data on the company’s lead T1D cell therapy candidate from the second cohort (data using the 10 chamber pouch) – expected in H1 2024.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.