SERNOVA

Following the release of new data on a core offering, Research Capital analyst Andre Uddin remains upbeat about the prospects of Sernova (Sernova Stock Quote, Chart, News, Analysts, Financials TSX:SVA).

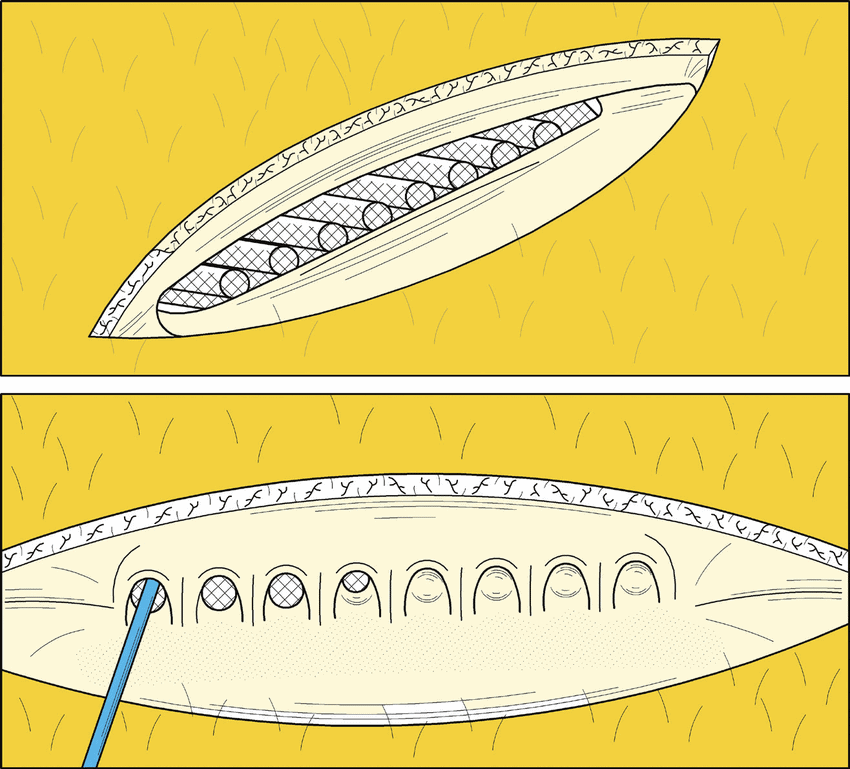

On September 29, Sernova presented what it described as “compelling new data” on its Cell Pouch system, a potential treatment for postoperative hypothyroidism at the 2023 American Thyroid Association meeting in Washington, D.C.

Postoperative hypothyroidism refers to the development of hypothyroidism (an underactive thyroid gland) after undergoing surgery, especially surgery related to the thyroid gland. Hypothyroidism is a condition in which the thyroid gland does not produce enough thyroid hormones. These hormones play a crucial role in regulating the body’s metabolism, among other functions.

In a research update to clients October 5, Uddin maintained his “Speculative Buy” rating and one-year price target of $3.50 on Sernova, implying a return of 332.1 per cent at the time of publication.

“Sernova released strong interim data from the first cohort (8 chamber Cell Pouch System) of the ongoing Phase1/2 study for T1D,” Uddin said. “Impressively, from this 1st cohort, 5 out of 6 achieved insulin independence with one for as long as 3.5 years. All 6 patients achieved HbA1c level below diabetic range (<6.5%). The initial safety profile remains clean, and none of the patients requested removal of the Cell Pouch with minimal discomfort even for a young patient (12 yrs old). No serious adverse effects were reported.”

“We remain bullish with the strong initial data on the company’s lead T1D cell therapy candidate, scalable Cell Pouch System platform, strong Q3 cash position, and strategic appointment of new CEO and CBO,” Uddin added.

COGNETIVITY

Softer than expected results from Cognetivity Neurosciences (Cognetivity Neurosciences Stock Quote, Chart, News, Analysts, Financials CSE:CGN) aren’t diminishing Echelon analyst’s Stefan Quenneville’s enthusiasm for the stock.

On September 29, CGN reported its Q2, 2024 results. The company lost $1.9-million on revenue of $20.3K, below the analyst’s expectations of a loss of $1.5-million on a topline of $58k.

Despite the miss, Quenneville says he remains bullish on the stock.

“Cognetivity Neurosciences reported operating results for FQ224 (period ended July 31, 2023) that were below expectations as the commercial rollout of its CognICA platform which, while still fledgling, continues to gain commercial traction,” he said. “We continue to believe the recent CMS decision to reimburse Alzheimer’s drugs with traditional FDA approval should serve as a meaningful catalyst to drive the adoption of CognICA, given that the reimbursement is contingent upon collecting real-world evidence of effectiveness through a registry that will gather patient information in an “easy-to-use” format. We continue to view CGN as meaningfully undervalued given the CognICA platform’s proven efficacy, ease of use, and scalability.

In a research update to clients October 2, Quenneville maintained his “Speculative Buy” rating and one-year price target of $0.75 on CGN< implying a return of 369 per cent at the time of publication.

Share

Share Tweet

Tweet Share

Share

Comment