SVA stock has an upside of 369%, Echelon says

Its third quarter results are out the door and Echelon analyst Stefan Quenneville thinks there is a lot of money to be made on Sernova Corp (Sernova Corp Stock Quote, Chart, News, Analysts, Financials TSX:SVA)

On September 13, Sernova, which is pre-revenue, reported its Q3, 2023 results. The analyst broke down the quarter, where he said the cash burn was better than expected.

“The Company’s reported R&D costs of $8.4M was above our $5.0M estimate, while the non-IFRS G&A expense came in lower-than-expected at $0.7M versus our $1.5M estimate,” he explained. “This led to a total spend of $9.1M, versus our $6.5M estimate and consensus also at $6.5M, while operating cash burn came in at $4.5M (versus ECM at $6.5M). The Company ended the quarter with ~$31.0M in cash, which we expect should be sufficient for continued clinical development over the next 12 months.”

In a research update to clients September 14, Quenneville maintained his “Speculative Buy” rating and one-year price target of $3.75 on SVA, implying a return of 369 per cent at the time of publication.

The analyst also touched on the management situation at the company, arguing that its new CEO brings strong industry and commercial experience and is looking to increase investor engagement.

“The Company last week announced the appointment of Cynthia Pussinen as its new CEO and Board member following a long search process that was initiated in December of last year. We view her deep commercial experience, particularly with innovative modalities such as gene therapy, as an excellent fit with Sernova as it drives forward its clinical programs and likely looks to further partnership opportunities for its Cell Pouch technology,” he said.

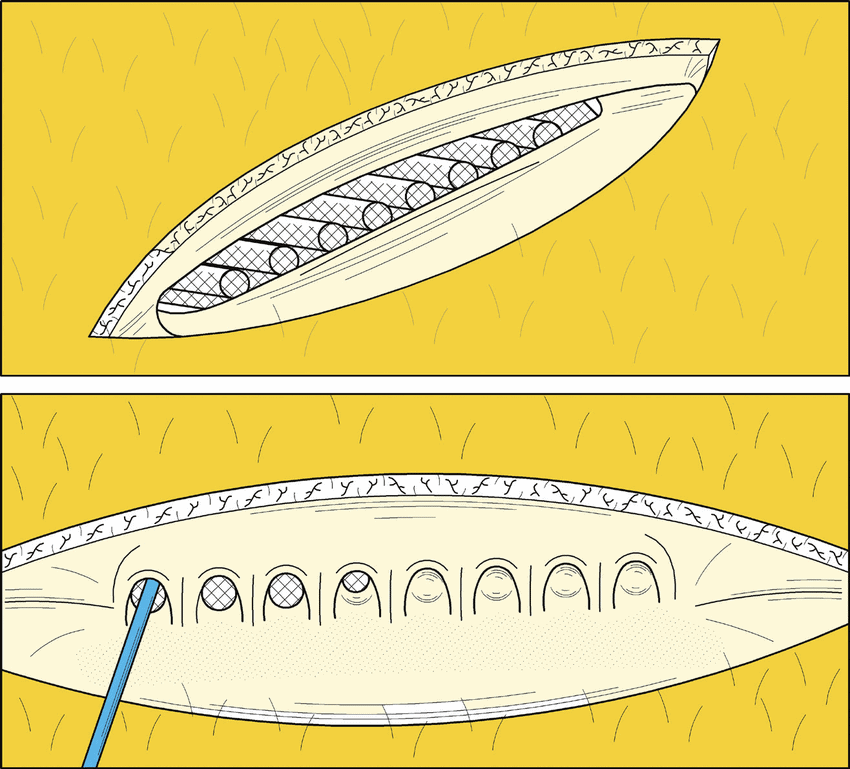

Sernova is a clinical stage company that is working towards the commercialization of its Cell Pouch System, which is a medical device that creates a vascularized tissue environment for the transplant of therapeutic tissues or cell to treat chronic diseases.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.