UGE International is heading to $3, says iA Capital

Shares of UGE International (UGE International Stock Quote, Charts, News, Analysts, Financials TSXV:UGE) have rallied off last year’s mid-summer lows, but there should be more upside over the next 12 months, according to iA Capital Markets analyst Naji Baydoun.

In an update to clients on Thursday, Baydoun maintained a “Speculative Buy” rating on the stock and C$3.00 target, saying UGE gives investors access to the US solar market at a discount.

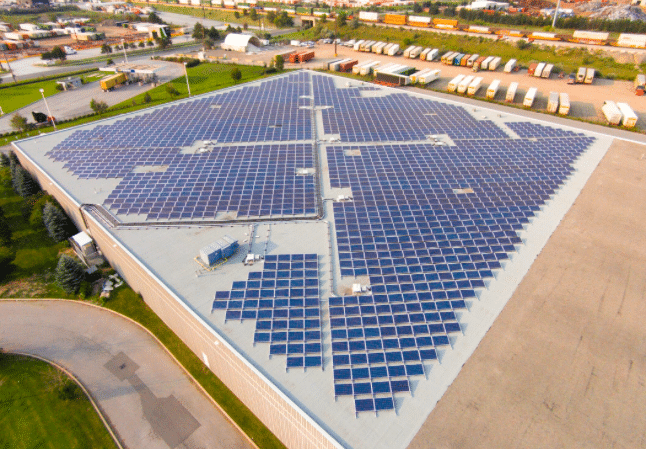

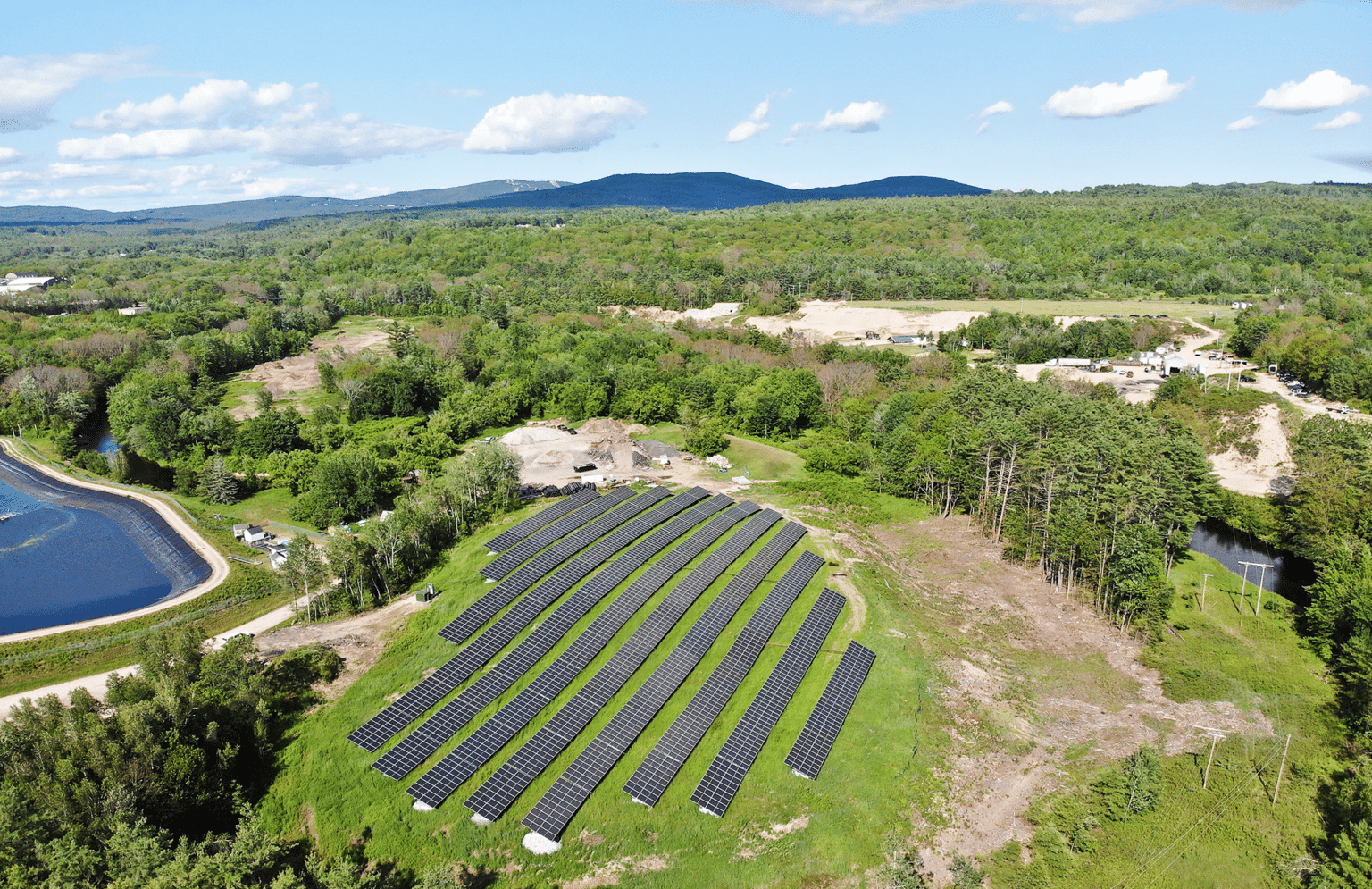

Dual-headquartered in Toronto and New York, UGE develops, builds, owns and operates commercial and community solar and storage projects in North America. The company delivered on Wednesday an update on its 2023-2026 strategic plan, pointing to a number of primary objectives, including an aim to reach 100 MW+ of operating assets by mid-2025 and to add another 100 MW per year thereafter.

UGE also said it is targeting over 20 per cent in total shareholder returns (TSR) from 2023 to 2026 and it aims to beat the TAN Solar Index ETF by over ten per cent per year.

UGE said over the second quarter 2023 its project backlog increased 14 per cent sequentially to 356 MW and says it’s ahead of schedule on adding 100 MW in backlog in 2023.

“In the summer of 2023, UGE has begun to capitalize on an enormous opportunity; renewable energy has never been so economically attractive, and UGE’s team has developed a robust pipeline of opportunities that will drive growth for years to come,” said CEO Nick Blitterswyk in the Strategic Plan report.

For Baydoun, his takeaways from the Strategic Plan included the observation that the rapid growth in UGE’s backlog should give investors additional visibility on the company’s near-term growth outlook, particularly as the company aims to convert a majority of its backlog into operating assets.

“UGE has been executing well on its strategy, advancing significant capacity toward commissioning, with Notice to Proceed (NTP) now reached on ~13.2MW YTD including a recently announced ~0.5MW project in New York (~20MW target for the year). We expect an improving corporate cash flow profile arising from NTPs as UGE earns EPC and development fees during the project build-out process,” Baydoun wrote.

Baydoun’s outlook for UGE has the company’s revenue going from $3.8 million in 2022 to $3.0 million in 2023, to $8.0 million in 2024 and to $15.1 million in 2025. Adjusted EBITDA is forecasted to go from negative $5.8 million in 2022 to negative $8.1 million in 2023, then to negative $3.4 million in 2024 and finally to positive $2.6 million in 2025. (All figures in US dollars except where noted otherwise.)

“UGE offers investors: (1) improving growth and cash flow fundamentals (driven by its strategic pivot towards contracted project development), (2) exposure to the high-growth community solar market in the US (~20-30 per cent+ CAGR through 2030), (3) attractive risk-adjusted project returns (double-digit equity IRRs), and (4) a discounted valuation compared with peers,” Baydoun said.

At the time of publication, Baydoun’s C$3.00 target price represented a projected one-year return of 130.8 per cent.

Staff

Writer