UGE International

After second quarter results he described as “soft”, Industrial Alliance analyst Naji Baydoun nonetheless remains optimistic about UGE International (UGE International Stock Quote, Chart, News, Analysts, Financials TSXV:UGE)

On August 24, UGE reported its Q2, 2023 results. The company posted Adjusted EBITDA of negative $2.6-million on revenue of $300,000, lower than the street’s expectation of $700,000.

Baydoun says despite the flat results, he sees many green shoots for UGE.

“UGE offers investors (1) improving growth and cash flow fundamentals (driven by its strategic pivot towards contracted project development), (2) exposure to the high-growth community solar market in the US (~20-30%+ CAGR through 2030), (3) attractive risk-adjusted project returns (double-digit equity IRRs), and (4) a discounted valuation compared with peers,” he argued. “Despite project delays and increased costs (which ultimately delay profitability timelines), we continue to see significant value in UGE’s backlog and pipeline, which could be unlocked over time via continued development success.”

In a research update to clients August 28, Baydoun maintained his “Speculative Buy” rating and one-year price target of $3.00 on UGE, implying a return of 130.8 per cent at the time of publication.

Boardwalktech Software

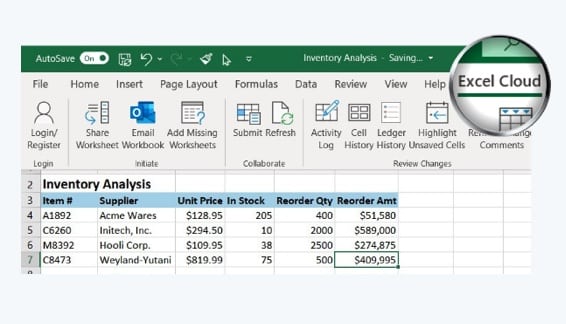

Following the company’s most recent quarterly results, Echelon Capital Markets analyst Mike Stevens has trimmed his price target on Boardwalktech Software (Boardwalktech Software Stock Quote, Chart, News, Analysts, Financials TSXV:BWLK) though the analyst remains bullish on the stock.

On August 24, BWLK reported its Q1, 2024 results. The company posted Adjusted EBITDA of negative $500,000 on revenue of $1.55-million, a topline that was up three per cent over the same period last year.

In a research update to clients August 28, Stevens explained why he has lowered his price target on BWLK (The analyst has maintained his “Speculative Buy” rating).

“With macro challenges still swirling, impacting both the Company’s ability to convert pipeline prospects into contracted clients along with investor sentiment and appetite for unprofitable microcap growth stocks, we are trimming our PT from C$1.15 to C$0.85 (still implying ~67% of upside),” the analyst said, “With the PT trim, we are also trimming our forecasts due to what we believe will be a slower ramp in realized revenues throughout the remaining 7+ months in Boardwalk’s F2024. We are also increasing our DCF valuation’s discount rate to 16% (from 15%) and our terminal EV/EBITDA multiple to 7.5x (from 8.5x) to reflect the referenced challenges, resulting in a DCF valuation of C$0.85. That being said, we look for Boardwalk to demonstrate momentum in FH224 closing deals and setting the stage for a strong FQ424 (where we forecast ~46% y/y Software subscriptions and services growth) and F2025 (beginning April 1, 2024).”

Stevens now thinks Boardwalktech will post EBITDA of negative $1.4-million in revenue of $7.3-million in fiscal 2024.

Share

Share Tweet

Tweet Share

Share

Comment