Boardwalktech Software has target clipped by Echelon

Expecting a slower revenue ramp from Boardwalktech Software (Boardwalktech Software Stock Quote, Charts, News, Analysts, Financials TSXV:BWLK), Echelon Capital Markets analyst Mike Stevens has lowered his target on the stock while keeping a “Speculative Buy” recommendation in a Thursday report.

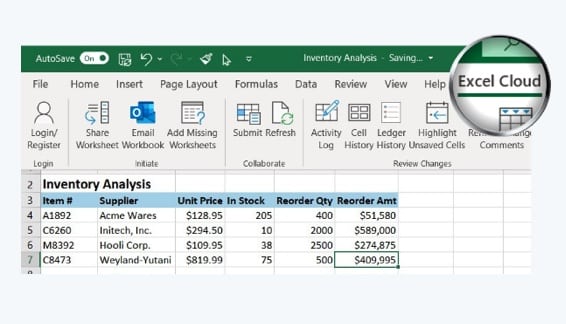

Boardwalktech has enterprise software solutions including Boardwalk Enterprise Digital Ledger Platform for customer automation of business processes. The company reported its fourth quarter fiscal 2023 financials on Wednesday, coming in with revenue of $1.7 million and EBITDA of negative $0.4 million. For the fiscal year, Boardwalktech had revenue up 48 per cent to $6.5 million and adjusted EBITDA of negative $1.6 million compared to negative $1.9 million a year earlier. (All figures in US dollars except where noted otherwise.)

Looking ahead, management guided for fiscal 2024 revenue of $8.5-$10.0 million, good for a 45 per cent growth rate at the midpoint.

“Fiscal 2023 was an inflection point in Boardwalktech’s overall business. We expanded revenue with existing clients, landed new Fortune 100 logos, and experienced growth across all financial metrics in the Company. While we are pleased with our progress last year, we are far from being satisfied,” said CEO Andrew T. Duncan in a press release.

Stevens said the Q4 results were in-line with his estimates, where the $1.7 million in revenue compared to Stevens’ forecast at $1.8 million, the $1.5 million in gross profit compared to the analyst’s $1.6 million estimate and the negative $0.4 million in EBITDA compared to the same negative $0.4 million from Stevens.

“With macro challenges affecting the timing of Boardwalk converting deals, we are trimming our forecasts due to what we believe will be a slower ramp in revenues throughout F2024, which reflects a more conservative stance on timing rather than confidence around deals closing,” Stevens wrote.

“We also impart a more cautious tone within a still-challenged small cap macroenvironment with tougher access (and increased cost) to capital, while USD weakness from when we initiated on Boardwalk (that ~1.38 USD/CAD exchange rate is now ~1.33) contributes to our lower DCF valuation,” he said.

For the fiscal 2024, Stevens is calling for revenue to come in at $8.5 million, with EBITDA at negative $0.9 million. At press time, Stevens’ new C$1.15 target price (previously C$1.30) represented a projected return of 117 per cent.

“We remain bullish on Boardwalk’s operational momentum and long-term trajectory – the Company just wrapped up a fiscal year that saw revenues grow nearly 50 per cent y/y (alongside ARR), an improving EBITDA drain of ~16 per cent, an upcoming fiscal year guided to 40 per cent+ growth and ample liquidity to achieve its growth and profitability targets,” Stevens said.