Beat the market with this biotech stock

It’s been an up-and-down year so far for Oncolytics Biotech (Oncolytics Biotech Stock Quote, Charts, News, Analysts, Financials TSX:ONC), but investors can expect better results over the next 12 months, according to Leede Jones Gable analyst Douglas W. Loe. Loe delivered an update to clients on ONC on Monday and reiterated a “Speculative Buy” rating on the stock and $8.50 target price, which at the time of publication represented a projected one-year return of 273 per cent.

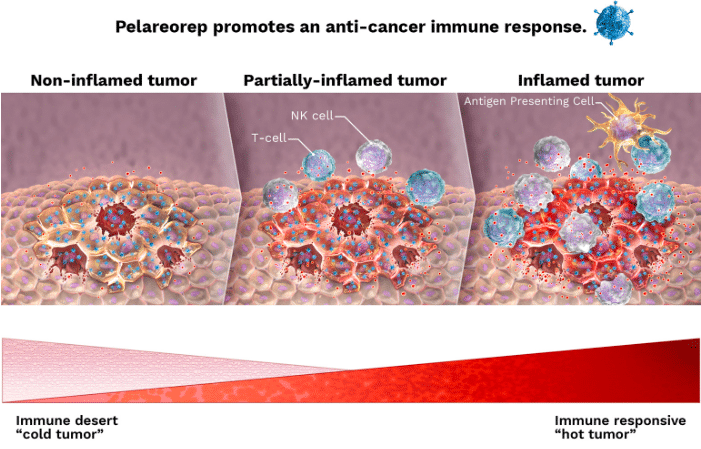

Alberta-based Oncolytics Biotech is a cancer biologics developer working on pelareorep (Reolysin), an intravenously delivered immunotherapy which is currently in Phase 2 trials for breast and pancreatic cancer. The company held a key opinion leader webinar and announced updated trial results on Monday for its Phase 2 BRACELET-1 trial in HR+/HER2- metastatic breast cancer. The data is also part of an oral presentation at the 2023 American Society of Clinical Oncology Annual Meeting.

The data showed a median progression-free survival of 9.5 months in the paclitaxel plus pelareorep cohort versus 6.3 months in the paclitaxel monotherapy cohort. (Paclitaxel is a common chemotherapy used in various cancer treatments including breast cancer.) Confirmed overall response rate (ORR) in the cohorts was 37.5 per cent and 13.3 per cent, respectively.

“BRACELET-1’s positive results complement prior phase 2 data showing a statistically significant increase in overall survival when pelareorep was combined with paclitaxel by demonstrating similar robust improvements in PFS and ORR in less heavily pre-treated patients,” said Dr. Matt Coffey, President and CEO, in a press release.

Looking at the results, Loe said the data show a positive clinical signal in breast cancer when combined with paclitaxel but with two different trials reporting distinct survival-based efficacy measures, as ONC’s previous Phase 2 trial also showed outperformance through the combined therapy but was based on overall survival compared to progression-free survival in the BRACELET trial.

On the key opinion leader discussion, Loe said the insights shared were consistent with his view that future Phase 3 pelareorep breast cancer testing will need to incorporate new standards of care, either as comparative controls or as separate regimens to which pelareorep could be added.

“While there is still an abundance of mechanistic insights to be garnered from just how pelareorep works in combination with paclitaxel, but not with avelumab, that could inform how it works as an anti-tumor agent specifically in breast cancer. The key opinion leaders seemed to think that a pivotal Phase III study comparing pelareorep/paclitaxel to paclitaxel could form the basis of a registration study, with some modifications,” Loe wrote.

“We do not wish to be influenced too dramatically by Phase 2 data that was derived from relatively small patient numbers, but collectively considering all Phase II pelareorep breast cancer data, we still believe that ongoing pelareorep clinical testing in breast cancer is justified, independent of advanced pancreatic cancer as a still-attractive secondary oncology market based on GOBLET data already generated. As such, we are maintaining our Speculative Buy rating and one-year PT of $8.50 on ONC,” he said.