Raymond James analyst Rahul Sarugaser has identified a biotech stock he thinks can be a winner for investors.

In a research update to clients April 4, Sarugaser initiated coverage of Oncolytics Biotech (Oncolytics Biotech Stock Quote, Chart, News, Analysts, Financials TSX:ONC) with an “Outperform” rating and a price target of $3.00.

Sarugaser says the problem that ONC is addressing is nothing less than dire.

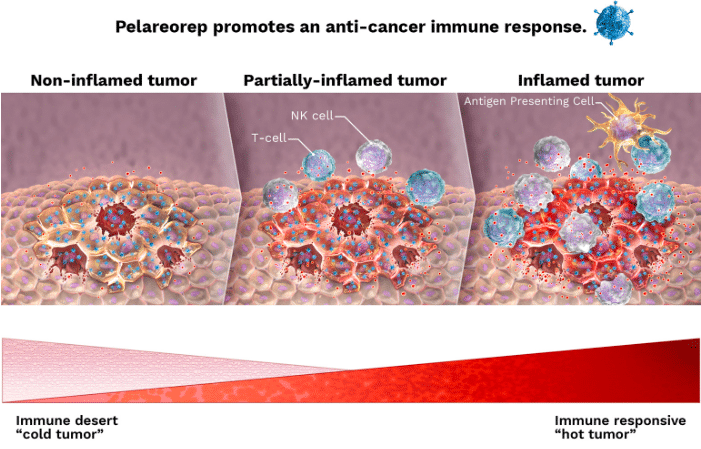

“Pancreatic cancer is the fourth-leading cause of cancer-related death in the US, with five-year survival rates below 10%, owing to a dearth of effective screening technologies. While advances in immunotherapy have improved the treatment of many cancers, pancreatic cancer is not among them; pancreatic tumors tend not to produce an immune reaction (i.e. they are ‘cold’ tumors), and, as a result, show little/no response to key immunotherapeutic drug classes such as anti–PD‐(L)1 (e.g. Keytruda, Opdivo, Tecentriq, Imfinzi, Bavencio, Libtayo), nor to anticytotoxic T‐lymphocyte–associated antigen 4 (anti–CTLA‐4) therapies (e.g. Yervoy, Imjudo). By 2028, we estimate that US + EU metastatic and second-line drug-treatable pancreatic cancer populations will comprise ~200k patients.

The analyst gave an overview of what the company has accomplished to date.

“Oncolytics Biotech is a clinical-stage biotechnology company focused on developing pelareorep: a retrovirus-based drug that has, across multiple clinical trials, been shown to make tumors more susceptible to other important oncology treatments by inducing an inflamed tumor phenotype, turning immunologically ‘cold’ tumors ‘hot’. Pelareorep has been studied in more than 1,100 patients, yielding clean safety and strong efficacy results across numerous tumor types.

Saurgaser says the company addressable market is sizeable and thinks it has a realistic chance of making an impact.

“We see the potential for ONC to submit NDAs for pelareorep in both pancreatic and metastatic breast cancer in 2027/8, yielding a large potential market opportunity (alongside earlier-stage pipeline programs with compelling clinical signals). In the interim, we anticipate a succession of value-creating catalysts, including multiple looks at clinical data, and, with a collection of well-heeled Pharmas already hanging around the hoop (Pfizer, Merck, Roche, Adlai Nortye, Incyte), we assign a non-zero probability to ONC securing material partnerships on data readouts/regulatory guidance in the near- and medium-term, which drives our OP2 rating.”

Share

Share Tweet

Tweet Share

Share

Comment