Look for continual improvement in earnings to boost the share price for ProntoForms (ProntoForms Stock Quote, Charts, News, Analysts, Financials TSXV:PFM), according to Beacon Securities analyst Gabriel Leung, who reiterated a “Buy” recommendation on the stock on Wednesday.

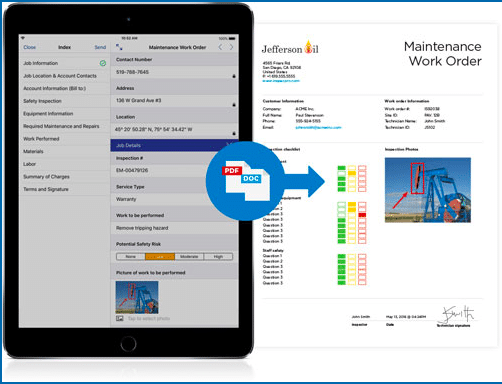

Ottawa-based ProntoForms, which has in-the-field work solutions to manage forms, paperwork and client relationships through a mobile device, released its first quarter 2023 results on Wednesday. Revenue was up 14 per cent year-over-year and up three per cent sequentially to $5.77 million, while the net loss for the Q1 was $1.13 million compared to a loss of $1.54 million a year earlier. (All figures in US dollars except where noted otherwise.)

In the management commentary, co-CEO Philip Deck underlined the steady rise in the company’s annualized recurring revenue, even during what was deemed a relatively light Q1 with no new significant enterprise wins.

“During the first quarter we made meaningful changes to our entire go-to-market strategy and organization, emphasizing our positioning as an enterprise field intelligence platform and focusing our rapidly maturing sales force on the most compelling customer opportunities,” Mr. Deck said in a press release.

Looking at the Q1 results, Leung said the topline of $5.8 million and EBITDA at negative $692K compared to his forecasts at $5.7 million and negative $247K, respectively. He noted that the EBITDA included about $200K in legal fees related to organizational changes, along with about $100K in severance. Excluding those charges, PFM’s EBITDA would have been about negative $392K.

Leung pointed to a recent $3.5 million contract win with a Global Fortune 500 medical manufacturing company as adding to ProntoForms’ annualized recurring revenue (ARR), and he noted that PFM has been making investments in the business, including upgrading sales personnel and IT infrastructure to support a higher growth business.

“We believe the company will continue to optimize its operations, including more targeted sales efforts and improved work flow with a goal of becoming a ~30 per cent ARR growth business over the coming years,” Leung wrote.

“We believe evidence of an acceleration in ARR growth, along with steadily improving EBITDA represent key near-term catalysts for the stock,” he said.

With the update, Leung’s forecast for PFM calls for 2023 and 2024 revenue of $24.3 million and $28.8 million, respectively, and for 2023 and 2024 EBITDA of negative $1.1 million and positive $1.5 million, respectively.

ProntoForms’ share price has been trading around the $0.45 per share mark for the past year. Leung reiterated a 12-month target price of C$1.05 per share, which translated at press time to a projected return of 128 per cent.

Share

Share Tweet

Tweet Share

Share

Comment