ProntoForms has a 92 per cent upside, says Beacon

In-line quarterly numbers from ProntoForms (ProntoForms Stock Quote, Charts, News, Analysts, Financials TSXV:PFM) include a healthy uptick in annual recurring revenue, according to Beacon Securities analyst Gabriel Leung. But the pullback on stocks across the tech space has prompted Leung to drop his target price on PFM while maintaining a “Buy” rating. In a Thursday report on ProntoForms, Leung lowered his target from C$1.10 to C$0.95 per share, which at the time of publication represented a projected one-year return of 92 per cent.

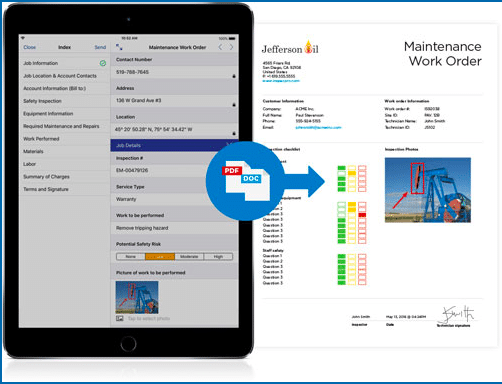

Ottawa-based ProntoForms, which offers in-the-field solutions for managing forms, paperwork and client relationships via mobile device, announced its third quarter financials on Thursday, coming in with revenue up 12 per cent year-over-year to $5.46 million and a net loss of $1.01 million compared to a net loss of $1.11 million a year earlier. (All figures in US dollars except where noted otherwise.)

“In Q3, our Annual Recurring Revenue (ARR) base grew by 4.5 per cent over Q2 2022 as we continue to drive our enterprise expansion strategy. ARR growth in the enterprise segment continues to grow in absolute and proportion of total ARR as enterprise account managers hired last year become increasingly productive,” said CEO Alvaro Pombo in a press release.

The company notched a number of new and expanded customer contracts over the Q3, including a top-five global oil and gas enterprise business expanding its deployment from $100K ARR to over $300K, a new business agreement with a global refrigeration and HVAC company and an expanded deployment and upgrade from an $18 billion construction services organization.

ProntoForms ended the quarter with cash of $6.05 million and C$1.8 million left on its C$10 million debt facility.

Looking at the Q3 numbers, Leung said revenue came in as expected at $5.5 million, while the company’s EBITDA loss of $751,000 was a little better than his forecast at negative $840,000.

“The company continues to see improving productivity from the enterprise account managers, who were hired last year. We believe this is represented by notable new and expansion progress from enterprise customers, including a top five global oil and gas enterprise expanding its deployment from $100k ARR to over $300k,” Leung wrote.

Looking further ahead, Leung is calling for full 2022 revenue and EBITDA of $21.4 million and negative $3.3 million, respectively, and moving to 2023 revenue and EBITDA of $25.6 million and negative $1.6 million, respectively.

“The company noted that its plan is to maintain and optimize the current operating expense structure and return to higher levels of growth, which we believe could help to drive better operating leverage over the near-term,” he said.

Leung said the Q3 results helped him maintain a “Buy” rating on the stock, while the lowered target came as a result of general industry multiple contraction, with his valuation going from 4x 2023 EV/Sales to 3.5x.

Staff

Writer