Diagnos is a Top Pick for the second quarter, says Echelon

2023 is shaping up to be a catalyst-rich year for artificial intelligence company Diagnos (Diagnos Stock Quote, Charts, News, Analysts, Financials TSXV:ADK), according to Echelon Capital Markets analyst Stefan Quenneville, who delivered an update on the company on Tuesday where he reaffirmed ADK as a Top Pick for the second quarter.

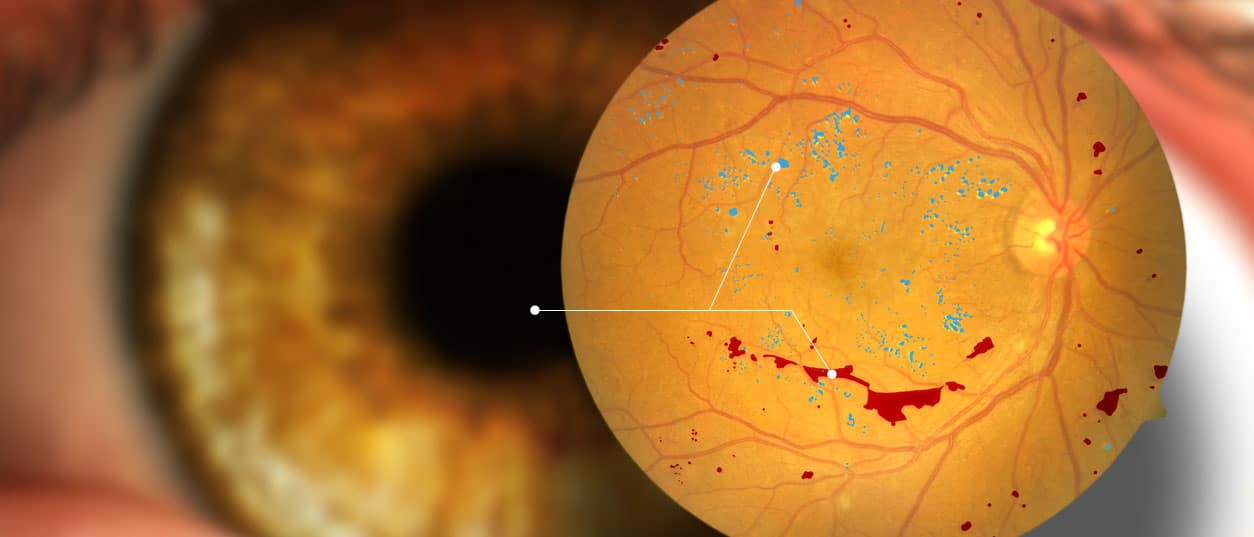

Montreal-based Diagnos is a commercial-stage AI company addressing the problem of diabetic retinopathy (DR), the leading cause of adult blindness. The company’s AI-based FLAIRE platform is an equipment-agnostic technology that integrates with existing optometry cameras to enable early detection and monitoring of DR.

Currently, Diagnos is rolling out the platform across New Look Vision locations in Quebec and various medical locations in Central America and Diagnos has an MOU with EssilorLuxottica, the world’s largest eye care company, announced in August 2021.

The expectation according to Quenneville is that the MOU will be converted to a contract to commercialize FLAIRE in up to 8,000-10,000 EssilorLuxottica locations worldwide.

“Of the ~500 million diabetics worldwide, 20-40 per cent have DR and are at risk of going blind and five to ten per cent will develop or see a progression in the severity of DR within 12 months. Regular eye exams are critical to early, pre-symptomatic detection, yet only half of patients are screened annually. ADK’s platform operates either as a decision support tool or for autonomous detection for DR and other indications such as stroke and macular edema (pending additional regulatory approvals),” Quenneville wrote.

Quenneville said that while the company’s rollout in Quebec has been slower than expected, the platform has been installed in about 30 locations to date across the province, with the larger and higher-volume locations prioritized. The analyst said management’s goal is to roll out at five to ten stores per week in 2023, implying a presence at about 250 New Look locations by the end of the year.

Further, Quenneville said Diagnos and partner Retina Labs are likely to win an RFP for retinal disease screening from the Quebec government, one which is expected to represent about $22 million and a “meaningful near-to-medium term opportunity” that could provide upside to current forecasts.

Quenneville is forecasting $0.6 million in revenue for its fiscal 2023 (year end March 31) and moving to $2.8 million for fiscal 2024. EBITDA is expected to go from negative $1.7 million in fiscal 2023 to negative $0.2 million for fiscal 2024.

With the update, Quenneville reiterated a “Speculative Buy” rating on Diagnos and $1.00 target price, which at press time represented a projected one-year return of 190 per cent.