Heading into the fourth quarter, Echelon Capital Markets analyst Stefan Quenneville still thinks highly of Diagnos (Diagnos Stock Quote, Chart, News, Analysts, Financials TSXV:ADK).

In a research update to clients October 3, the analyst maintained his “Speculative Buy” rating and one-year price target of $1.00 on ADK, implying a return of 88 per cent at the time of publication.

Quenneille said an existing understanding might soon lead to something more substantive.

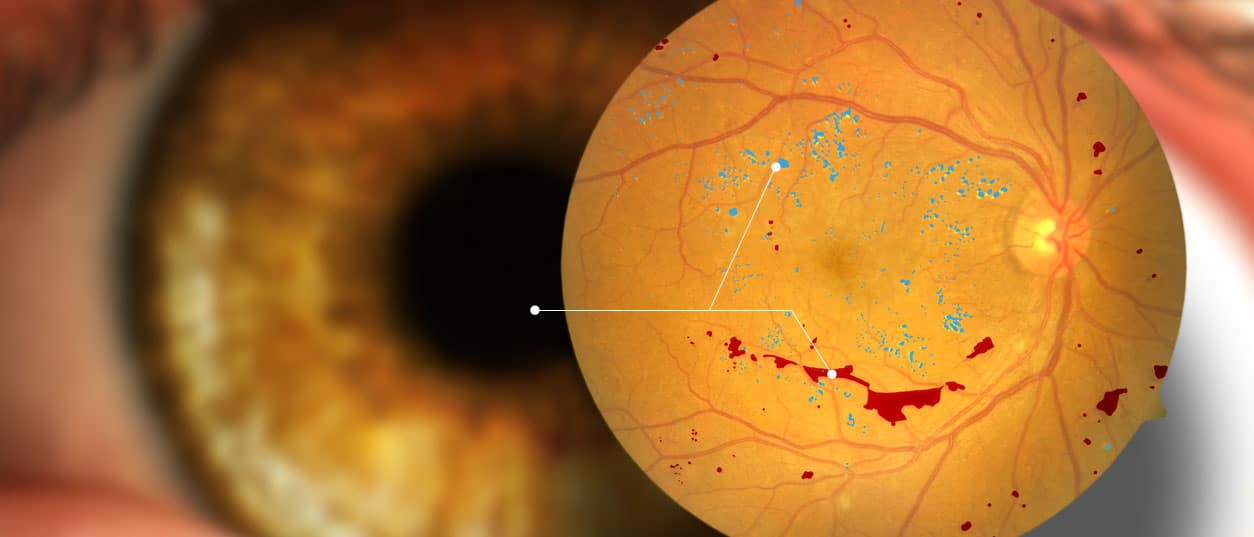

“DIAGNOS Inc. remains a Top Pick with the expectation that the August 2021 MoU with EssilorLuxottica (EL-MIL, NR), the world’s largest eye care company, will be converted to a contract to commercialize the AI-based FLAIRE platform to screen for Diabetic Retinopathy (DR), the leading cause of adult blindness, in up to 8,000-10,000 of its worldwide locations,” the analyst said. “Often undetected due to screening bottlenecks, DR progresses asymptomatically until irreversible vision loss occurs. ADK’s equipment-agnostic platform seamlessly integrates with existing optometry cameras and workflows to enable early detection, grading, and monitoring of DR, which can be difficult and time-consuming using current manual approaches.”

The analyst thinks ADK will produce EBITDA of negative $2.0-million on revenue of $500,000. He expects those numbers will improve to EBITDA of negative $1.8-million on a topline of $1.6-million.

Share

Share Tweet

Tweet Share

Share

Comment