Following first quarter results that missed his expectations, Echelon Capital Markets analyst Stefan Quenneville has kept his “Speculative Buy” rating on DIAGNOS (DIAGNOS Stock Quote, Chart, News, Analysts, Financials TSXV:ADK).

On August 24, ADK reported its Q1, 2024 results. The analyst summarized the quarter.

“FQ124 revenues came in at $43.3K, below our $102.0K estimate and down -70.9% y/y (-36.6% q/q) due to slower-than-expected New Look roll-out. In addition, last year’s revenue included one-time customization consulting fees for the deployment and enhancement of additional AI-based eye exams (such as glaucoma and macular degeneration) that are expected to follow the launch of the diabetic retinopathy diagnostic test. The Company’s FQ124 gross profit of -$173.2K and EBITDA of -$569.4K also came in below our estimates of -$30.6K and -$158.1K, respectively. The net loss came in at -$752.2K in FQ124 versus our -$251.8K estimate. The Company ended FQ124 with $694K of cash and short-term investments, which was helped by net proceeds of $844K from convertible debt and stock warrants issued in FQ124.”

In a research update to clients August 25, Quenneville maintained his “Speculative Buy” rating and one-year price target of $1.00 on DIAGNOS, implying a return of 104 per cent at the time of publication.

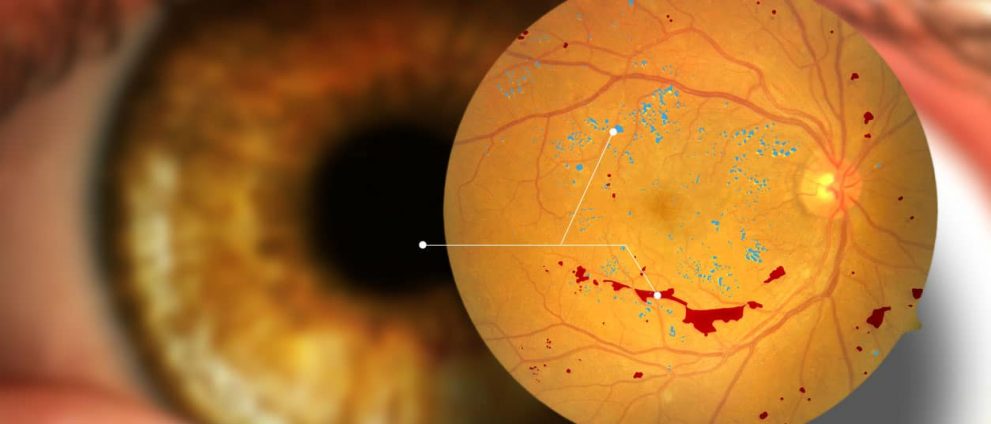

Montreal-based Diagnos is a commercial-stage AI company addressing the problem of diabetic retinopathy (DR), the leading cause of adult blindness. The company’s AI-based FLAIRE platform is an equipment-agnostic technology that integrates with existing optometry cameras to enable early detection and monitoring of DR.

The analyst thinks ADK will post EBITDA of negative $1.8-million on revenue of $1.6-million.

“Nevertheless,” Quenneville added, “with ADK remaining the likely winner of the Quebec RFP, which was recently retendered, as well as the potential for a transformational deal with EssilorLuxottica (EL-MIL, NR), we maintain our Top Pick rating and $1.00/shr target price ahead of what we expect to be a catalyst-rich back half of the year.”

Share

Share Tweet

Tweet Share

Share

Comment