Bellus Health shareholders should take the deal, says Research Capital

Shareholders should take the acquisition offer just announced for Canadian biopharm company Bellus Health (Bellus Health Stock Quote, Charts, News, Analysts, Financials NASDAQ:BLU). That’s the call from Research Capital analyst André Uddin, who moved his rating on BLU from “Hold” to “Tender” and his target price from $8.10 to $14.75 in a Tuesday update.

Laval, Quebec-based Bellus Health, a clinical-stage biopharmaceutical company focusing on refractory chronic cough (RCC), announced on Tuesday in conjunction with British pharma giant GSK plc an agreement where GSK will acquire Bellus for $2.0 billion or $14.75 per share. Bellus shares essentially doubled in value on Tuesday. (All figures in US dollars.)

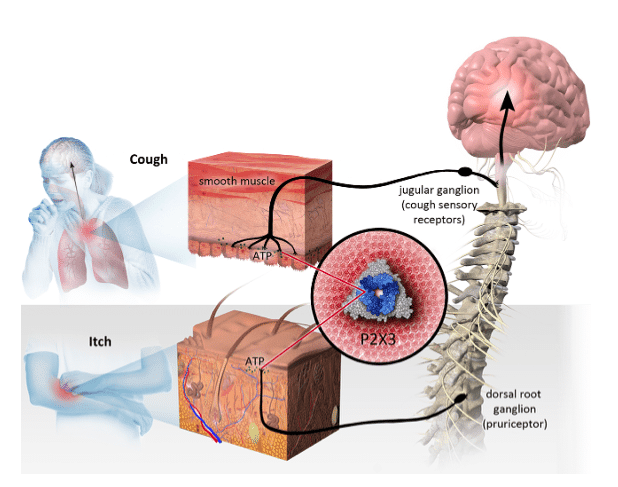

The deal will see GSK acquire Bellus’ camlipixant, a P2X3 antagonist currently in Phase 3 development for RCC, which currently has no approved medicines in the US or the EU.

“This acquisition recognizes the value of our highly selective P2X3 antagonist camlipixant and validates the hard work and dedication of all the BELLUS employees in advancing camlipixant to date,” said Bellus CEO Roberto Bellini in a press release.

The press release from the two companies said 28 million patients suffer from chronic cough and ten million patients globally including six million in the US and the EU who suffer from RCC. The companies said following anticipated regulatory approval and a launch of camlipixant in 2026, the acquisition is expected to deliver for GSK significant sales from 2027 through 2031 and beyond.

Bellus has had its ups and downs over the years with a number of its development programs including camlipixant, which in 2020 missed a primary endpoint with a Phase 2 study for RCC, causing the stock to fall over 70 per cent in one trading day.

But the new news represents a nice resolution to the Bellus story, according to Uddin, who said he had expected Bellus to out-license camlipixant (BLU-5937) once the Phase 3 trial results were completed.

“We believe GSK is acquiring a potential best-in-class P2X3 antagonist (BLU-5937) for recurrent chronic cough in Phase 3 trials,” Uddin wrote. “Like father like son, we congratulate the Bellini family on once again proving their success in the biopharmaceutical arena.”

Roberto Bellini is the son of former BioChem Pharma chief Francesco Bellini, who sold the company in 2001 to Shire Pharmaceutical for $5.9 billion. BioChem was responsible for the first HIV/AIDS drug 3TC Epivir.