Research Capital Corporation analyst André Uddin thinks Bellus Health (Bellus Stock Quote, Chart, News, Analysts, Financials TSX:BLU) could be a winner in the race to deliver a chronic cough drug. Uddin reviewed Bellus’ latest quarterly report in an update to clients on Thursday where he maintained his “Speculative Buy” rating while reducing his target price from US$17.40/share to US$14.80/share.

Based in Laval, Quebec, Bellus Health is a clinical-stage biopharmaceutical company developing novel therapeutics for the treatment of chronic cough and other hypersensitization-related disorders.

Uddin’s latest analysis comes after Bellus Health reported its fourth quarter financial results for the 2021 fiscal year, though Uddin also reiterated that financials aren’t as important for Bellus right now given its status as a clinical stage company.

Staying in line with projections, the company did not generate any revenue in the quarter to match the same quarter of 2020, though it also produced a net loss of $14.8 million or $0.18/share, slightly higher than the Research Capital projection of a $13.4 million loss or $0.17/share, and significantly more than the $7.5 million net loss ($0.13/share) it incurred in the same quarter of 2020. (All figures in US dollars.)

All told, the company has $248.8 million in cash available to work with compared to zero debt, though Uddin noted the company closed in December a $200-million equity financing in December, which was cause for the target drop.

Clinically, the company released encouraging results from its Phase 2b SOOTHE trial for refractory chronic cough with its BLU-5937 candidate back in December. The trial met its primary endpoint of daily (24h) cough frequency after four weeks of treatment and the topline results showed that the 50mg and 200mg doses achieved a clinically meaningful and statistically significant placebo-adjusted reduction in daily cough frequency of 34 per cent.

Now, the company is pursuing an End-of-Phase 2 (EOP2) meeting with the FDA to discuss the design of Phase 3 trials with the candidate in refractory chronic cough, which is expected to take place in the second quarter of 2022.

Uddin said Bellus is part of a four-candidate race to become the primary RCC treatment, with the others being Merck’s gefapixant, Shionogi’s sivopixant (S-600918), Bayer’s eliapixant (BAY 1817080), though Bayer discontinued the development of eliapixant on February 4 due to an unfavorable risk/benefit profile.

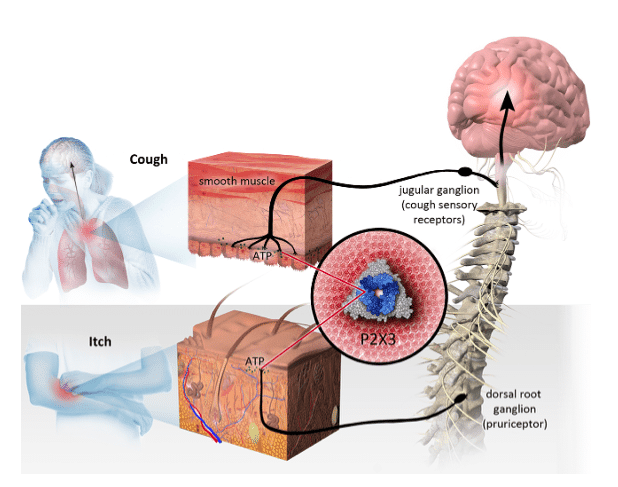

“2021 was a momentous year for BELLUS Health, underscored by positive topline results from the Phase 2b SOOTHE trial and developments within the P2X3 class that positioned BLU-5937 as a differentiated product candidate with the potential to be best-in-class,” commented Roberto Bellini, President and Chief Executive Officer of BELLUS Health in the company’s February 23 press release. “Our optimized Phase 2b design showcased the true promise of our highly selective, second generation P2X3 antagonist in RCC, demonstrating its ability to significantly decrease cough frequency with a favorable tolerability profile. We look forward to another productive year ahead, as we plan to take the necessary steps – including conducting an End-of-Phase 2 meeting with the FDA – to initiate our Phase 3 program in RCC this year.”

Uddin projects the company to start bringing in revenue in 2022 at $4.9 million (all report figures in US dollars), remaining there in 2023, but growing as high as $179.9 million in 2027, with the entirety of that mix coming from BLU-5937 revenue and other royalties.

Accordingly, Uddin introduces the P/Sales multiple projection in 2022 at 130.9x and remaining there for 2023, with projections for it to drop to 3.5x by 2027.

From a cash flow perspective, after the company reported a positive operation of $1.27/share for 2021, Uddin projects another positive projection of $0.63/share in 2022 before shifting to a negative projection of $0.17/share in 2023, though he projects it to turn positive once again in 2024 at $0.31/share and going up from there.

After reporting a multiple of 4.7x for 2021, Uddin projects a jump in the company’s P/CFPS multiple to 9.6x in 2022, followed by an NMF for 2023 before estimating a 19.3x multiple in 2024, which drops to a projected 5.66x by 2027

Meanwhile, he expects the company’s EPS to improve from the reported loss of $0.90/share in 2021 to a projected loss of $0.25/share in 2022, with a further projected loss cut to $0.13/share in place for 2023 before turning positive in 2024 at a projected $0.32/share.

Bellus Health’s stock price has blossomed to a 55.4 per cent return over the last 12 months, though things haven’t been so rosy to start 2022, which has returned a 19.9 per cent loss to date. Bellus began its climb after hitting a 52-week low of $3.39/share on July 28, eventually hitting a 52-week high of $10.67/share on December 21. At the time of publication, Uddin’s new US$14.80 target represented a projected 12-month return of 172 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment