Taking in some positive clinical results from Canadian drug company Bellus Health (Bellus Stock Quote, Chart, News, Analysts, Financials TSX:BLU), Research Capital Corporation analyst André Uddin has upped his target price in a report to clients on Monday. Uddin maintained his “Speculative Buy” rating while raising his target price from $11.20/share to $17.40/share for a projected return at the time of publication of 211 per cent.

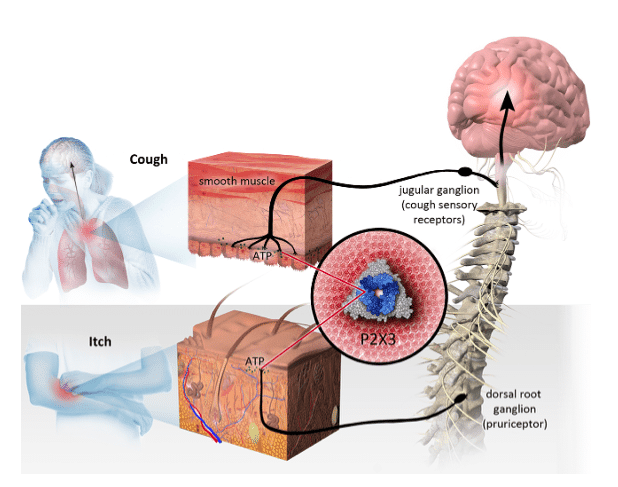

Spiking a full 48 per cent in trading on Monday, Laval, Quebec-based Bellus Health, a clinical-stage biopharmaceutical company developing novel therapeutics for the treatment of chronic cough and other hypersensitization-related disorders, released earlier in the day encouraging data on its Phase 2b SOOTHE trial for refractory chronic cough with its BLU-5937 candidate.

“RCC represents a large unmet medical need worldwide – it was estimated there are approx. nine million, nine million and seven million patients in the U.S., Europe (including the UK) and China, respectively,” Uddin said. “Based on BLU’s Phase 2a RELIEF trial and Merck’s trials with gefapixant, 70 per cent of RCC patients are expected to have over 25 coughs/hour (cough frequency).”

The SOOTHE trial is a randomised, double-blind, placebo-controlled Phase 2b trial with BLU-5937 in refractory chronic cough (RCC) patients, testing different dose strengths of the candidate (12.5 mg, 50 mg and 200 mg BID) against placebo in 249 RCC patients with a baseline cough frequency of greater than or equal to 25 coughs per hour.

The trial results showed BLU-5937 met its primary endpoint of daily (24h) cough frequency after four weeks of treatment, with the topline results showing that the 50mg and 200mg doses achieved a clinically meaningful and statistically significant placebo-adjusted reduction in daily cough frequency of 34 per cent.

“BLU-5937 demonstrated a clear dose-dependent response on the primary endpoint,” Uddin said. “Although cross-trial comparison is like comparing apples to oranges, we believe the SOOTHE trial so far generated the best outcome of the daily cough frequency reduction among late-stage trials in the P2X3 inhibitor landscape.”

In addition, BLU-5937 was said to be tolerable from a taste perspective, with taste-related side effects reported at 4.8 per cent, 6.5 per cent and 4.8 per cent of subjects for 12.5 mg, 50 mg and 200 mg BLU-5937, respectively.

BLU-5937 also did a good job of hitting its secondary endpoints, with Uddin noting that the 50mg and 200mg doses significantly improved both the cough severity visual analog scale (CS-VAS) and Leicester cough questionnaire (LCQ), with the 12.5mg significantly reducing the CS-VAS.

“The Phase 2b SOOTHE topline results demonstrated an important treatment benefit of BLU-5937 and its potentially best-in-class tolerability profile, with low taste-related side effects observed,” said Dr. Catherine Bonuccelli, Chief Medical Officer of BELLUS Health in the company’s December 13 press release. “We look forward to incorporating the SOOTHE results into our accelerated planning for Phase 3 with the objective of bringing this treatment option to patients with refractory chronic cough as efficiently as possible.”

Going forward, Bellus intends to request an End-of-Phase 2 meeting with the FDA for BLU-5937 in chronic cough in the second quarter of 2022, with Phase 3 testing projected to begin shortly thereafter. Meanwhile, Bellus has also initiated the work to develop a once-daily formulation of BLU-5937 compared to the current two-a-day formulation, with clinical trials scheduled to run simultaneously with the Phase 3 SOOTHE trials in the second half of 2022.

The company also reported results for its Phase 2a BLUEPRINT trial in patients with chronic moderate-to-severe pruritus associated with mild-to-moderate atopic dermatitis. However, the trial failed to meet its primary endpoint, weekly mean Worst Itch Numeric Rating Scale (WI-NRS), with Uddin not assuming any sales for this indication in his projections.

Uddin projects the company to start bringing in revenue in 2022 at $4.9 million (all report figures in US dollars), remaining there in 2023; accordingly, Uddin introduces the P/Sales multiple projection in 2022 at 67.1x, remaining there for 2023.

From a cash flow perspective, Uddin projects a loss of $0.46/share in 2021 before improving to a positive projection of $0.84/share in 2022, though he projects further losses of $0.25/share in 2023; Uddin also provides a P/CFPS multiple of 5x for 2022.

Meanwhile, he expects the company’s EPS to improve from a projected loss of $0.89/share in 2021 to a projected loss of $0.35/share in 2022, with a further projected loss cut to $0.20/share in place for 2023.

The successful trial prompted Uddin to significantly alter his sales figures within the US, increasing his 2025 target to $291 million from the previous $83 million, then doubling to a projected $582 million in 2026 (previously $333 million), and continuing to jump to the point of potentially crossing the 10-figure threshold to a projected $1.08 billion in 2029 (previously $915 million), eventually settling in at a consistent rate of $1.25 billion from 2031 (previously $998 million) onward.

In Uddin’s projections, the United States represents the entire sales market for BLU-5937, though with projected expansion to other markets in play, Uddin projects the American market to account for 79.3 per cent of sales by 2034. As for the failed severe pruritus trial, Uddin had not assumed any sales of BLU-5937 from that indication in his model

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment