Sernova has a 255 per cent upside, says Leede Jones Gable

Leede Jones Gable analyst Douglas W. Loe kept a “Speculative Buy” rating on med tech company Sernova Corp (Sernova Stock Quote, Charts, News, Analysts, Financials TSXV:TSVA) in a Tuesday report to clients. Loe said at this point, Sernova’s Cell Pouch technology has been substantially de-risked as a core and even necessary component of any regenerative medicine therapy seeking long-term reversal of disease symptoms in endocrinology indications.

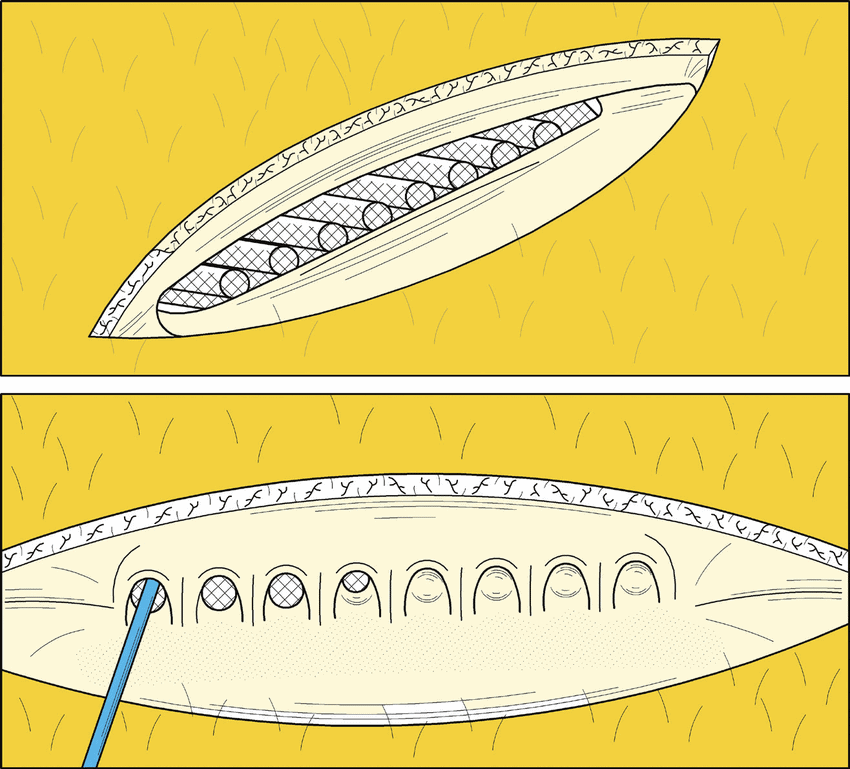

London, Ontario-based Sernova announced on Tuesday “significant progress” in its collaboration with German regenerative medicine company Evotec SE, saying results related to Sernova’s Cell Pouch technology are positive for going into Phase 1/2 human type 1 diabetes/hypoglycemia trials sometime during the first half of 2024. Sernova’s Cell Pouch is an implantable cell reservoir in early development for the long-term survival and function of therapeutic cells to support treatment of chronic diseases.

“Together Sernova and Evotec maintain a shared, singular focus on developing the first combination product involving ethically sourced iPSC-derived islet-like clusters within Sernova’s Cell Pouch for a type 1 diabetes functional cure that could, conceivably, eliminate the need for daily insulin injections in patients with diabetes and significantly reduce the burden on healthcare systems worldwide,” said Sernova President and CEO Dr. Philip Toleikis in a press release.

Assessing the news, Loe said while Sernova is targeting a few endocrinologic markets with the Cell Pouch, including hemophilia A and thyroid disease, for example, he continues to see the Evotec alliance as being central to his forecast on Sernova’s Cell Pouch and on advances in the tech’s potential deployment.

“Our model continues to be substantially based on the large and growing diabetes market and correspondingly based on our view that Cell Pouch in combination with stem cell-based regenerative medicine-based pancreatic islet cells can be a long-term, curative alternative to chronic insulin supplementation in insulin-dependent patients. Today’s update keeps the partners on pace to achieve this objective over a timeline that is consistent with our already-positive investment thesis for SVA specifically,” Loe wrote.

Loe said the take-out value of Sernova’s legacy regenerative medicine peers provides an attractive comparison on the company. Loe said its main competitor in the space is Vertex Pharmaceuticals, which in recent quarters acquired two of Sernova’s major peers in ViaCyte and Semma Therapeutics. Loe said at Semma’s take-out value of US$950 million, Sernova’s notional value would be US$3.45 per share, keeping in mind the distinctions between the two companies.

With his “Speculative Buy” rating, Loe also maintained a 12-month target of $3.30 on SVA, which translated to a projected return of 255 per cent at the time of publication.

Staff

Writer