A new concept study on its proprietary Cell Pouch System is positive news for Sernova Corp (Sernova Corp Stock Quote, Charts, News, Analysts, Financials TSX:SVA), according to Leede Jones Gable analyst Douglas W. Loe, who provided an update to clients on the company on Monday. Loe maintained a “Speculative Buy” rating on the stock and target price of $3.30 per share, good for a projected 12-month return of 192 per cent.

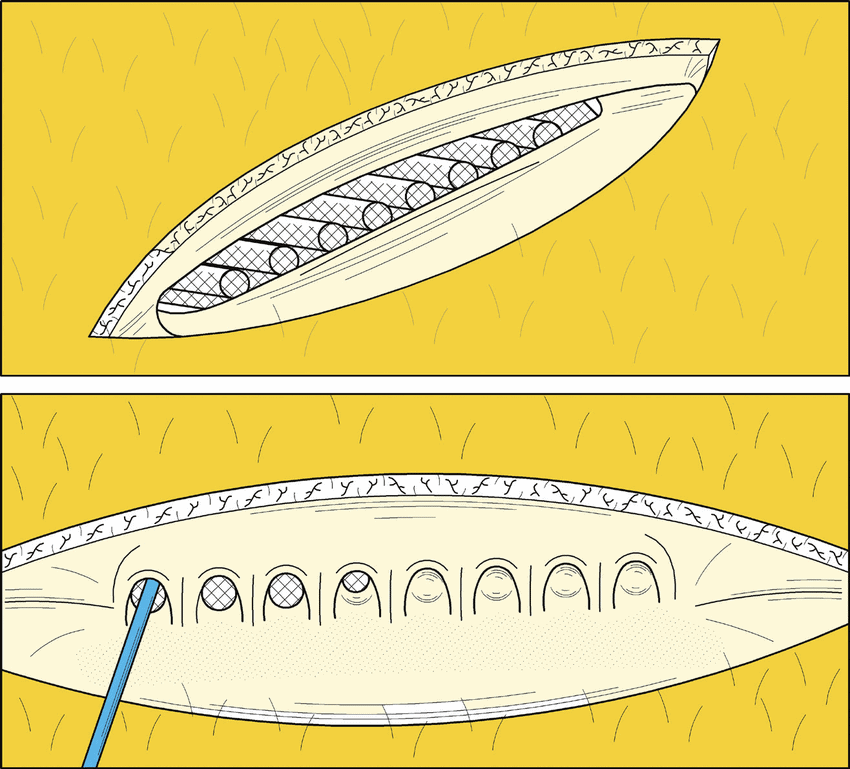

Sernova, an Ontario-based regenerative medicine technology developer, provided on Monday a pre-clinical update on its implantable, vascularizable cell therapy reservoir Cell Pouch. The update was on performance in preserving hormone-responsive thyroxine/triiodothyronine production of autologous thymocytes in test animals who underwent thyroid gland removal. The concept study found that the Cell Pouch can compensate for the removed gland and restore normal thyroid hormone levels in the animal model.

“These findings demonstrate a further therapeutic application of Sernova’s Cell Pouch System,” said Dr. Philip Toleikis, President and CEO, in a press release. “In addition to type 1 diabetes [and hemophilia], this study shows the potential to treat the significant number of patients undergoing removal of their thyroid glands each year. We have already begun to interact with regulatory authorities towards initiating clinical trials with this novel therapy.”

On the announcement, Loe called it positive to his investment thesis on Sernova’s Cell Pouch, although thyroid disease-based activities were already infused into his SVA valuation and Loe said the Cell Pouch’s value is more concentrated on its potential for targeting type I/II diabetes, for which the technology is also currently in development.

“We are encouraged that Sernova is advancing its Cell Pouch thyroid disease program in parallel with its diabetes-focused alliance with Evotec and its clinical collaboration with the University of Chicago in the same indication,” Loe wrote.

“While the diabetes market and the Evotec alliance are major value drivers in our model, as justified by deal economics and technical advances already achieved, we continue to reflect positively on the extent to which Cell Pouch’s broader utility in regenerative medicine has been well-demonstrated in other seminal, if smaller, markets,” he said.

Loe said his $3.30 target price stems from his net present value model with a 25 per cent discount rate and multiples from his 2028 EBITDA/fully diluted EPS forecasts, while his enterprise value calculation incorporates pro forma cash of $52.3 million.

Share

Share Tweet

Tweet Share

Share

Comment