OpSens has target lowered by Raymond James

Share dilution from a new financing round is cause for a target drop on OpSens Inc (OpSens Stock Quote, Charts, News, Analysts, Financials TSX:OPS), according to Raymond James analyst Rahul Sarugaser, who delivered a report to clients on the company on Thursday. Sarugaser still likes the long-term outlook on the company and stock, however, and reiterated an “Outperform” rating.

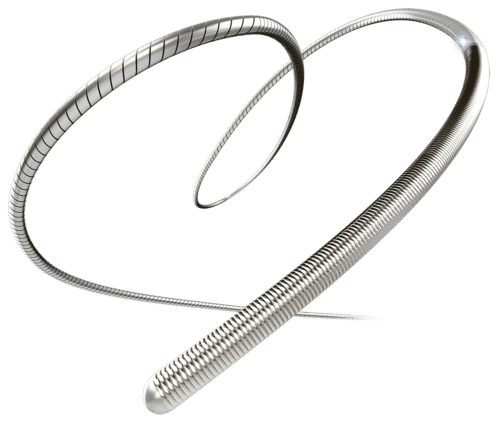

Québec City-based medical device company OpSens has a suite of optical devices including the OptoWire, a fibre-optic pressure guidewire used in the diagnosis and treatment of patients with coronary artery disease. The company announced on Thursday the closing of a $11.5-million bought deal public offering including a $1.5 million overallotment, issuing approx. six million shares at $1.90 per share.

OpSens said it would use the funds to support its commercializing and marketing efforts with regards to the launch of SavvyWire along with funding R&D and general working capital purposes.

Sarugaser commented on the equity raise, saying while OpSens technically had enough cash on hand to execute its SavvyWire commercialization launch, the consensus was that the company should add more cash to “supercharge” the launch and give the SavvyWire its best chance at market penetration.

But Sarugaser said he’s unconvinced that this particular financing round will do the job, saying that $11.5 million won’t be enough to supercharge the rollout, while the $1.90 per share price turns out to be an outsized dilution compared to what the company might have arranged at a different time, with the analyst pointing to the fact that OPS’ stock had been at around $3.00 at the time the FDA’s approval of SavvyWire was announced this past September.

“As such, sentiment appears to have cooled on OPS’ stock, and we anticipate it trading range-bound until the company demonstrates that it is generating material adoption of SavvyWire, the earliest signs of which we expect to see in mid/late-2023,” Sarugaser wrote.

“We reiterate, however, that our long-term conviction in SavvyWire’s commercial potential in the global TAVR market remains unflinching; we maintain our rating at Outperform,” he said.

With the new financing, Sarugaser lowered his target price on OPS from $5.00 to $3.50, which at the time of publication represented a projected one-year return of 95.5 per cent.

On OpSens financials, Sarugaser is forecasting full fiscal 2023 (year end August 31) revenue of $35 million and EBITDA of negative $12 million, moving to 2024 revenue of $60 million and EBITDA of negative $7 million.