The bid from Haemonetics to acquire Opsens (Opsens Stock Quote, Chart, News, Analysts, Financials TSX:OPS) is not a great outcome for Opsens shareholders and a better offer could emerge.

That’s the opinion of Raymond James analyst Rahul Sarugaser, who in an update to clients October 11 lowered his price target on the stock from $3.50 to $2.90 and dropped his rating on the stock from “Outperform 2” to “Market Perform 3”

On October 10, Opsens announced it had entered into a definitive agreement to be acquired by Haemonetics Corp and 9500-7704 Quebec Inc., its wholly owned subsidiary.

The transaction, which was unanimously approved by the Opsens board, represented a 50 per cent premium over the October 6 closing price and valued the company at about $345-million.

“This Transaction will create value for our Shareholders and is a testament to the quality of the team’s work over the years, the added value of our products, and the potential for the years to come. The integration within Haemonetics should enhance the benefits for Opsens’s products with access to a world-class sales network, while capitalizing on the specialized production and R&D expertise of Opsens. From design to production, Opsens’s expertise and knowledge are recognized by clinicians, hospitals and device industry suppliers and Opsens’s innovative products will be a valuable addition to Haemonetics’s existing product line,” said Opsens CEO Louis Laflamme.

But Sarugaser says shareholders could do better than this and says he sees another suitor potentially emerging.

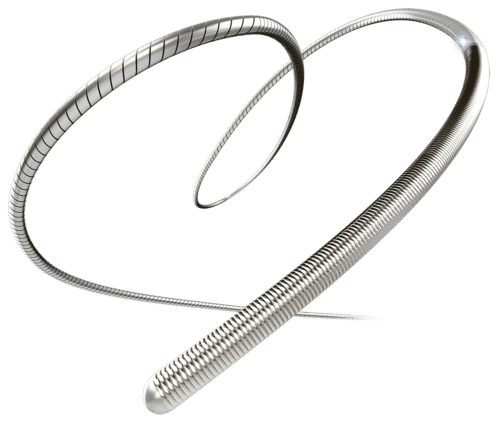

“While this deal represents a 68% premium to OPS’s 10-day VWAP, we do not view it as a great outcome for OPS’s shareholders, and predict a non-zero probability of an over-the-top bid from a better-suited party willing to pay a fairer price for OPS’s cath lab products—OptoWire & SavvyWire—plus its underlying optical technology and IP,” he wrote.

The analyst says OPS is worth $3.50 to $4.00 a share.

“To us, the $2.90/sh deal price—representing a price tag of 5.4x FY24 consensus Rev.—feels quite low,” he argued. “OPS is still in the very early innings of its SavvyWire product launch, which we expect to inflect Rev. into 2025 (not to mention the potential for greater synergistic OptoWire penetration, plus, OPS’s growing OEM Rev. from sales to JNJ – see our JNJ acq. ABMD note), so, using relatively conservative multiples of 4.5x, 4.0x, and 3.5x OPS’s 2025, 2026, and 2027 Rev., we calculate a fair price closer to $3.50. Further, given that this is the potential Rev. we est. in OPS’s own hands, for this to be a good deal, shareholders should expect HAE to supercharge OPS’s baseline sales, so it would not be unreasonable to expect a price premium closer to $4.00.”

Share

Share Tweet

Tweet Share

Share

Comment