The numbers are looking good from Canadian online learning platform D2L Inc (D2L Stock Quote, Charts, News, Analysts, Financials TSX:DTOL), according to Eight Capital analyst Christian Sgro, who delivered an update to clients on Thursday where he reviewed D2L’s latest quarterly results and reiterated a “Buy” rating on the stock.

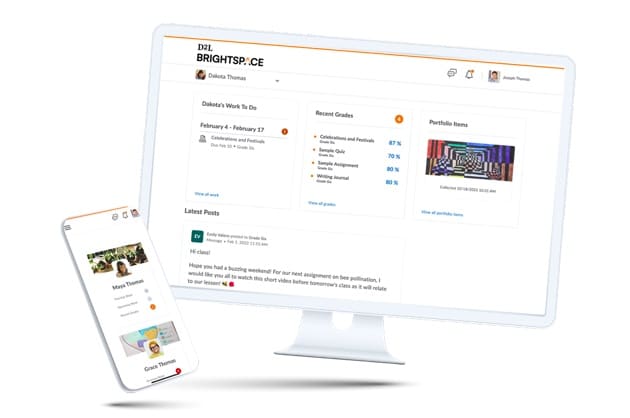

Cloud-based learning management company D2L, which has clients in the K-12, higher education and corporate environments, announced its third quarter 2023 results on Thursday for the quarter ended October 31, 2022, showing revenue up nine per cent year-over-year to $42.7 million and gross profit of $27.5 million, up 62 per cent from a year earlier. Adjusted EBITDA was a loss of $0.4 million compared to a loss of $0.3 million a year earlier. (All figures in US dollars except where noted otherwise.)

The company recently made a couple of C-Suite announcements, promoting Stephen Laster to President and saying that CFO Melissa Howatson has resigned. Operationally, D2L launched in November its Brightspace Creator+ add-on, while looking ahead, management said its earnings loss for the 12 months ended January 31, 2023, will likely be less than previously assumed. D2L said adjusted EBITDA is expected to be a loss of between $4 and $6 million compared to its previous guidance of a loss between $6 and $8 million.

“We continued to expand our customer base and presence in multiple markets during the third quarter. Our growing market share and win rate in higher education positions us well for renewed market activity, as institutions make strategic investment decisions to address the need for flexible, high-quality, digital learning experiences,” said John Baker, CEO of D2L,” said CEO John Baker in a press release.

Looking at the Q3 results, Sgro said the bottom line was a beat at adjusted EBITDA of negative $0.4 million compared to his forecast at negative $1.9 million and the consensus call at negative $1.8 million. The $42.7 million topline was also a hair above the Eight Capital estimate at $42.4 million as well as the Street’s $42.5 million.

“D2L reported a beat on profitability and improved its full-year outlook, benefitting from cost optimizations, FX, and scale,” Sgro wrote. “Revenue and ARR continue to battle unfavourable FX trends, making the unchanged top-line guidance more encouraging.”

“We see the medium-term ten to 15 per cent revenue growth path as achievable and supported by strong win rates and investment in innovation. As examples, we see the launch of Brightspace Creator+ and traction with D2L Wave as key developments to enhance growth. We are positive on the results which support the company’s medium-term operating and profitability goals, which we believe make shares attractive as the business proves out its stable cash-generative potential,” he said.

With his “Buy” rating, Sgro maintained a target price of C$11.00 on DTOL, implying a 12-month return at press time of 88 per cent.

Share

Share Tweet

Tweet Share

Share

Comment