Aerospace and defence name Raytheon Technologies (Raytheon Technologies Stock Quote, Charts, News, Analysts, Financials NYSE:RTX) has seen a nice uptick in its share price over the past couple of years, but portfolio manager Christine Poole thinks there’s more where that came from, and not just because of increased military spending.

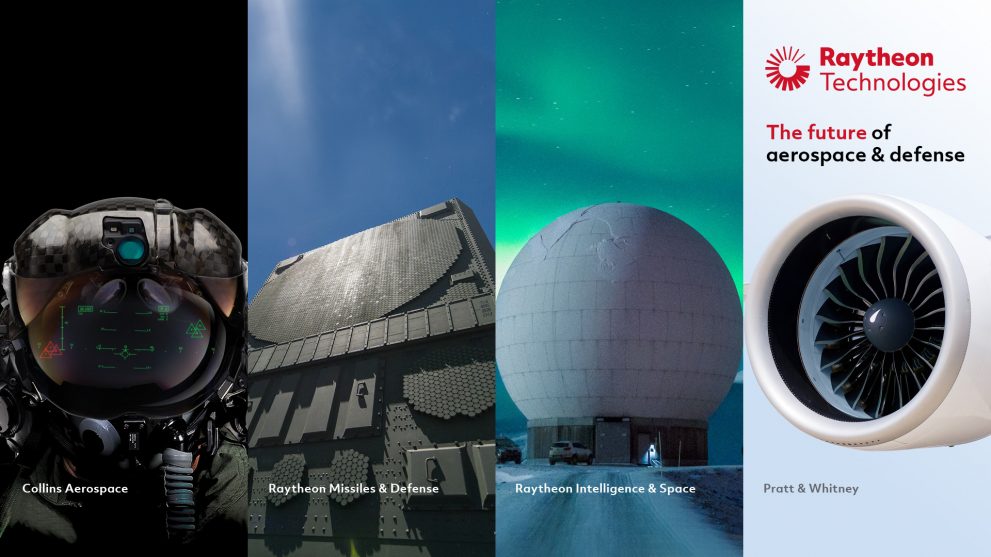

Raytheon, which is comprised of Collins Aerospace Systems, Pratt & Whitney, Raytheon Intelligence & Space and Raytheon Missiles & Defense, came about in 2020 when United Technologies spun out its Otis and Carrier businesses and then merged with Raytheon Company. The result is an aircraft, aerospace and defence contracting powerhouse, one which has seen business levelling off, with supply chain constraints persisting.

Last month Raytheon’s third quarter 2022 showed sales of $17.0 billion, up five per cent year-over-year but adjusted EPS was down four per cent to $1.21 per share. Free cash flow of $263 million and the company repurchased $616 million in RTX shares.

“While we expect industry-wide challenges to continue near-term, we remain focused on operational excellence, including cost containment and program performance, to deliver on our commitments,” said Chairman and CEO Greg Hayes in a press release.

Poole, who nominated Raytheon as one of her three top picks for the next 12 months on a BNN Bloomberg segment on Friday, says coming out of the pandemic, Raytheon’s commercial aerospace business will do well.

“We’ve owned this name for a while,” said Poole, CEO of GlobeInvest Capital Management. “Commercial has been very strong for Raytheon. The aftermarket for commercial coming out of the pandemic … when planes fly, they need to be serviced and Raytheon makes aircraft engines, avionics, interiors, and so those engines have to be serviced when you fly a certain number miles.”

“That’s been very beneficial on the Commercial side, and that’s what has driven the earnings improvement,” she said.

On RTX’s defence business, Poole said countries’ spending budgets on defence have gone up as the geopolitical climate has heated up over the past year, including with the war in Ukraine. That coupled with the current supply chain issues means a lot of business upcoming for Raytheon, she said.

“I think you still have leverage going forward for the defence side to kick in. Those problems will get resolved,” she said. “They were able to deal with the labour shortages and supplies much better on the commercial side, but according to management, procurement rules on the defence side are much more restrictive — you can’t hold that much inventory, whereas on the commercial side, they could ask their suppliers to hold more and they have preferential treatment.”

Poole says air travel is now opening up internationally, especially in China, and that should be good for Raytheon as well.

“We like the balance and we think that defence spending is going to continue to grow,” she said.

Share

Share Tweet

Tweet Share

Share

Comment