There are many ways to play the economic rebound and portfolio manager Bruce Murray says owning defence and aerospace name Raytheon Technologies (Raytheon Technologies Stock Quote, Charts, News, Analysts, Financials NYSE:RTX) is right up there on his list. In fact, Murray has picked RTX as one of his three best ideas for the year ahead, saying the company has some great growth years ahead.

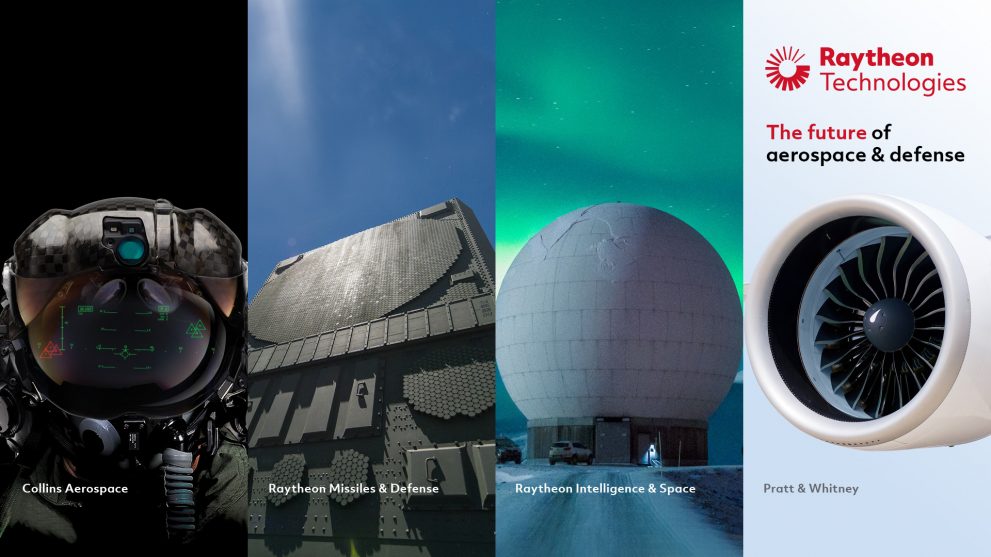

Formed out of the merger last year between the defence weapons and commercial electronics business Raytheon Company and the aerospace division of United Technologies, Raytheon Technologies is a $130 billion market cap company with over $60 billion in annual sales. The company has segments in Collins Aerospace, Pratt & Whitney, Raytheon Intelligence & Space (RIS) and Raytheon Missiles & Defence (RMD), with its Collins Aerospace being the largest among them with about $20 billion in annual sales.

The stock has done well in 2021 to recover from the COVID-19 pullback in early 2020 and is pretty well at the point it was before the pandemic just below $90 per share. But Murray sees a bit over 20 per cent upside from here.

“Raytheon Technologies is the result of the merger of the aerospace division of United Technologies — people may remember they spun off the Otis Elevator and Carrier air conditioning businesses — and Raytheon. There’s substantial upside in the stock due to $1.3 billion of cost synergies from the merger, along with material recovery in commercial aerospace,” said Murray, CEO of the Murray Wealth Group, who spoke on BNN Bloomberg on Tuesday.

“The economic rebound should lift the stock by we think 20 per cent per annum through 2024,” he said.

Raytheon delivered mixed earnings last month for its third quarter 2021, generating revenue up ten per cent year-over-year to $16.21 billion which was below analysts’ consensus expectation at $16.37 billion. Adjusted earnings were $1.26 per share, up a full 125 per cent from a year ago and ending up above the $1.09 call from the Street. Adjusted net income was $1.9 billion compared to $855 million a year earlier. (All figures in US dollars.)

“Our performance this quarter clearly demonstrates our ability to capitalize on the increased demand across our commercial aerospace and defence businesses, and our intense focus on cost reduction and operational execution,” said Chairman and CEO Greg Hayes in a press release.

“During the quarter, we announced strategic acquisitions that advance our technology focus areas and made significant progress on several key programs, as evidenced by the successful completion of the first flight test of a scramjet-powered Hypersonic Air-breathing Weapon Concept (HAWC) for DARPA and the U.S. Air Force. Our strong performance this year along with the positive trends in our end markets gives us the confidence to again raise our 2021 adjusted EPS outlook,” he said.

The company continues to pick up big contract wins, ending the third quarter with a backlog of $156.1 billion compared to $151.8 billion at the end of the previous quarter. Among the mix, Raytheon recorded $962 million in classified bookings through its RIS business and $570 million in missile contracts through RMD. The Collins Aerospace business had a good quarter as commercial sales were up due to the recovery in commercial air traffic, resulting in a profit of $480 million for the segment compared to just $73 million a year earlier.

The stock dropped after the third quarter financials came out, however, with management having slightly lowered their full-year 2021 guidance, going from an earlier range of between $64.4 and $65.4 billion to now about $64.5 billion. At the same time, the company was more upbeat on earnings, calling for 2021 EPS to be in the range of $4.10 to $4.20 per share compared to the previous guidance of between $3.85 and $4.00.

“We continue to feel good about the long-term fundamentals of our business and our ability to drive growth and margin expansion over the next several years,” said Hayes in the third quarter earnings call.

Murray says Raytheon’s various businesses are all expected to grow over upcoming years.

“Raytheon Technologies’ Pratt and Whitney division has developed the most fuel efficient engine called the geared turbofan and it’s being deployed on the new Airbus 320 neo family,” said Murray. “And, unfortunately, Boeing’s 737 was developed earlier and the space under the wing to the runway is not large enough to put on a geared turbofan so that’s giving Airbus a bit of an advantage along with Boeing’s other 737 issues.”

“And the Collins aerospace division is a huge company as well. It’s a major player in everything in the plane other than the engines,” he said. “Raytheon itself is basically a government contractor. They do all kinds of stuff, a lot of US intelligence work, a lot of stuff that can’t talk about, space technology and obviously missile defence. And these businesses are solid. They grow at about five per cent.”

“We’ve got $110 target price on Raytheon so that’s about $25 higher than it’s currently at, so we’re focusing in the short term here on the turnaround in the economy,” Murray said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment