Investors will want to take advantage of a downturn in Canadian cleantech stock Greenlane Renewables (Greenlane Renewables Stock Quote, Charts, News, Analysts, Financials TSX:GRN). That’s according to Haywood Capital Markets analyst Colin Healey, who delivered a recent report to clients on the company, saying Greenlane remains a Top Pick with a number of catalysts still to come this year.

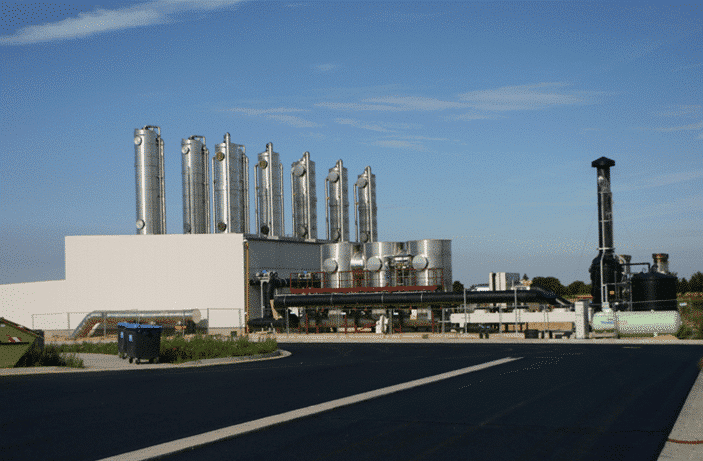

Vancouver-based Greenlane makes biogas upgrading systems to generate renewable natural gas, producing fuel from organic waste sources like landfills, wastewater treatment plants, dairy farms and food waste streams. The stock zoomed up from about 50 cents in late 2020 to as high as $2.86 by February 2021. That’s when the air came out of the green and clean tech stocks and GRN started retreating, ending up all the way back below $0.70 per share as of last month before a bit of a rally with the general market recovery, bringing the stock to now around the $0.80 range.

But Healey is expecting more from GRN over the next 12 months, reiterating in his August 22 report a “Buy” rating on the stock and $2.40 per share target price, which at press time represented a projected one-year return of 200 per cent.

“We continue to highlight Greenlane as a top pick as the company remains our preferred way to gain leverage to the accelerating global investment in RNG infrastructure,” Healey wrote. “Following recent share price pressure along with other ESG-themed ideas focused on alternative energy, we see the recent sell-off as a compelling opportunity for investors to ‘average in’ and participate in a recovery from current levels.”

“Greenlane offers the broadest range of technologies, providing a strategic advantage. We expect the company to continue to grow its international footprint of project installations and see RNG as a critical component of the green energy revolution and continue to see governments world-wide prioritizing it,” he said.

Greenlane announced on Monday a second deployment of development capital, providing pre-construction development capital to an un-named project developer focused on developing landfill gas-to-renewable natural gas projects, with the outlay comprising a $0.7 million loan and an option to convert the loan into an equity interest in the project developer. The company’s first such deployment came earlier this summer with an outlay for dairy cluster RNG projects in California.

“We are rapidly moving forward with our development capital program,” said Brad Douville, Greenlane President and CEO, in a press release. “We continue to see abundant opportunities in different countries around the world to add incremental value to project developers by providing development capital to accelerate RNG projects to the ready for construction phase.”

“Our aim is to help de-risk projects and build scale in RNG origination, while securing Greenlane system sales and services and new long-term recurring revenue for Greenlane as the industry continues to expand,” Douville said.

Commenting on the announcement, Healey said it’s a small but significant move, representing a push by Greenlane into expanding its recurring revenue stream through investment and ownership exposure in the projects it builds for clients. Healey said he expects Greenlane to continue accelerating these efforts in upcoming years and thereby reducing risk by diversifying its revenue streams.

By the numbers, Healey is calling for Greenlane to generate full 2022 revenue of $70.1 million compared to $55.4 million for 2021 and leading to $88.1 million for 2023. On EBITDA, he is forecasting negative $0.1 million for 2022 and moving to positive $4.6 million for 2023.

“Our 2022 outlook for Greenlane includes about 27 per cent topline year-over-year growth, building on its 146 per cent revenue growth in 2021, as it continues to capture market share and augment its leading competitive position in the RNG infrastructure space offering the broadest scope of upgrading technologies,” Healey wrote.

Healey said Greenlane’s order backlog and balance sheet are both looking solid, with $23.2 million in cash and equivalents and no debt, which will support accretive M&A activities.

“With a strong backlog of sales and the potential for several catalysts in 2022, including M&A and an augmented business model that includes more significant recurring revenue, we continue to like the outlook for Greenlane and maintain it as a Top Pick,” he said.

Share

Share Tweet

Tweet Share

Share

Comment