Haywood Capital Markets analyst Colin Healey is staying on the fence with alternative energy sector play Greenlane Renewables (Greenlane Renewables Stock Quote, Charts, News, Analysts, Financials TSX:GRN), saying in a Monday report that the company just took a positive first step in the evolution of its business model.

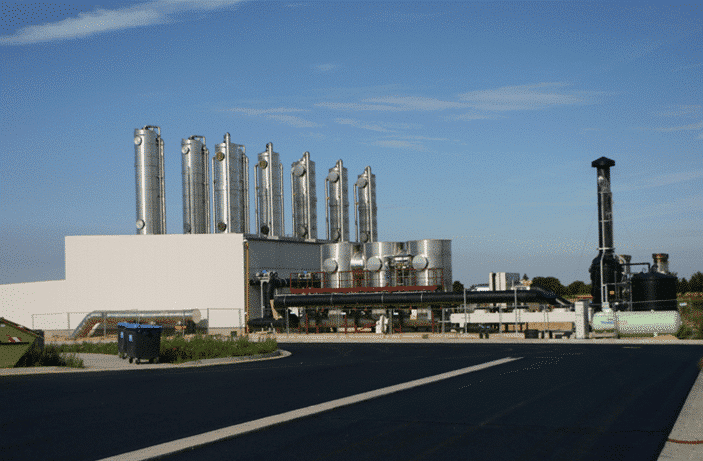

Greenlane Renewables, which develops biogas upgrading systems to produce renewable natural gas from organic waste sources like landfills, wastewater treatment plants and agriculture and food waste, announced on Monday a collaborative agreement with ZEG Biogas e Energia to locally produce, market and sell Greenlane’s upgraders in Brazil. Greenlane said ZEG Biogas 50 per cent owner Vibra Energia is committed to investing up to $109 million in the ZEG Biogas business over the next few years.

ZEG and Greenlane will produce GRN’s Totara+ water wash biogas upgraders, with ZEG getting the exclusive rights to localize the supply chain and manufacturing under the Greenlane brand and market and sell the product to projects in which it has an equity stake or an off-take agreement, while Greenlane with have design responsibilities and provide items not locally sourced in Brazil. The Monday press release did not provide details on such items as the deal’s royalty structure, revenue projections or revenue timing.

Greenlane CEO Brad Douville called it the most important deal the company has done to date.

“We believe it opens up an excellent opportunity to accelerate the production of biomethane in Brazil, at an industrial scale, and to solidify Greenlane’s market leading position, together with a very capable and ambitious local partner,” Douville said in a press release.

Healey called it a positive first step in the evolution of Greenlane’s business model, although he said he’s waiting for further clarity before factoring its impact into his valuation on GRN.

“We do have confidence in the Greenlane Management team and expect this agreement will prove to be accretive to margins going forward as the royalty model should deliver revenue with minor overhead impact,” Healey wrote.

“Greenlane continues to be a leader in the RNG infrastructure segment, but we see it facing headwinds to maintaining the high-growth trajectory of the past. In lieu of formal guidance from management, we are relying on our assessment of data and trends that appear to be softening. We are recommending investors take a ‘wait-and-see’ approach to Greenlane, looking for evidence of recovery of key leading indicators before increasing exposure,” he said.

With the update, Healey retained a “Hold” rating and $0.55 target price, implying at press time a 12-month return of 53 per cent.

Share

Share Tweet

Tweet Share

Share

Comment