The semiconductor chip shortage has been weighing on industries worldwide, but for investors curious about entering the space, portfolio manager Kim Bolton has a few key points to keep in mind, starting with picking your stocks.

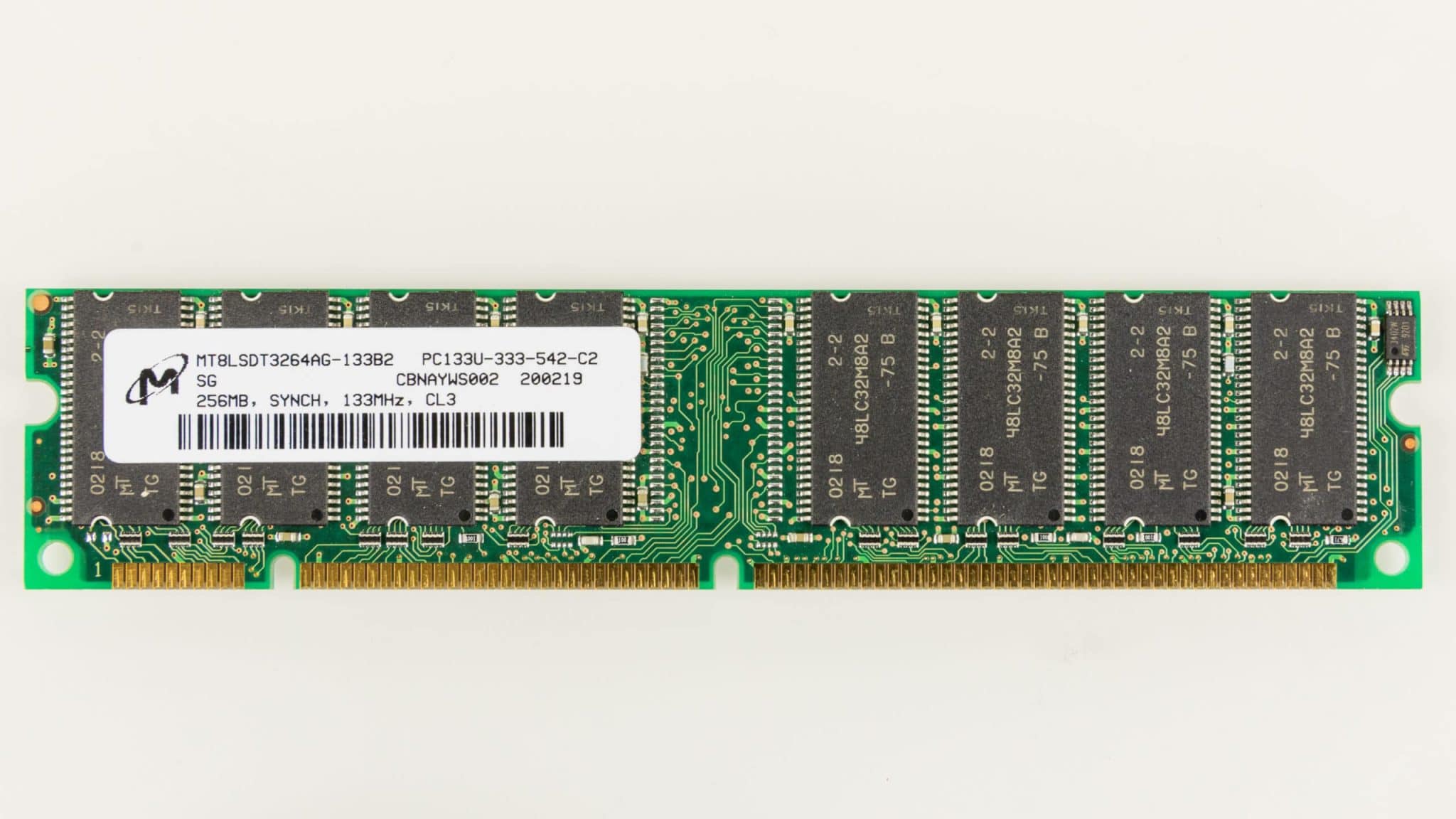

“There are basically four moving pieces when it comes to the semiconductor side,” says Bolton, President of Black Swan Dexteritas, who spoke on BNN Bloomberg on Wednesday. “Number one are the foundries like a Taiwan Semiconductor; number two are the manufacturers and manufacturers actually design and manufacture their own chips, and Micron Technology is one of the leaders on those manufacturers.”

“Then there are the designers like Nvidia and AMD and then the fourth area are the equipment suppliers like a Lam Research or KLA Corp or Applied Materials and so on,” he said.

“I think when it comes to the semiconductors you’re probably better to actually buy the single stocks and the leadership in the manufacturers and the foundries and the designers and the equipment makers,” Bolton said.

The semiconductor space as a whole had been doing well over the past couple of years but it has hit a rough patch since the start of the new year. Stocks like Nvidia Corp (Nvidia Stock Quote, Charts, News, Analysts, Financials NASDAQ:NVDA), Micron Technology (Micron Technology Stock Quote, Charts, News, Analysts, Financials NASDAQ:MU) and Taiwan Semiconductor Manufacturing (Taiwan Semiconductor Manufacturing Stock Quote, Charts, News, Analysts, Financials NYSE:TSM) had been hitting new highs as of last year before trending downward lately.

One of the more popular ETFs for the space, the PHLX Semiconductor Ishares ETF (PHLX Semiconductor Stock Quote, Charts, News, Analysts, Financials NASDAQ:SOXX), had been on a decade-long hot streak with barely a bump in the road registered during the market pullback to start off the pandemic in early 2020, but the stock is down sharply in 2022 and is about negative 16 per cent year-to-date.

The increased demand for chips across almost all sectors of the economy has pushed production from semiconductor companies and the results have shown up lately on companies’ top and bottom lines, which have been stellar. So, why the pullback? The general consensus is that chip stocks are getting wrapped up in the overall market rotation away from growth-oriented, seemingly riskier areas of the market towards more value and income-generating plays like the banks and utilities.

The result has been a selloff in tech in general and that includes semis. Since the start of the year, Taiwan Semi is now down almost 13 per cent, Micron Technology is down 15 per cent, Nvidia is down 22 per cent and Advanced Micro Devices is down 23 per cent.

But pullbacks create buying opportunities and that’s the case here, says Bolton, who thinks a number of the plays in semiconductors are blue chip winners, starting with fabless chip designer Nvidia.

“To us, Nvidia remains the greatest secular growth story in the whole semiconductor business,” Bolton said. “It’s riding the tailwinds including the transition to the [Graphics Processing Unit (GPU)] and the data centre for gaming and edge computing, autonomous vehicles and AI and it is really the poster child when it comes to the semiconductor side.”

“Nvidia is a designer so they design the chips and then they send them out to foundries or manufacturers like Taiwan Semiconductor to build the chip for them. Nvidia’s cloud business should see continued secular strength over the coming years as the GPU penetration in the data centres increases,” he said.

“It’s just a key part of [our] portfolio,” he said.

Nvidia reported strong fourth quarter earnings last month, with revenue up a whopping 53 per cent compared to a year earlier to $7.64 billion for full 2021 revenue of $26.91 billion, up an even better 61 per cent over 2020’s numbers. Adjusted earnings were $1.32 per share, also up 69 per cent year-over-year. Both the Q4’s top and bottom beat analysts’ estimates which were calling for $7.42 billion in revenue and $1.22 per share in earnings.

The outlook was rosy, too, with management forecasting $8.1 billion in Q1 revenue on high demand for its chips in fields like artificial intelligence.

“We are entering the new year with strong momentum across our businesses and excellent traction with our new software business models with NVIDIA AI, NVIDIA Omniverse and NVIDIA DRIVE. GTC is coming. We will announce many new products, applications and partners for NVIDIA computing,” said Nvidia founder and CEO Jensen Huang in a February 16 press release.

As for the other corners of the industry, Bolton pointed to Taiwan Semiconductor as a go-to name in the foundry space and Micron on the manufacturing side.

“[Micron] is spending a heck of a lot of money on building out its manufacturing facilities around the world and it’s getting a lot of business, both over in Europe and certainly in North America,” Bolton said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment