Boise, Idaho’s Micron Technology delivered a well-received earnings report last week, showing revenue up 12 per cent to $5.77 billion as demand for its chips has strengthened amid the ongoing digital transformation, work-from-home movement and emergence of 5G networks.

CEO Sanjay Mehrotra said of Micron’s fiscal first quarter 2021 that with its investments in its DRAM and NAND chips and the secular tailwinds, Micron is “in a better technology and product position than ever before, despite the ongoing challenges posed by the pandemic.”

“We began shipping the industry’s most advanced NAND with 176 layers. And in DRAM, we made good progress on our 1-alpha node and are on track to begin volume production in the first half of calendar 2021,” said Mehotra in the Q1 conference call last week.

“We believe DRAM is past the bottom of the industry cycle and expect improving trends through calendar 2021 as the digitization of the global economy continues, fueled by artificial intelligence, cloud, 5G and the intelligent edge, including smart vehicles. Against this backdrop, Micron is poised to emerge stronger and we are excited about our future,” Mehotra said.

Micron earned $0.78 per share by non-GAAP measures compared to $0.48 per share a year ago but down from $1.08 per share a quarter ago. Analysts had called for $5.66 billion in revenue and $0.71 per share. Management guidance was also better than analysts had forecasted at around $5.8 billion for the fiscal Q2 representing EPS of about $0.75 per share. (All figures in US dollars.)

The result has been a strengthened Micron share price which has climbed from $50.00 at the start of November to now above $80.00. Micron finished 2020 up 40 per cent. That’s in keeping with the semiconductor sector as a whole which which had a great year: the PHLX Semiconductor Index jumped 51 per cent in 2020.

But Sissons has reservations about Micron and in fact suggests investors look elsewhere in the chip space.

“We’ve had quite a run in some of the semiconductor names,” says Sissons, vice president and partner at Campbell Lee & Ross, who spoke on BNN Bloomberg on Friday. “If you look at Micron, what you see is it has had quite a nice surge recently, but the problem I have is that it’s actually quite cyclical. It’s the kind of thing that if you see the market decline, you want to buy it.”

“From a practical point of view I’m always looking for structural growth stories, stories that have a diversified basis and that tend to be quite sustainable even during downturns,” Sissons said. “Samsung Electronics is a company we own and it has significant exposure to the semiconductor space. I just think that’s a better company to look at, or a name that we don’t own, Taiwan Semiconductor, which I think is rich but that’s a great company, too. I think those are two better names to look at.”

“Micron, when it’s broken, buy it, when it’s not broken, stay away because it can obviously decline,” Sissons said.

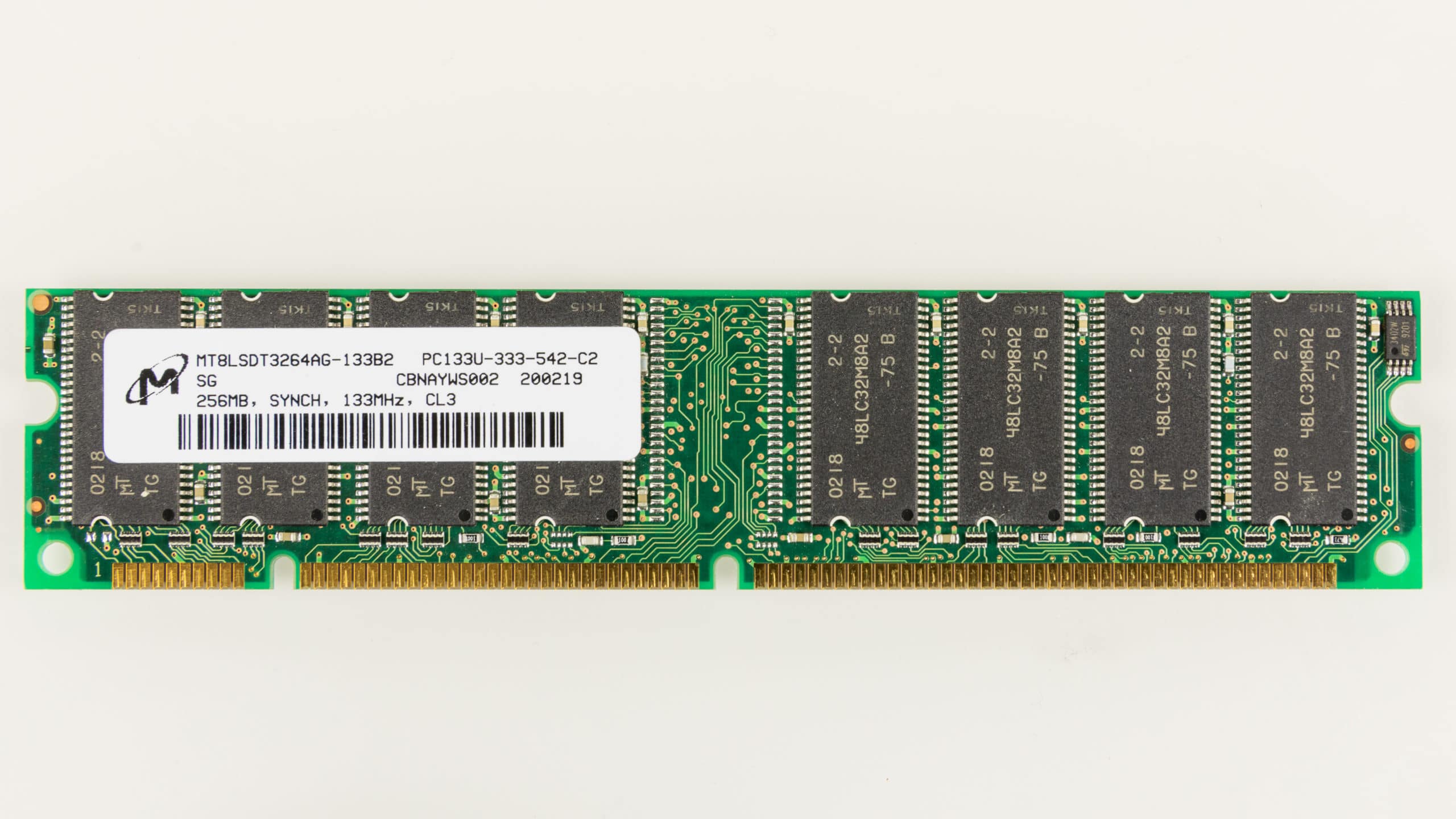

Micron gets the majority (about 70 per cent) of its revenue from its DRAM chips, which sells chips for storing data in a memory cell, and that business posted revenue of $4.0 billion for the company’s fiscal Q1, up by 17 per cent year-over-year. NAND chip revenue, which accounted for 27 per cent of the company’s sales in the Q1, grew by 11 per cent year-over-year to $1.6 billion.

Samsung, by contrast, is a bigger player in the memory game with a market share of about 41 per cent of the DRAM industry. Samsung did $7.21 billion in DRAM revenue in its latest quarter and $4.8 billion in NAND sales for its third quarter 2020, delivered in November.

Samsung pre-announced fourth quarter numbers earlier this month, saying operating profit will likely come in 26 per cent higher year-over-year to $8.22 billion and sales are expected to be up two per cent from a year earlier. The numbers were slightly under analysts’ forecasts with lower smartphone sales being potentially a factor. The world’s largest smartphone company saw a 59-per-cent increase in operating profit over its third quarter but had said that competition in the smartphone space would eat into its profits in the fourth quarter. Samsung’s full Q4 results are due later this month.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment