Echelon Capital Markets analyst Stefan Quenneville is sold on Canadian biotech company Sernova (Sernova Stock Quote, Chart, News, Analysts, Financials TSXV:SVA), initiating coverage on Wednesday with a “Speculative Buy” rating and target price of $3.25/share for a projected return of 108 per cent.

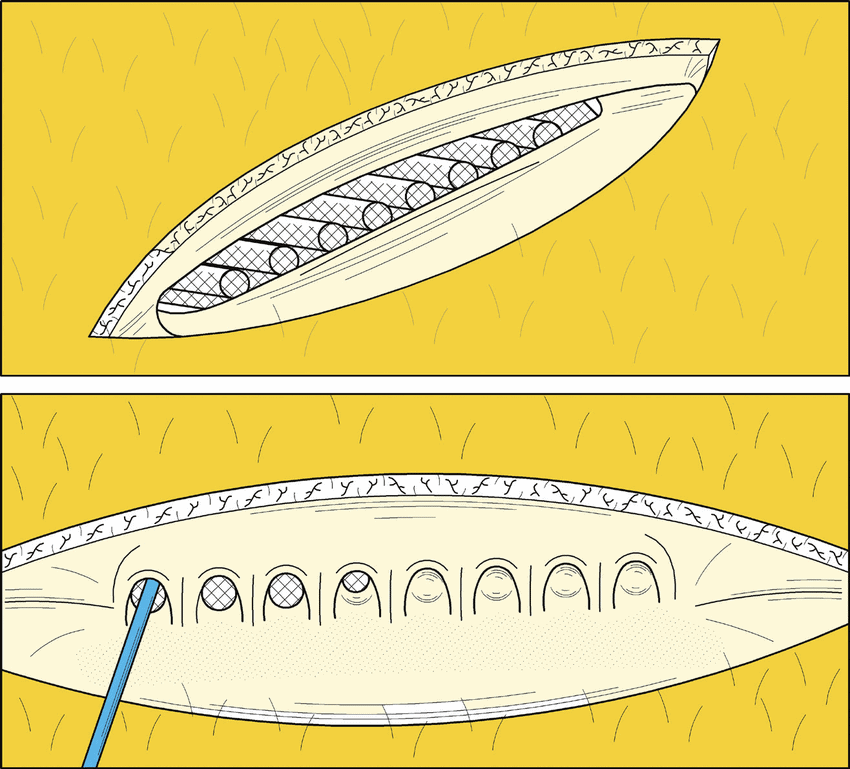

Founded in 2006 and headquartered in London, Ont., Sernova is an early clinical-stage biotechnology company developing a regenerative medicine platform to provide functional cures for chronic diseases such as diabetes, hypothyroidism and hemophilia A. The company’s lead product, the Cell Pouch System, is an implantable and scalable medical device that forms a natural vascularized environment for the long-term housing and function of therapeutic cells that release proteins or factors to treat chronic diseases.

According to Quenneville, the Cell Pouch System has so far demonstrated safety in Type 1 Diabetes patients, creating a safe environment for implanted pancreatic islet cells to produce healthy levels of insulin and reduce or eliminate insulin dependence. Though the initial trial itself only consists of seven patients the first two have achieved sustained insulin independence and freedom from severe hypoglycemic events for three and 22 months without issues related to the technology.

“While the CPS technology will first target only the highest-risk T1D patients, the potential transformative impact of reducing or eliminating the need for insulin injections or pumps will garner pricing in the US$100-200K range per course of treatment per patient, resulting in a multi-billion-dollar market opportunity in the context of a US$50 billion global diabetes drug market,” Quenneville said.

Sernova is expected to provide provide preclinical and clinical updates on its technology including on its ongoing T1D trial and the initiation of a Phase I/II trial for its hypothyroidism product, with announcements on formal med-tech/pharma partnerships for Cell Pouch distribution and scalable supply of stem cell-derived therapeutic cells to address supply constraints of donor cells for diabetic patients expected this year.

Sernova began 2022 with a pair of high-profile research pieces published in medical journals, with an article called Efficient and Safe Correction of Hemophilia A by Lentiviral Vector-Transduced BOECs in an Implantable device (Sernova’s Cell Pouch) being published in the December 2021 edition of Molecular Therapy: Methods & Clinical Development, Volume 23.

“This publication represents approximately four years of dedicated work by the HemAcure consortium, from conceptualizing this novel treatment approach, through to validating its potential as a safe and long-term treatment option for people with hemophilia A. The Sernova Cell Pouch provides the required environment for transplanted cells to survive and function in the body, as demonstrated by the production of FVIII to improve blood clotting as reported by Dr. Follenzi and colleagues,” said Dr. Philip Toleikis, President and CEO Sernova Corp in a January 20 press release. “We recognize ex vivo gene therapy as a potential therapeutic option for people suffering from multiple rare diseases and we are proud that our technologies may contribute to the development and future delivery of functional cures for these ailments.”

Sernova followed that up by having another article, titled Subcutaneous transplantation of human thyroid tissue into a pre-vascularized Cell Pouch, published in the PLOS ONE scientific journal on January 20.

Quenneville doesn’t expect Sernova to begin bringing in revenue until 2027 at a forecasted $148.4 million, but he projects a steep growth curve from there, with an aim toward clearing $1 billion in annual revenue by 2031, eventually building out to a projection of $1.16 billion in 2032. By contrast, the consensus expects minimal revenue to start trickling in around late 2026, but the estimates from 2027 ($135.8 million) and beyond aren’t as optimistic as Quenneville’s, with a peak estimate of $766 million in 2030.

Gross profit estimates also begin in 2027 at $96.4 million, with the gross margin gradually growing from 65 per cent in 2027 to 67 per cent ($779 million) in 2032, roughly in line with consensus estimates through the end of their projections in 2030.

Meanwhile, Quenneville projects Sernova to incur EBITDA losses ranging as high as $47 million annually through 2027, with an expectation of turning positive in 2028 at $154.8 million for an implied margin of 36 per cent. From there, Quenneville projects the margin to get wider, eventually landing at a projected 52 per cent ($599.9 million) in 2032.

Quenneville’s EBITDA projections are significantly lower than those of the consensus, bringing in an estimate of $117.3 million in 2027, a year before Quenneville’s positive forecast begins, and growing to $643 million in the final projection in 2030, well ahead of the $404.5 million forecasted by Quenneville.

Sernova’s stock price has sagged to a 9.7 per cent loss over the last 12 months, with a more pronounced 18.1 per cent drop since the calendar turned to 2022. The stock began the year at a 52-week high of $2.12/share on January 7, but was unable to sustain the momentum, though it’s still above its 52-week low of $1.21/share from August 5.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment