ProntoForms (ProntoForms Stock Quote, Charts, News, Analysts, Financials TSXV:PFM) received a coverage re-launch from PI Financial on Thursday, with analyst Kris Thompson saying industry tailwinds and a renewed emphasis on building up its Enterprise client business are good signs for the mobile workflow solutions company. Thompson has given PFM a “Buy” rating and price target of C$1.50 per share, which at press time represented a projected one-year return of 92.3 per cent.

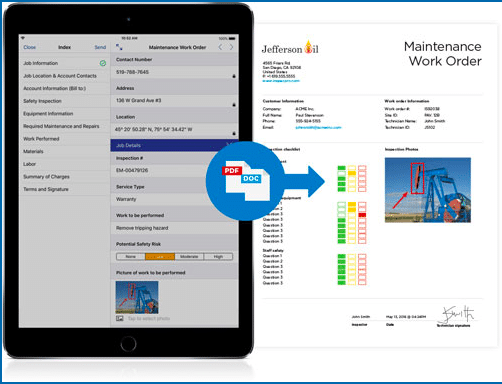

Founded back in 2001 and based out of Ottawa, Ontario, ProntoForms designs field automation solutions with it app offering capabilities including Frontline Work Enablement and Management, Safety, Training & Compliance, Collaboration, Analysis and Reporting. ProntoForms’ mobile app gives field users capabilities on data, image and GPS/Time stamp capturing which can then be shared with back-office systems and cloud services. The company currently generates revenue from about 25 countries worldwide with over 100,000 subscribers and has key verticals in heavy manufacturing, medical device manufacturing, energy resources, natural resources and utilities.

Thompson said the tech advance of the smartphone and now the ongoing digital transformation across all industries have come in PFM’s favour.

“While the Company may have been a little ahead of its time 20 years ago, the advent of iOS (iPhones and iPads) allowed ProntoForms to help unlock the true potential of workflow automation in field services management for its customers. With the ever-growing demand for custom-built business apps and a shortage of professional developers in the market, ProntoForms was designed for the Citizen Developer; to enable the relevant but non-technical employees in an organization to build apps for their field functions,” Thompson wrote.

On the financial end, ProntoForms had revenue of $17.7 million in 2020 and a net loss of $2.3 million or $0.01 per share. More recently, the company’s latest reported quarter, its Q3 2021, featured revenue up eight per cent year-over-year to $4.89 million and a net loss of $1.11 million. (All figures in US dollars except where noted otherwise.)

Thompson said ProntoForms has built up a sticky recurring revenue base, with strong integration partnerships and generates over 90 per cent gross margin on its recurring revenue stream of business and half of its current annual recurring revenue (ARR) base is now made up of Enterprise clients.

“The Company is looking to push aggressively into its Enterprise base. [ProntoForms] already has an installed base of ~165 Enterprise accounts with only 29 of them contributing >US$100k ARR. There is a substantial opportunity for ARR growth even without acquiring new logos,” Thompson wrote.

“The Company is spending significantly on its growth initiatives to boost ARR growth and drive operating leverage. ProntoForms enjoys solid control on its expense levers, which it can toggle as suited to its operating requirements and is accelerating sales & marketing and product spend exiting the COVID-19 pandemic,” he said.

The $100-million market cap PFM saw its share price rise steadily over 2020 and then spike at the start of 2021. Since then it’s been mostly downhill for the stock, which finished 2021 with a negative return of 13 per cent and is so far in 2022 down a further eight per cent.

Commenting on his company’s progress in the third quarter 2021 report in November, ProntoForms founder and CEO Alvaro Pombo said PFM is steadily adding new and large customers to its base with good expansion profiles.

“We are encouraged by the continued steady growth in net bookings and enterprise opportunities. Our platform continues to provide value to world-class enterprise organizations thanks to our continued investment in vertical product solutions, platform capabilities, and enterprise go-to-market,” Pombo said.

“This quarter was marked by our user conference, EMPOWER’21 – sessions featured Fortune 500 field service leaders, Service Council and ServiceMax, industry analysts, and ProntoForms product experts. During this event, ProntoForms’ new customer community was also announced and officially launched,” he said.

By the numbers, Thompson is expected ProntoForms to generate 2021, 2022 and 2023 revenue of $19 million, $23 million and $29 million, respectively, and for EBTIDA over the three years to go from negative $4 million to negative $6 million to negative $5 million, respectively. The analyst sees PFM’s EV/Revenue multiple going from 4.0x in 2021 to 3.4x in 2022 to 2.7x in 2023. Thompson’s C$1.50 target equates to an EV/Sales of 6.6x and 5.3x on his 2022 and 2023 estimates, respectively.

“ProntoForms operates in a highly fragmented market, providing opportunities for acquisitive growth. With so many players operating in the mobile business application market, there is ample room for consolidation, although organic growth is the near-term focus,” Thompson said.

Thompson said PFM has about $6.5 million in cash on its balance sheet as well as $6 million in a revolving operating facility and said he expects the company’s cash burn rate (average $800 per quarter in 2021 from roughly break-even in 2020) to increase in upcoming quarters as ProntoForms continues to deploy into its growth initiatives.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment