Medicenna has lots of upside, says Research Capital

Look for a big catalyst over the near term from biotech company Medicenna (Medicenna Stock Quote, Charts, News, Analysts, Financials TSX:MDNA). That’s the scoop from Research Capital analyst André Uddin who reviewed the company’s latest quarter in an update to clients on Wednesday.

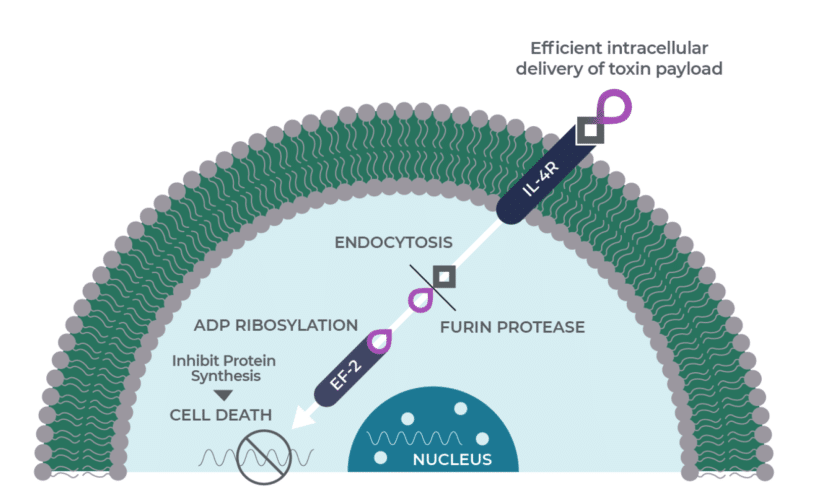

Medicenna is a clinical-stage immuno-oncology company focused on novel interleukin (IL)-based treatments and has lead orphan drug candidate MDNA55 in development for recurrent glioblastoma, with Medicenna currently seeking a partnership to advance MDNA55 through a Phase 3 trial and commercialization. The company also has MDNA11 in a Phase 1/2 ABILITY trial in patients with advanced, relapsed or refractory solid tumours.

The company reported fiscal third quarter 2022 results on Wednesday, showing zero in revenue and a net loss of $4.8 million or $0.09 per share compared to a loss of $5.3 million or $0..11 per share a year earlier. Medicenna said the drop in net loss was primarily due to lower R&D expenses.

In December, Medicenna announced positive preliminary data in the ABILITY (A Beta-only IL-2 ImmunoTherapY) Phase 1/2 trial for MDNA11, with the company saying the results also included an “encouraging” safety profile with no dose limiting toxicities and no evidence of cytokine release syndrome or vascular leak syndrome reported to date. Medicenna also received in December regulatory clearances from the US FDA and Health Canada to expand the ABILITY study, which is currently enrolling patients in Australia, the US and Canada.

“Our recent progress was highlighted by the ABILITY study’s preliminary readout, which although early supports our belief that MDNA11 has significant potential,” said Fahar Merchant, PhD, President and CEO, in a press release. “Despite the low doses tested, we believe the biological activity observed to date was superior to those reported by other programs in the clinic at equivalent doses of IL-2. Furthermore, MDNA11 was well tolerated while exhibiting preferential stimulation of anti-cancer immune cells and we expect that its biological activity will be further enhanced in subsequent dose escalation cohorts.”

“We are pleased with the trial’s progress and results to date and we believe that this will position us to report the first set of efficacy results from early dose escalation cohorts in mid-calendar 2022,” he said. “Beyond MDNA11, we will continue to leverage our platforms and the expertise of our recently formed Scientific Advisory Board and Development Advisory Committee, to advance additional candidates towards the clinic. Efforts to date on our Superkine and BiSKITs platforms will be unveiled at a conference in calendar Q2. Looking forward, we believe our robust platforms set a solid foundation for sustained growth with a steady cadence of catalysts expected over the coming months.”

Reviewing the quarter, Uddin said financials are less important at this stage for MDNA, though the net loss of $4.8 million came in under his $6.4-million forecast. Uddin said with $23.4 million in cash and no debt Medicenna should have the cash runway to proceed through to the end of the current calendar year.

On MDNA55, Uddin said he is now moving forward his projected date for an out-licensing deal from the first quarter of calendar 2022 to the second, saying, “The company has been working diligently to strike a deal with a potential partner. According to our recent discussion with management, partners’ perception regarding the candidate centres on commercial and pricing analysis, as well as, its route of administration (convection enhanced delivery or CED).”

“We still believe MDNA can sign a licensing deal – which remains a key near-term catalyst. To be conservative, we are pushing out our assumption of the deal from Q1/CY22 to Q2/CY22 and maintaining the assumption of $60 million upfront,” Uddin wrote.

Uddin is forecasting zero revenue for Medicenna in fiscal 2022, followed by $8.6 million, $25.5 million and $25.5 million in fiscal 2023, 2024 and 2025, respectively.

With the update, Uddin has maintained his “Speculative Buy” rating and $6.90 target price for Medicenna, which at the time of publication represented a projected one-year return of 191 per cent. The analyst noted that since initiating coverage on MDNA the stock has generated a 249 per cent return. Meanwhile, Medicenna’s share price ended 2021 down 65 per cent and so far in 2022 is up about 11 per cent.

Last month, Medicenna announced the publication of peer-reviewed preclinical data on MDNA11 in the Journal for ImmunoTherapy of Cancer. The presented data are from in vitro, murine and non-human primate studies evaluating MDNA11’s anti-cancer activity as well as its selective IL-2 receptor (IL-2R) binding, pharmacokinetic, pharmacodynamic and safety profiles.

“We believe that this prestigious peer-reviewed publication provides important external validation for MDNA11’s preclinical dataset, which demonstrates the advantages of the Superkine’s differentiated ‘beta-only’ approach to targeting the IL-2 receptor,” said Merchant in a January 26 press release.