Following the company’s third quarter results, Research Capital analyst Andre Uddin has kept his “Speculative Buy” rating on Medicenna Therapeutics (Medicenna Therapeutics Stock Quote, Chart, News, Analysts, Financials TSX:MDNA).

On February 14, MDNA reported its Q3, 2024 results. The pre-revenue company reported that its cash position was $21.8-million.

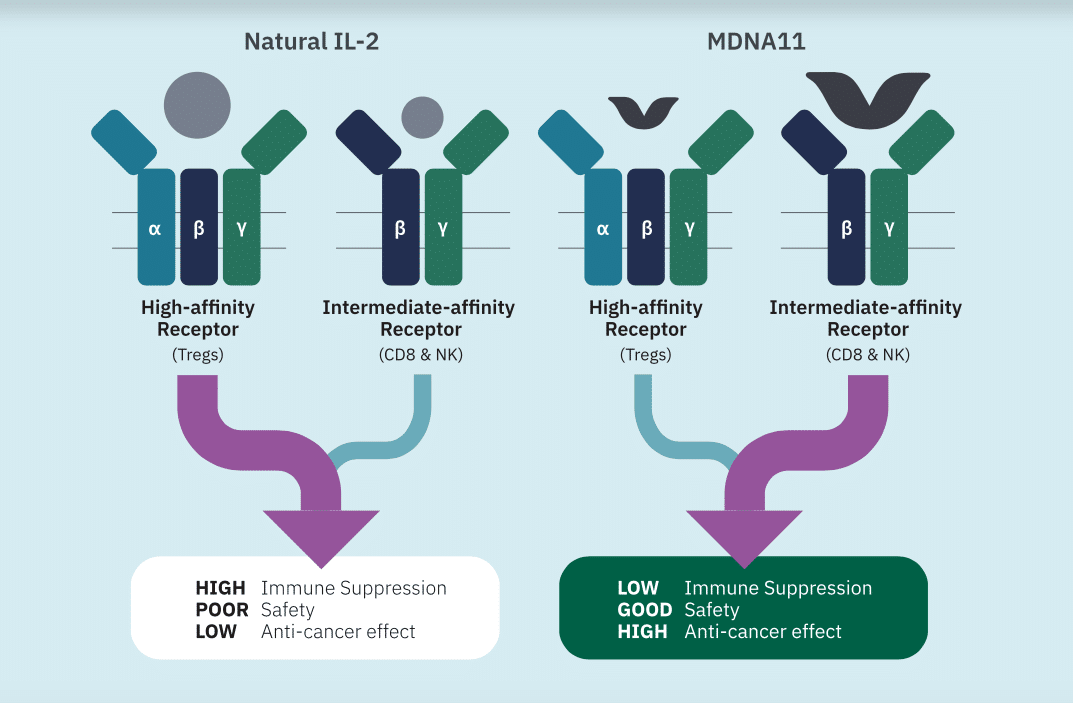

“We are off to a solid start in 2024 with further validation of single-agent anti-tumor activity of our IL-2 super-agonist, MDNA11, in the ABILITY-1 study,” said CEO Dr. Fahar Merchant. “We are encouraged by another PR, increasing the total number of PRs to 3 in patients with prior failure from immune checkpoint therapy. With response rates above 20% at this early stage of the trial in high-dose phase-2 eligible patients, we believe that MDNA11’s differentiated mechanism demonstrates its clinical superiority to competing IL-2 programs. This is especially gratifying in view of the desirable safety, pharmacokinetic and pharmacodynamic characteristics observed to date. We look forward to reporting additional monotherapy dose expansion and combination escalation and expansion data from the ABILITY-1 study during H1 and H2 2024.”

Uddin summed up the quarter and where the company is at with its “dynamic duo” of MDNA-11 & Keytruda.

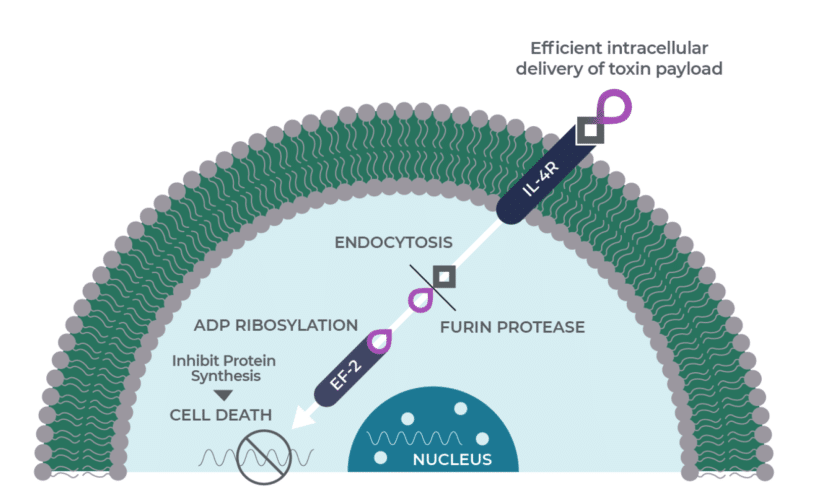

“Medicenna released their Q3 (2024 fiscal year) results ending Dec 31st, 2023 (calendar year). Their financials are less important as Medicenna is a clinical-stage biotech company,” the analyst wrote. “Medicenna reported they have $21.8M in cash as of December 31. On Jan 9th, Medicenna initiated patient enrollment for the combination therapy of MDNA11 and Merck’s Keytruda as part of the current Phase 1/2 ABILITY-1 study for advanced cancer patients. We expect synergistic outcome of the combination because the IL-2 superkine could potentially sensitize the tumor-killing immune cells to Keytruda – we await further data by calendar Q2 of 2024. Management continues to seek a partner to initiate a Phase 3 study for bizaxofusp (MDNA55) – we have assumed this is forged by mid year. A licensing deal for bizaxofusp (MDNA55) has taken longer than we expected, failing to bring in a partnership soon would imply a financing would be needed – MDNA has a cash runway into Q2 2025. Recently, Medicenna presented strong long-term data (>4 years) of bizaxofusp at the Society for Neuro-Oncology (SNO) 2023 Annual Meeting. Management has met with the FDA pertaining to the bizaxofusp (MDNA55) Phase 3 trial design, and is currently working toward securing alignment with the EMA thereby enabling data from a single Phase 3 registrational trial to be able to file for approval in the EU and U.S.”

In a research update to clients February 14, Uddin reiterated his “Speculative Buy” rating and price target of $1.60 on MDNA stock, implying a return of 138.8 per cent at the time of publication.

Share

Share Tweet

Tweet Share

Share

Comment