Following the company’s delisting from the Nasdaq, Research Capital analyst Andre Uddin has lowered his price target on Medicenna Therapeutics (Medicenna Therapeutics Stock Quote, Chart, News, Analysts, Financials TSX:MDNA).

On October 27, MDNA announced it had received a delisting notice from the Nasdaq and had made the decision to forego the listing.

“To better position Medicenna for the benefit of all our shareholders, we undertook a thorough and thoughtful review of our cost structure, including costs associated with being a Nasdaq-listed company,” said CEO Fahar Merchant. “Our Board of Directors concluded that within the context of the current biotech markets, the Company and its stockholders do not benefit from a Nasdaq listing considering the associated significant costs and resources required. We remain in good standing with our TSX listing, have no debt and have sufficient cash to potentially fund the company well beyond key value inflection milestones from the MDNA11 Phase 2 monotherapy and combination trial. We look forward to sharing additional new data at major conferences next month for the MDNA11, BiSKITs and bizaxofusp programs.”

Nasdaq Listing Rule 5550(a)(2) mandates that a company’s common stock must maintain a minimum closing bid price of $1.00 per share to remain listed on the Nasdaq stock exchange. If a company’s stock closes below the $1.00 minimum bid price for 30 consecutive business days, it will receive a deficiency notice from Nasdaq.

Uddin summarized the development.

“Not an easy decision in this very tough financing environment,” he wrote. “Medicenna has announced the company will cutback its management team after their recent US hires and will delist from NASDAQ and maintain its TSX listing – this should now extend the company’s runway to the end of calendar 2024/Q1 2025. MDNA’s CEO does not expect to do a predatory financing near these levels and will await further data of MDNA11 in H1 2024. The company is expected to take a charge for this in fiscal Q3 2023 and is expected to provide some financial guidance of their cuts when they report – which we expect to be around sometime near November 7. MDNA would make an interesting acquisition for a larger immune oncology company given its unique pipeline candidates – MDNA is now trading below its cash value.”

In a research update to clients October 27, the analyst maintained his “Speculative Buy” rating but lowered his one-year price target on the stock from $2.00 to $1.60.

Uddin says there is still promise to MDNA’s business.

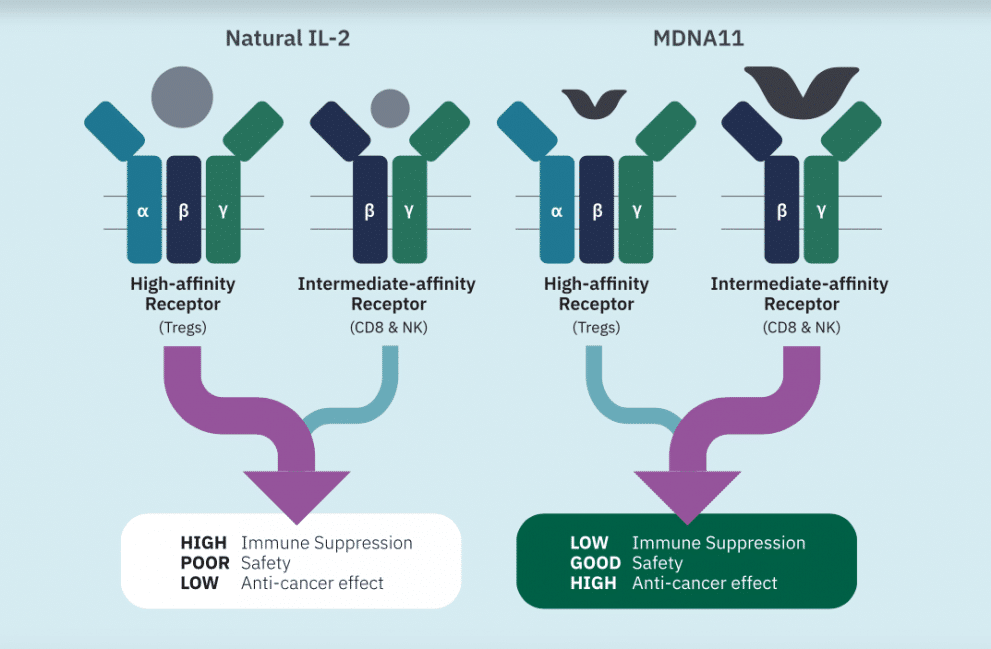

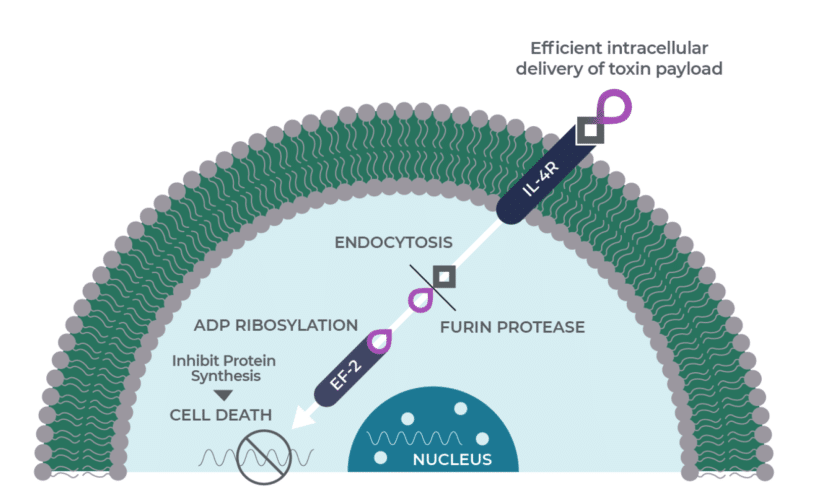

“We expect the company to announce additional data from the dose escalation portion of their Phase 1/2 ABILITY study for MDNA11, a beta-only, long-acting IL-2 super-agonist at the Society of Immunotherapy for Cancer (SITC) Annual Meeting around November 4, 2023. In the Phase 1 monotherapy dose escalation portion of the study, which evaluated 20 patients, MDNA11 was well tolerated with promising single-agent activity. As of the data cutoff date of June 20, 2023, responses included one confirmed durable (> one year) partial response in a heavily pretreated patient with metastatic pancreatic cancer who continues on treatment with MDNA11 and six patients with stable disease. Of note, one patient with melanoma experienced prolonged stable disease, which lasted over 1.5 years,” he concluded

Share

Share Tweet

Tweet Share

Share

Comment