The stock may be down plenty over the past 12 months but investors with a longer term horizon should be keeping in mind Greenlane Renewables (Greenlane Renewables Stock Quote, Charts, News, Analysts, Financials TSX:GRN). That’s according to portfolio manager Bruce Campbell, who thinks long-term tailwinds in the renewable energy sector will be to Greenlane’s advantage.

“The whole renewable natural gas businesses, that’s a trend that’s going to continue to develop over the next decade,” said Campbell, president at StoneCastle Investment Management, speaking on a BNN Bloomberg segment on Wednesday.

“If you look at what happened with renewable power, 20 years ago there wasn’t much renewable power and now it’s a bigger and bigger part of the power that we all use every single day. The same thing is going to happen with natural gas,” he said.

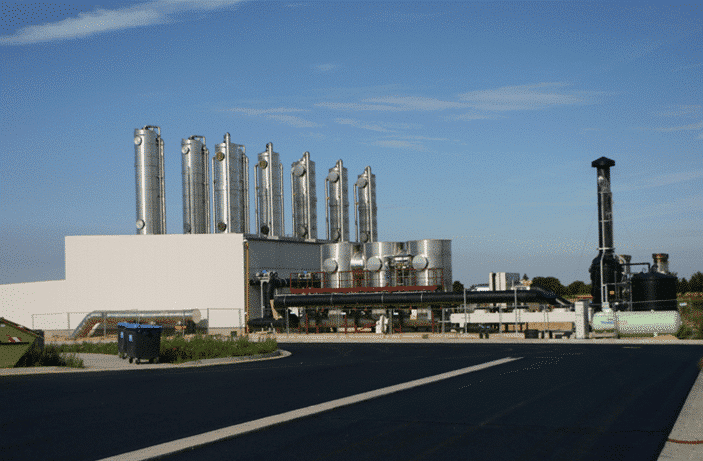

Vancouver-based Greenlane is a renewable natural gas equipment provider, offering a number of RNG purification and upgrading solutions for installation at places like landfills and diary farms to capture and process methane gasses for energy uses. Greenlane has been racking up new contract wins of late, including biogas upgrading projects in the US and Brazil, worth over $7 million and announced in January, and a $12.1-million contract awarded in December for a biogas upgrading system for a Vancouver landfill.

“One of the big emitters right now of carbon is feedlots and cattle and there’s a way that you can capture that,” Campbell said. “A lot of the authorities and regulators are pushing to have more renewable natural gas in the gas pipeline. Right now, it’s less than a half of a percent, and, depending on the jurisdiction, they want to take it up somewhere in that five to ten per cent range over the next decade.”

“It means there’s going to be a tremendous amount of expansion and a tremendous amount of opportunity,” he said. “Greenlane is a little bit niche. They’re smaller but they have three technologies whereas some of their competitors only have one. So, what that means is they can go out to a job, they can look at it and then have an option of different technologies depending on what’s going to be the application that suits it best.”

Like much of the renewable energy space, momentum was growing for a number of years and then it peaked about this time last year when stocks started tumbling. The pullback has been attributed to a sector that had gotten ahead of itself along with attenuated optimism about the renewable power industry as a whole, itself brought on in part due to ongoing difficulties the US Biden administration has had with enacting clean energy bills.

For Greenlane, that has meant the rapid climb over the end of 2020 and the start of 2021 where the stock shot up by 5x, going from $0.50 to $2.50, was followed up by a gradual descent over the past twelve months, with GRN heading back to now the $1.00 level.

But Campbell says the recent factors influencing Greenlane’s progress are likely short-lived.

“The stock has really pulled back here. Part of it was that we’ve seen a lot of focus and a lot of pressure on the smaller cap companies and the second thing is that with COVID, Greenlane’s business was expanding quite well and then with a lack of travel we ended up seeing a lot of projects get delayed — it doesn’t mean they were cancelled, it just meant it was more difficult for them to get out there and do the initial work and the engineering and meet with the decision makers,” Campbell said.

“That’s all going to happen. It just gets pushed down the pipeline and it’s just a little bit slower in the process,” he said.

“We don’t own it right now. We have in the past and we certainly have our eye on it to see when the wind starts to return to the sails of some of the smaller caps because this is one that will have wind at their back from an industry perspective for probably the next decade,” he said.

Last month, Haywood Capital Markets analyst Colin Healey nominated Greenlane Renewables as one of his Top Picks, calling it Haywood’s preferred way to gain leverage to the accelerating global investment in RNG infrastructure.

“We like GRN’s positioning in the renewable natural gas (RNG) infrastructure space as a global leader in project deployments,” Healey said in a January 4 report. “Greenlane offers the broadest range of technologies, providing a strategic advantage. We see RNG as a critical component of the green energy revolution and continue to see governments worldwide prioritizing it.”

Healey has a “Buy” rating on GRN with a $3.75 target price, which at the time of publication represented a projected one-year return of 202 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment