Haywood Capital Markets analyst Colin Healey is staying bullish on Canadian cleantech company Greenlane Renewables (Greenlane Renewables Stock Quote, Charts, Analysts, News, Financials TSX:GRN), giving the company his Top Pick status while maintaining a “Buy” rating in an update to clients on Tuesday.

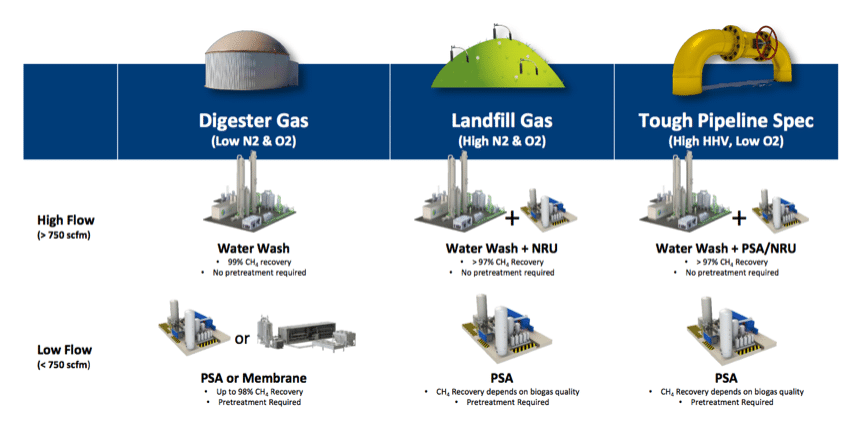

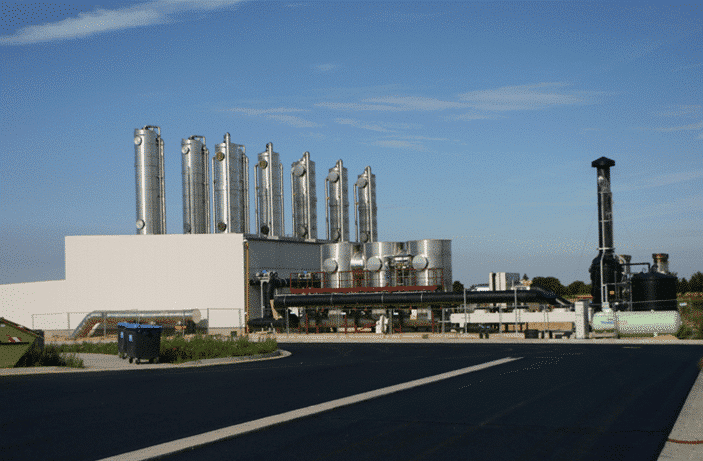

Founded in 1986 and headquartered in Burnaby, B.C., Greenlane Renewables designs, develops, sells and services a range of biogas upgrading systems, which remove impurities and separate carbon dioxide from biomethane in the raw biogas created from anaerobic decomposition of organic waste at landfills, wastewater treatment plants and farms and for injection food waste facilities into the natural gas grid or for direct use as vehicle fuel.

Healey’s updated analysis comes after Greenlane announced it had secured two new supply contracts with a combined value of $7.1 million.

“As always, further contract wins come as positive news for the company as it continues to grow its top line and further build out its sales order backlog, which stood at $47.1 million at the end of Q3,” Healey said. “Greenlane continues to rapidly grow its business and position itself as a global leader in the renewable natural gas (RNG) infrastructure space.”

The contracts are for separate renewable natural gas projects in the United States and Brazil, with the company expecting order fulfillment to begin immediately, according to Healey.

In the United States, Greenlane will supply a biogas upgrading system for a dairy farm RNG project in Nebraska, with its system being used to upgrade biogas generated from anaerobic digestion of dairy cow manure into carbon-negative renewable natural gas suitable for injection into the local pipeline.

“Dairy-derived RNG is highly carbon negative providing one of the most impactful ways to achieve deep decarbonization and reach net zero emissions targets,” said Brad Douville, President and CEO of Greenlane in the company’s January 4 press release. “For this reason, it continues to be one of the most dynamic and fastest growing segments of the market.”

Meanwhile, in Brazil, Greenlane will work with Orizon Valorizacao de Residuos, one of the South American country’s largest landfill operators, to supply a system based on water wash technology to upgrade landfill gas to low carbon renewable natural gas.

The contract is the sixth in the country for Greenlane, which has identified Brazil as an underpenetrated market with significant upside potential.

“This new project for Greenlane marks the sixth system supply contract we have won in a country that we believe has significant upside potential for biogas upgrading, including landfill gas-to-RNG, sugarcane production waste and other types of upgrading projects,” Douville added. “Although Brazil’s RNG industry is in the early stages of development, Greenlane has been an early mover and market share leader in the country, having sold 67 per cent of the commercial scale biogas upgrading systems in the country.”

Greenlane said its sales pipeline reached $850 million at the end of its most recent quarter, a 6.3 per cent sequential increase and 23 per cent year-over-year growth, with the company’s sales backlog of $47.1 million representing 12.4 per cent sequential growth and a 7.5 per cent year-over-year increase.

The company has also made other international inroads, having broken into the Colombian market while winning another contract in Spain, acquiring an Italian biogas upgrading product solution provider, and continuing its business in North America.

“We like GRN’s positioning in the renewable natural gas (RNG) infrastructure space as a global leader in project deployments,” Healey said. “Greenlane offers the broadest range of technologies, providing a strategic advantage. We see RNG as a critical component of the green energy revolution and continue to see governments worldwide prioritizing it.”

On top of a projected $50.5 million in revenue in 2021 (24.4 per cent year-over-year growth), Healey forecasts further growth to a projected $65.3 million in 2022, a 29.3 per cent jump. The EV/Revenue multiple is forecasted to drop on a similar trajectory, with Healey estimating a halving from 5.7x in 2020 to 2.8x in 2021, then dropping to 2x in 2022, trading at a discount compared to its cleantech peers at 6x.

Meanwhile, Healey projects the company’s EBITDA will turn positive at $1.1 million in 2021 before growing to a forecasted $5.4 million in 2022, with Healey introducing an initial EV/EBITDA multiple projection of 24.3x in 2022.

“With a robust backlog of sales and the potential for a number of catalysts in 2022, including strategic M&A, we continue to like the outlook for Greenlane,” Healey said. “We see the recent weakness in the stock as an opportunity for investors to increase exposure at bargain prices as the underlying business remains robust.”

Greenlane’s stock price has dropped by 43.5 per cent over the last calendar year, recently hitting a 52-week low of $1.13/share on December 15 after enjoying a high of $2.86/share on February 17. With his reasserted “Buy” rating, Healey has maintained his $3.75 target price which at the time of publication represented a projected one-year return of 202 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment