Echelon Capital Markets analyst Rob Goff has changed his tune on Think Research Corp. (Think Research Stock Quote, Chart, News TSXV:THNK), maintaining a “Speculative Buy” rating but lowering his target price to $4.00/share from $6.00/share in an update to clients on Monday.

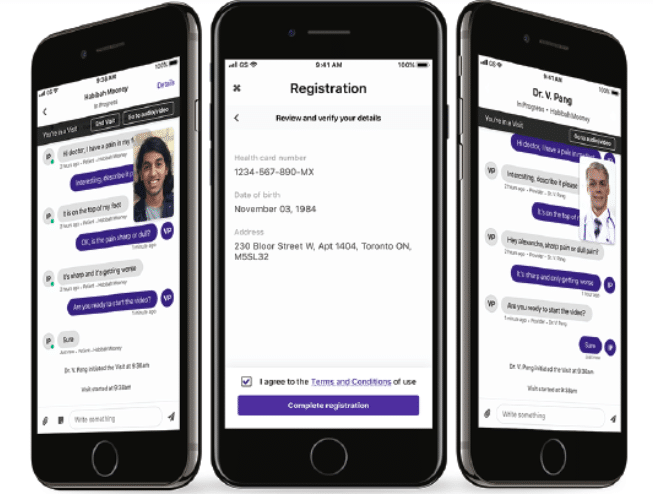

Headquartered in Toronto, Think Research gathers, develops and delivers knowledge-based SaaS solutions for the global healthcare industry. The company’s product line includes COVID-19 tools, Progress Notes to help clinical workers keep documentation standardized, eReferrals to help doctors make referrals within its system, VirtualCare to replace in-person appointments when needed, eForms to track resident volumes, signature adherence and compliance and decision support tools for seniors living in long-term care and retirement homes.

Goff’s latest analysis comes after Think Research thought highly enough of Pharmapod, which operates a SaaS electronic data capture solution that serves pharmacies, hospitals and long-term care facilities around the world reaching over 9,000 pharmacies across Canada, the UK, Ireland, and Australia, to acquire its assets through a receivership for $1.04 million.

“While the transaction is of the small tuck-in variety, we believe it represents a seamless strategic fit within Think’s operations and holds considerable value for the investment,” Goff said.

The Pharmapod deal not only represented a bargain for Think, which acquired the assets at a rate of 0.4x Pharmapod’s $2.5 million revenue, but it also helped from a competitive perspective as Pharmapod, in conjunction with CareRx, was previously a competitor to Think in the electronic data capture space.

All told, Think Research paid $350,000 in cash, with the rest of the offering coming through the issue of over 300,000 shares at a rate of $2.25/share, an increase to the $2.23/share issue included for the company’s acquisition of BioPharma in September.

Furthermore, Goff notes that Pharmapod brings positive economics to Think, with gross margins in line with other SaaS operations at around 70 per cent with an expectation of bringing positive cash flow upon completion of its first fully integrated quarter.

“Think is going through an exciting period of growth. We are driven to transform healthcare through digital health solutions, and are scaling up to achieve our goal of creating change on a global level,” said Sachin Aggarwal, CEO of Think Research in the company’s November 4 press release announcing the acquisition. “We see great synergies with Pharmapod and are eager to increase our offerings to our growing network of international clinicians.”

Goff has made revisions to his financial projections for Think Research, lowering his revenue target for 2021 to $49.2 million from his initial $53.8 million projection, though the new figure still represents potential year-over-year growth of 154 per cent. Other changes for 2021 include a reduction in the projected gross profit from $29.8 million to $25 million, as well as a further adjusted EBITDA loss of $5.9 million compared to the initial estimate of a $1.8 million loss.

However, Goff believes the company will spring forward again in 2022, projecting revenue at a near double to $94.6 million, a gross margin jump to $46.7 million, and a move to positive EBITDA at a projected $8.1 million.

Based on DCF targets, Goff believes Think is in position to perform well compared to its peers from a valuation perspective, projecting EV/Revenue to be 2.4x in 2021 compared to the peer estimate of 3.2x and the consensus of 5x, with further separation coming in 2022 at a projected 1.2x for Think, 2.4x for the peer group, and a projected 2.6x for the consensus.

Goff’s EV/Gross Profit multiples also show favourably for Think Research, as he projects the company’s multiple at 4.7x for 2021 compared to the peer group estimate of 4.9x and the consensus estimate of 9.8x, with the figures only improving in 2022 at projections of 2.5x for Think, 4x for the peer group, and 5.2x for the consensus.

However, while the tuck-in acquisition is an overall positive development for Think Research, Goff’s lowered target comes on account of expected revenue recognition delays at MDBriefcase, along with a slow couple of months at Clinic 360, where the broad easing of COVID-19 restrictions (including travel) led to periods of above average, vacation-led staff shortages.

“We believe these are transitory events, where Clinic 360’s strong momentum, patient volumes, and surgery backlogs remain elevated and MDBriefcase is expected to recognize strong Q421 revenues,” Goff said. “We still prefer to take a more conservative posture against our previously above-consensus Q421 forecasts.”

Think Research’s stock price has cratered recently, contributing to the stock’s overall loss of 61.3 per cent for the year to date. The stock’s low point for 2021 came on November 4, when it dropped to $1.56/share. At press time, Goff’s new $4.00 target represented a projected return of 124.7 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment