It’s been a bang-up year so far for tech, with both Canadian and US technology names performing well over the first two quarters. Looking at the Q3, Echelon Capital Markets delivered on Thursday its Top Picks list, with five tech names in the mix.

Echelon said the second quarter was unkind to its top picks, with names like Quipt Home Medical, Quisitive Technology Solutions and Converge Technology Solutions all underperforming broader indices.

On the bright side, Echelon’s top picks have a much better longer-term result, where their five-year gain of 75.0 per cent outperformed the S&P/TSX Composite and the S&P/TSX Small Cap Index with returns of 44.4 per cent and 18.3 per cent, respectively.

Echelon said its top picks list has performed well due to its focus on catalyst-rich, small cap companies where growth is a clear focus.

“While the prospects of rising rates and the negative economic consequences remain clear headwinds, we look for investor focus to at some point return to high-quality, small cap names with specific catalysts or underlying secular growth trends,” Echelon said in its report.

Below are five stocks from Echelon’s Q3 2023 Top Picks, with all projected returns to target written as of the Echelon report’s publication date.

Stock: kneat.com (kneat.com Stock Quote, Charts, News, Analysts, Financials TSX:KSI)

Echelon rating: Speculative Buy

Echelon target price: $4.20

Projected one-year return: 42 per cent

Echelon analyst Rob Goff says the numbers really tell the tale for SaaS provider kneat, which revenues has climbed from $8.7 million in 2021 to $17.3 million in 2022 and with the company on track to meet or exceed Goff’s current projection of $28.6 million in 2023.

“We see expansion to adjacent markets supporting potential outperformance while the TAM redefinition suggests sustained outperformance. KSI’s recently announced €15 million secured debt financing funds the Company’s aggressive R&D development spending while supporting its continued growth,” Goff wrote.

Stock: Think Research (Think Research Corp Stock Quote, Charts, News, Analysts, Financials TSXV:THNK)

Echelon rating: Speculative Buy

Echelon target price: $1.10

Projected one-year return: 224 per cent

Another SaaS provider, Think Research has digital health solutions for clients such as government bodies and large pharma companies. Goff said shares are flat year-to-date despite Think having achieved significant cost synergies in 2022 and turning EBITDA-positive on increased scale with its record fourth quarter 2022 results and winning significant contracts.

Goff sees catalysts for Think in near-term SaaS deals and pipeline opportunities as well as continued outperformance by the company in comparison with his baseline forecasts.

“We believe Think might eventually garner strategic takeout interest from its larger Canadian peers given the Company’s heavily discounted valuation and niche business,” he said.

Stock: Quisitive Technology Solutions (Quisitive Technology Solutions Stock Quote, Charts, News, Analysts, Financials TSXV:QUIS)

Echelon rating: Speculative Buy

Echelon target price: $1.25

Projected one-year return: 252 per cent

IT services provider Quisitive looks undervalued, says Goff, and has a compelling sum-of-the-parts valuation. The analyst said Quisitive’s PayiQ commercialization should garner investor attention exiting 2023 and he’s looking for further IT Services contracts to showcase double-digit organic growth.

“We see upside to baseline, consensus forecasts given the positive leverage of PayiQ as it first reduces its drain then turns EBITDA positive seems discounted in mid-longer-term forecasts. Our aggressive $1.53 SOTP valuation finds support in its valuation assumptions and peer transactions,” Goff wrote.

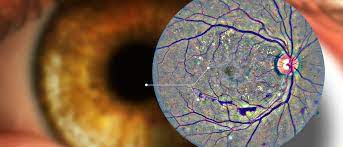

Stock: DIAGNOS Inc (DIAGNOS Inc Stock Quote, Charts, News, Analysts, Financials TSXV:ADK)

Echelon rating: Speculative Buy

Echelon target price: $1.00

Projected one-year return: 156 per cent

Echelon analyst Stefan Quenneville said DIAGNOS has now validated the commercial potential of its AI-enabled platform for identifying patients with diabetic retinopathy through an MOU with eye care giant EssilorLuxottica and the company is building on that momentum and is poised to be a leading player in the use of AI to treat vision problems, according to Quenneville.

“While the timeline and scale remain uncertain for now, the conclusion of a deal with EssilorLuxottica would be a game-changer for ADK given the sizeable financial opportunity and the industry validation of its technology platform,” Quenneville said.

Stock: Quipt Home Medical (Quipt Home Medical Stock Quote, Charts, News, Analysts, Financials TSX:QIPT)

Echelon rating: Buy

Echelon target price: $11.75

Projected one-year return: 65 per cent

In-home patient monitoring and durable medical equipment company Quipt completed earlier this year its largest acquisition to date and will see improved margins as a result, Quenneville argued. At the same time, Quipt stays in the “M&A sweet spot” as an attractive target for larger national players within the fragmented DME market in the US.

“We reiterate our Top Pick rating and target price of C$11.75, which is based on an 8.3x EV/EBITDA multiple applied to our C2023 Adj. EBITDA estimate. We view QIPT as a compelling opportunity for investors as it currently trades at 6.2x versus its broader North American peer group currently at a median valuation of 10.8x,” Quenneville wrote.

Share

Share Tweet

Tweet Share

Share

Comment