Canadian microcap company Greenlane Renewables (Greenlane Renewables Stock Quote, Charts, Analysts, News, Financials TSX:GRN) has been having a rough go of it this year after a breakout 2020. Where’s the stock headed next?

Bruce Campbell thinks Greenlane’s small size gives it a relative advantage in the renewable gas industry, one which has plenty of tailwinds behind it.

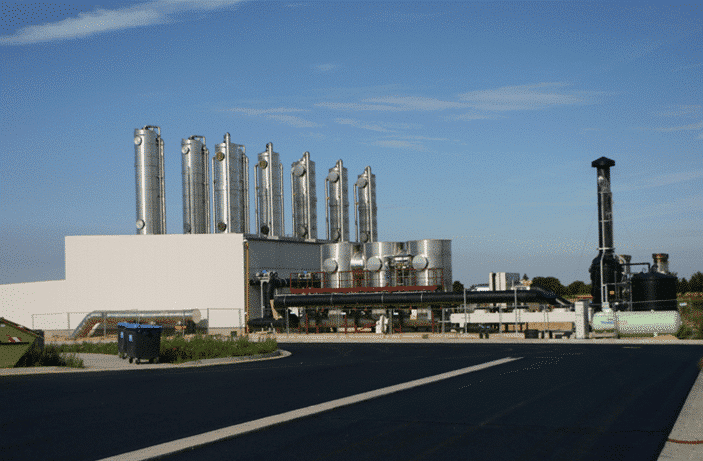

“Greenlane is in the renewable natural gas business and they have a few different technologies. There are multiple different [approaches] depending on where you’re getting your feedstock from and what you’re trying to remove the natural gas from and Greenlane has a few different technologies,” said Campbell, president of StoneCastle Investment Management, who spoke on BNN Bloomberg on Thursday.

“They’ve been doing quite well. Obviously, that sector is going to have huge tail winds behind it probably for the next decade,” he said. “What’s happening is a lot of governments and regulators are putting in legislation for these natural gas companies so that they have a certain amount of renewable natural gas in the system by a certain date. Right now, it’s very low — it’d be less than a half of a percent in a lot of cases [but] it needs to go up to ten to 15 per cent over the next decade.”

“So there are [many] of these projects that are looking to be done in North America and globally and that’s where Greenlane is. They’re right in that space,” Campbell said.

Vancouver-based Greenlane started out as a spinout from Pressure Technologies to build biogas upgrading systems for organic waste sources like landfills, wastewater treatment plants and diary farms. The company began trading on the TSX Venture Exchange in mid-2019 before graduating to the senior board in early 2020.

But the sparks didn’t really start to fly until the fourth quarter of last year, where GRN went from $0.45 per share to as high as $2.86 by mid-February 2021. It might have been a case of flying too close to the sun or that plus a general pullback across the clean energy and renewables space, but by June the stock was back down to the $1.50 range, where it has more or less stayed since.

Operationally, the company keeps progressing, though. Greenlane delivered its second quarter 2020 results in July, showing revenue up 200 per cent to $12.6 million with a gross profit of $2.9 million and adjusted EBITDA of $0.1 million.

“From a profitability standpoint, over the last 18 months, our quarterly revenue growth rate has been 3.4 times greater than the quarterly growth rate in operating expense, generating positive adjusted EBITDA starting in Q4 2020,” said President and CEO Brad Douville in a press release. “This leverage effect highlights the strength of our asset-light business model, which we expect to see continuing as the top line grows.”

The company said its sales pipeline at the quarter’s end was over $800 million, while the order backlog stood at $41.9 million. Last month, Greenlane announced a further $12.8 million in upgrading system supply contracts in the US, involving the company’s membrane separation biogas upgrading system and two others that will use GRN’s pressure swing adsorption (PSA) upgrading system.

Greenlane said it’s seeing an industry-wide uptick where the number and calibre of RNG project developers and owners looking to develop their clean energy infrastructure is growing.

“We have worked hard to be the go-to solution provider for these customers and anticipate continued success. We believe that our ability to compete for and win new projects is based on our flexibility to provide multiple core upgrading technologies, our sole focus on the RNG market, and our strong industry track record and reputation,” said Douville in a press release.

For Campbell, Greenlane is a Buy right now.

“Greenlane has raised some capital recently, they have a strong balance sheet, and what they’re doing beyond just supplying the systems is they’ve done a joint venture with a capital partner where they’re going to build these facilities and then operate them as well,” Campbell said. “So, look at the margins off of operating in addition to building [upgraders].”

“It’s one that we hold in our portfolio,” he said. “The stock has pulled back this year, really based more on the industry than anything else, but it’s one that we continue to hold.”

Campbell said Greenlane’s varied approach and adaptability make it an attractive option.

“Greenline and [Xebec Adsorption] are probably the two smaller niche players [in the industry]. If you take a look at what’s happening here, Greenlane really has as their specialty in engineering expertise, so they can really look at different approaches. So, if somebody comes in with one application or one need they don’t have a cookie cutter where they say, this is it. They have three different approaches that they can look at and manufacture based on the actual needs of the project and what’s going to work best,” Campbell said.

“That’s really what kind of differentiates them. And being smaller, they’re adaptable and a lot quicker to move,” he said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment