With the economy picking up speed and things returning to somewhat near normal, there’s more growth ahead for Raytheon Technologies (Raytheon Technologies Stock Quote, Charts, News, Analysts, Financials NYSE:RTX), according to portfolio manager Gordon Reid.

“Raytheon I think represents tremendous latent value simply because their aerospace business has been held back by the trials and tribulations of Boeing and general air travel reluctance because of the pandemic,” says Reid, President and CEO of Goodreid Investment Counsel, speaking on BNN Bloomberg on Wednesday.

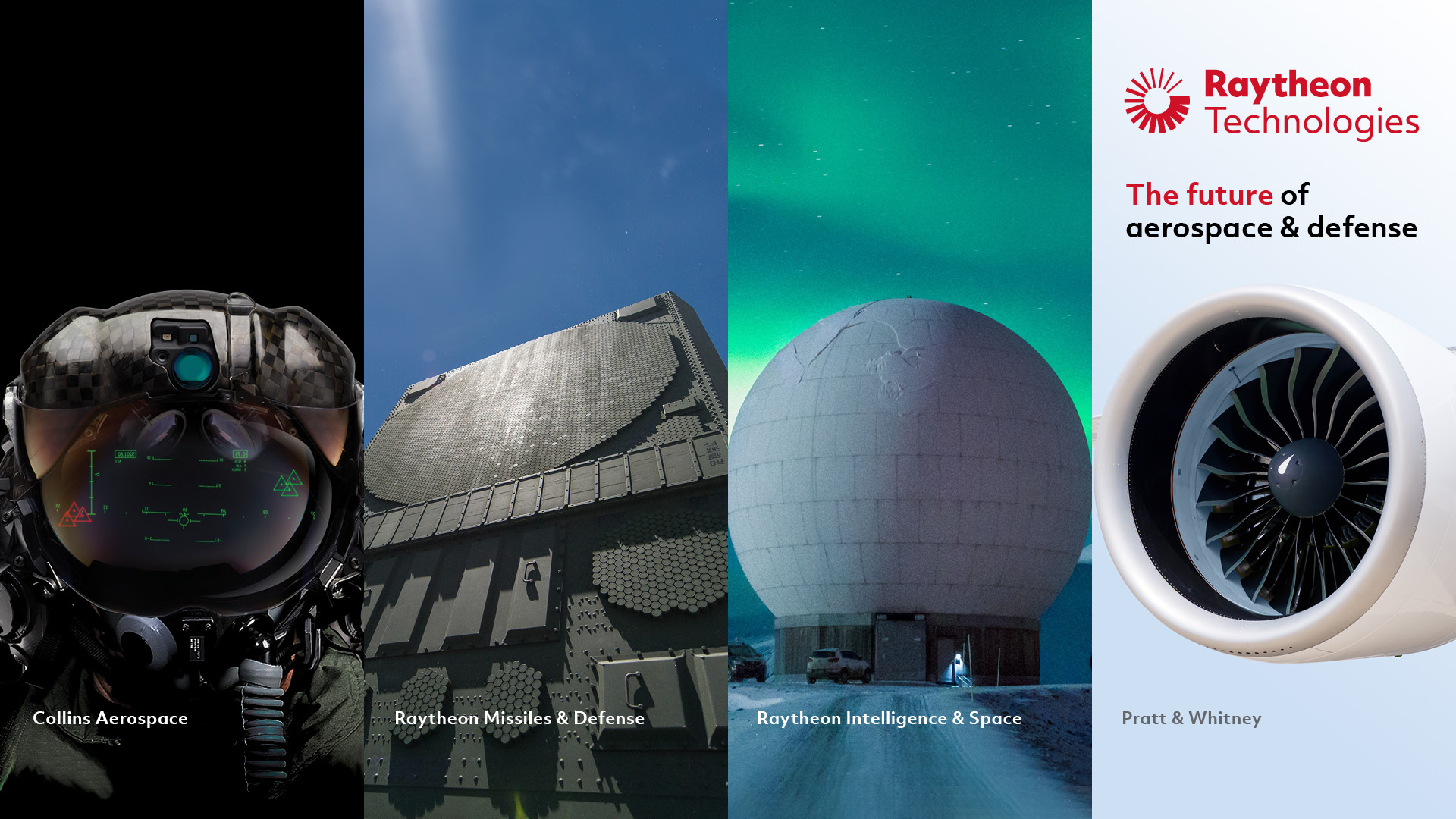

Waltham, Massachusetts-headquartered Raytheon is one of the world’s largest aerospace and defence company, developing aircraft engines and tech, cybersecurity, missiles and air defence systems, satellites and drones.

The company gets a big chunk of its business from defence contracts which naturally include the ebbs and flows of government spending in the sector, and with the Biden administration now well into its first year, questions have been posed as to the US defence budget and its potential impact on Raytheon. In May, the US Department of Defense requested $715 billion for its fiscal 2022 budget, which would be up from the department’s $705 billion 2021 budget request under the previous administration.

On that front, Raytheon CEO Greg Hayes has said although defence spending with the current administration is likely to remain flat in the years to come, the company will do fine considering its backlog of business.

“We continue to see encouraging trends across our market,” said Hayes in the company’s second quarter earnings call in late July. “Our confidence in our ability to achieve these targets remain strong and as you saw at the end of May, the Department of Defense released the fiscal year ’22 budget request, which was generally in line with our expectations with respect to our portfolio of products and the investments we’re making in differentiated technologies, including missile defense, space-based systems, next-generation propulsion and hypersonics.”

For the second quarter, Raytheon beat estimates on earnings, generating $1.03 per share compared to the expected $0.93 per share. Sales were up 13 per cent year-over-year to $15.88 billion while net income hit $1.04 billion compared to negative $3.84 billion a year earlier. The company’s backlog at the end of the quarter stood at $151.8 billion, with $85.7 billion coming from commercial aerospace and $66.1 billion from defence. (All figures in US dollars.)

Management raised its full-year 2021 forecast, pointing to a rise in commercial air travel as a factor.

“Our solid execution gives us the confidence to raise our adjusted EPS and free cash flow outlook, as well as the low end of our sales outlook range for 2021,” Hayes said in the company’s second quarter press release on July 27. “In addition, our relentless focus on operational excellence, structural cost reduction and integration execution has enabled us to further raise our merger related gross cost synergy target by $200 million to $1.5 billion.”

Overall, guidance on sales went from $63.9-$65.4 billion to $64.4-$65.4 billion with adjusted EPS going from $3.50-$3.70 per share to $3.85-$4.00 per share. Free cash flow is expected to hit $4.5-$5.0 billion compared to the previously guided $4.5 billion.

Reid said confidence in a strong pandemic recovery should put investors in the mood to invest in Raytheon.

“Raytheon has a division that includes Pratt and Whitney engines and Goodrich, which has parts and braking systems and that type of thing. On avionics, this part of the business really hasn’t produced, understandably,” Reid said.

“But if you believe as I do that we’ll move past this era of reluctance to travel — and we’re seeing signs of it already, although the Delta variant is making another push back at us — longer term, I’m a strong believer that we’re going to beat this thing and we’re going to go back to ‘normal,’ and that includes airlines buying new products from companies like Boeing and Airbus and fleets having to be serviced and repaired,” he said.

“And that falls right into what Raytheon does,” Reid said.

Raytheon, which has a market capitalization of about $129 billion and pays out a dividend currently featuring a 2.4 per cent yield, is still trading a bit below its pre-COVID highs. The stock was up to $92 per share in February 2020 and lately has been trading in the high $80 range.

“We think that there’s a lot of room to grow for Raytheon,” said Reid. “Greg Hayes, who’s the CEO, does a great job. He’s been very transparent about what to expect, and what he’s telling us is to expect good growth but interestingly and excitingly great cash flow generation [as well], which is never a bad thing for shareholders and stakeholders.”

“So, I don’t think you’ve missed the missed the boat at all and I think at this point it’s a good buy,” he said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment